South africa yield curve information

Home » » South africa yield curve informationYour South africa yield curve images are ready. South africa yield curve are a topic that is being searched for and liked by netizens now. You can Get the South africa yield curve files here. Find and Download all free images.

If you’re looking for south africa yield curve pictures information linked to the south africa yield curve interest, you have visit the ideal site. Our site always provides you with hints for viewing the maximum quality video and picture content, please kindly surf and locate more enlightening video content and images that match your interests.

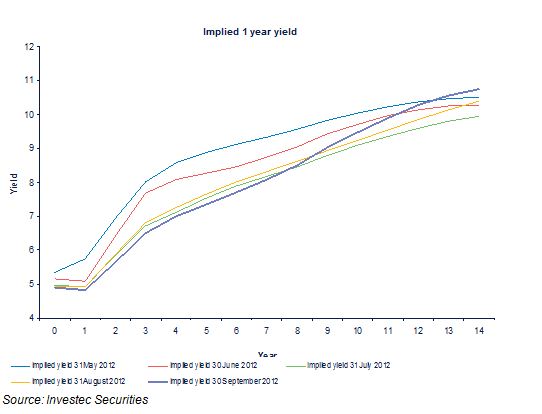

South Africa Yield Curve. South Africas yield curve makes long bonds attractive for JPMorgan. 27 11 339 6640 Email. The South African Reserve Bank targets inflation between 3 and 6. The premium of 30-year yields over two-year yields in Africas most-industrialized economy is among the highest in.

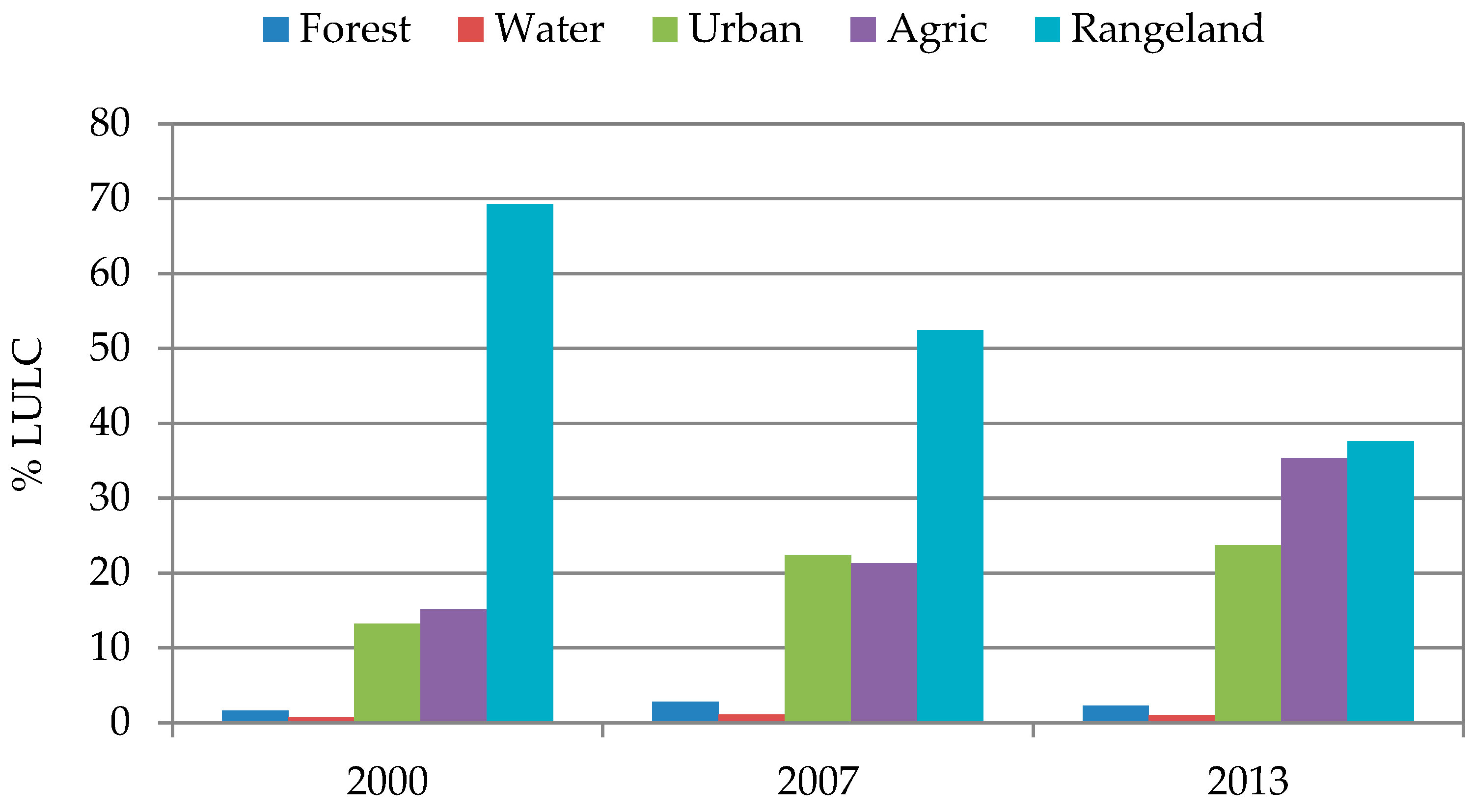

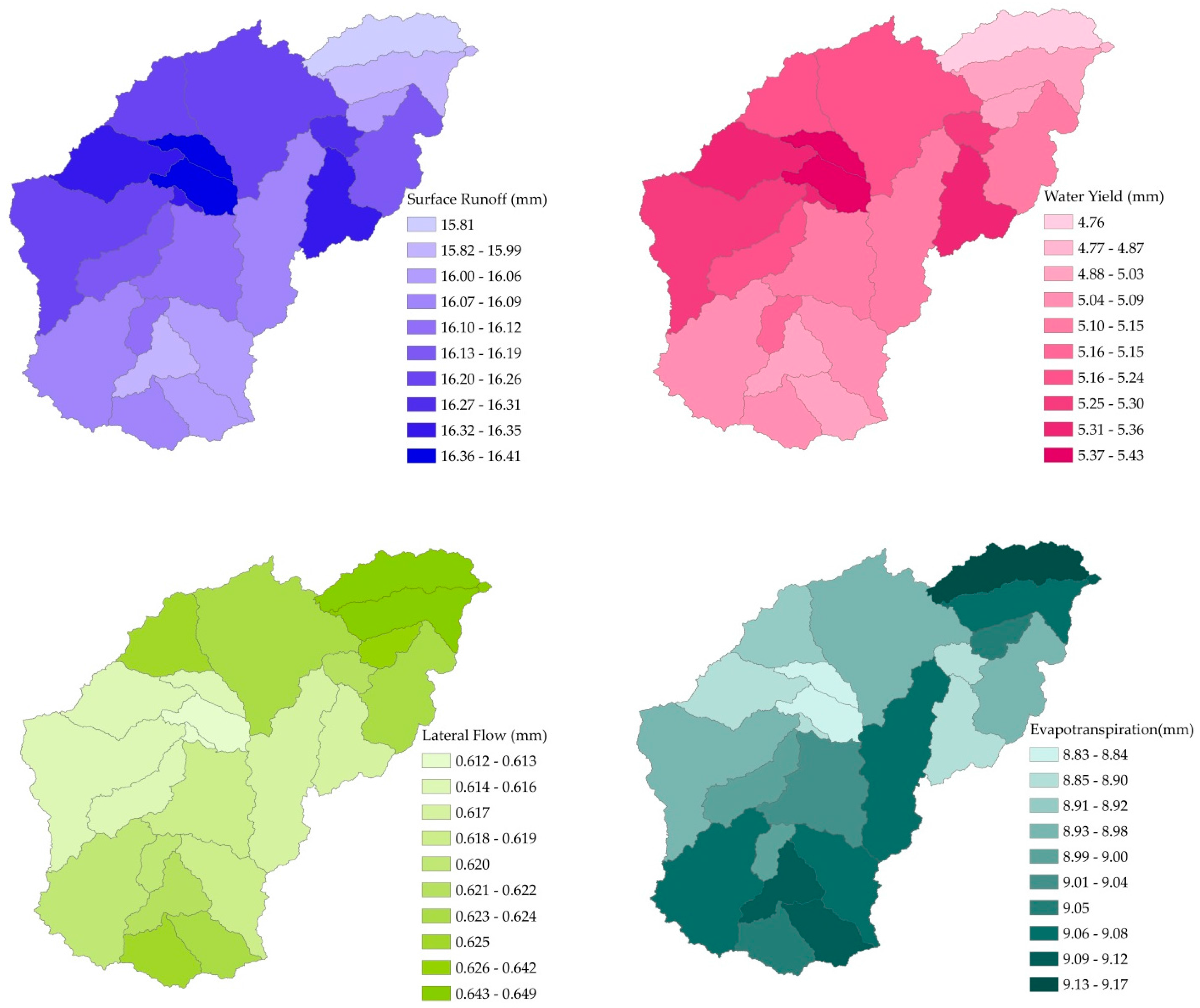

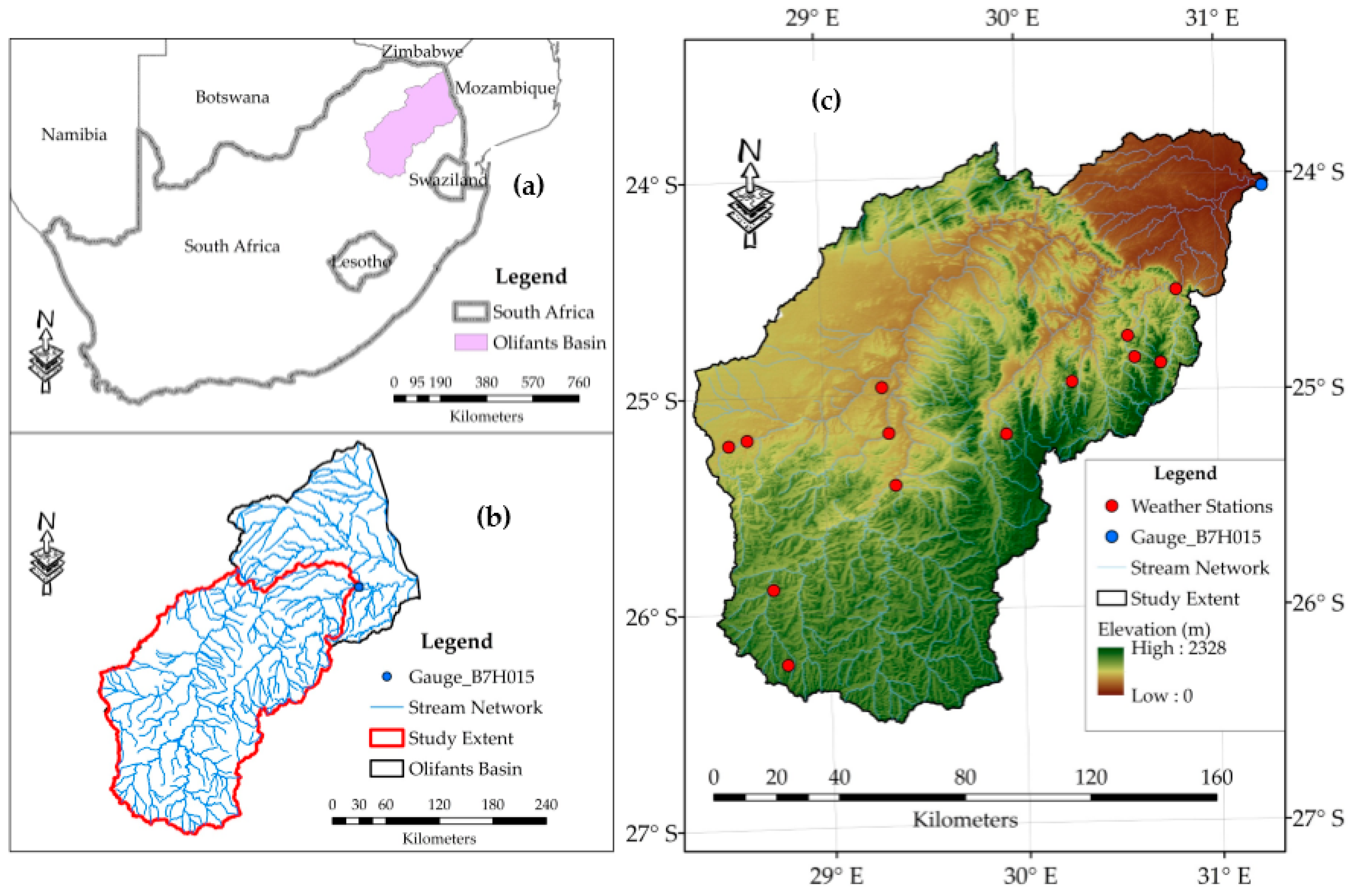

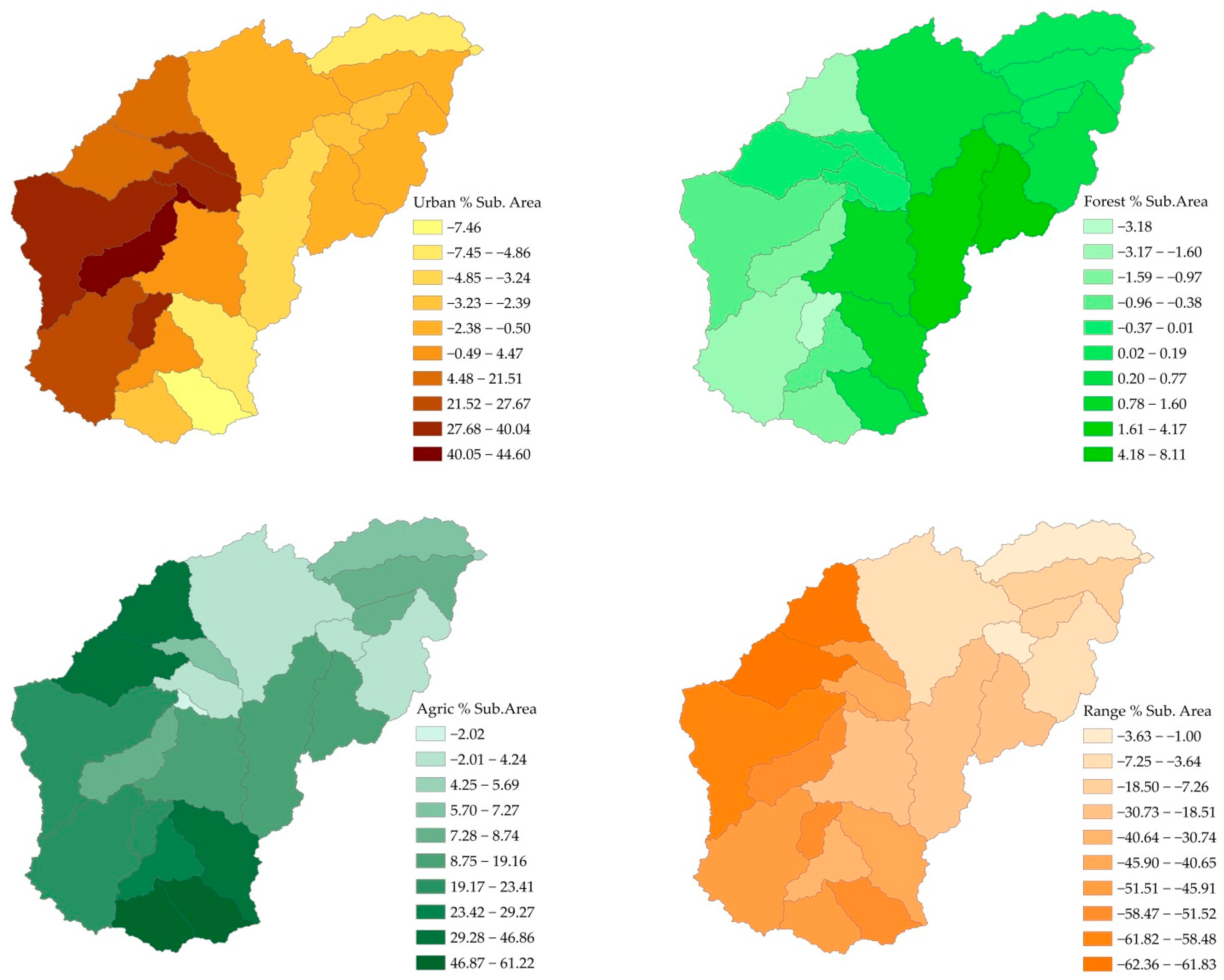

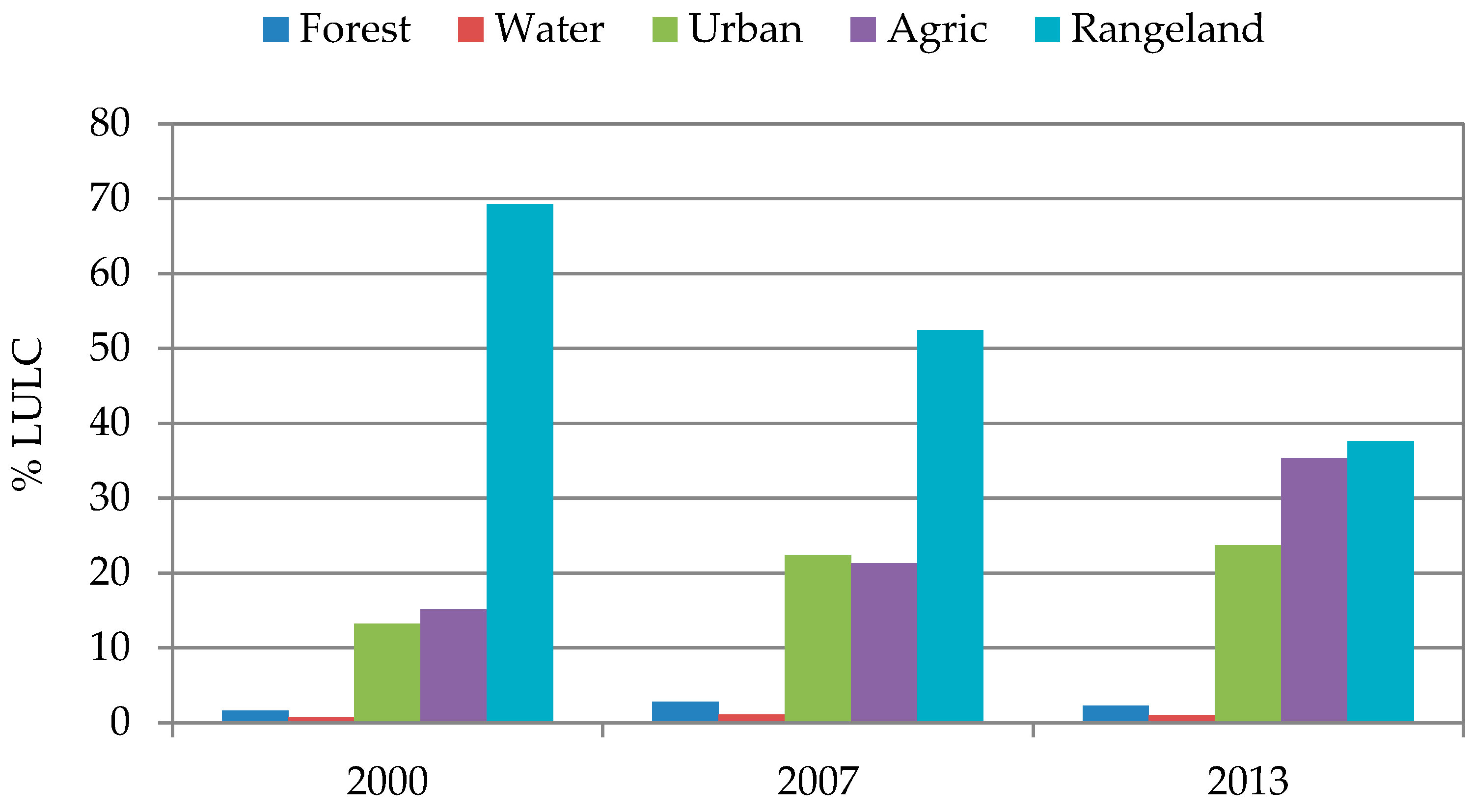

Water Free Full Text Hydrological Responses To Land Use Cover Changes In The Olifants Basin South Africa Html From mdpi.com

Water Free Full Text Hydrological Responses To Land Use Cover Changes In The Olifants Basin South Africa Html From mdpi.com

And in most cases the inverted yield curve signals a pending economic contraction. 8875 0005 006. The South Africa 3 Months Government Bond has a 3750 yield last update 5 Jul 2021 215 GMT0. The study builds on the earlier work of Nel 1996 and Aziakpono and Khomo 2007 who found that the yield curve does accurately forecast downswings in the South African economy. Central Bank Rate is 350 last modification in July 2020. 10 Years vs 2 Years bond spread is 359 bp.

It confirms Aziakpono and Khomos finding that the yield curve falsely predicted a downswing in 200203 but provides evidence that the yield curve has not lost its predictive powers in the most recent.

The information set out above has been compiled in good faith based on facts and information supplied to RMB using sources believed by RMB to be reliable. The spread between 20-year and two-year debt has risen 48 basis points over the past month amid renewed electricity blackouts a second-wave of. The South African Reserve Bank targets inflation between 3 and 6. The South Africa 3 Months Government Bond has a 3750 yield last update 5 Jul 2021 215 GMT0. And in most cases the inverted yield curve signals a pending economic contraction. Yield changed -25 bp during last week -50 bp during last month -610 bp during last year.

Source: futuregrowth.co.za

Source: futuregrowth.co.za

Bloomberg –The coronavirus crisis is scratching old fiscal wounds in South Africa as investor concern about a gaping budget hole and resurgent inflation helps to steepen the sovereign yield curve. 5 Jul 2021 1215 GMT0. Mishkin 1996 as well as the modified probit model suggested by Dueker 1997 to examine the ability of the yield curve to predict recessions in South Africa and compares its predictive power with other commonly used variables such as the growth rate of real money supply changes in stock prices and the index of leading economic. Historical data is currently unavailable. The study builds on the earlier work of Nel 1996 and Aziakpono and Khomo 2007 who found that the yield curve does accurately forecast downswings in the South African economy.

Source: elibrary.imf.org

Source: elibrary.imf.org

The spread between 20-year and two-year debt has risen 48 basis points over the past month amid renewed electricity blackouts a second-wave of. Historical data is currently unavailable. The South Africa 10Y Government Bond has a 8900 yield. Mishkin 1996 as well as the modified probit model suggested by Dueker 1997 to examine the ability of the yield curve to predict recessions in South Africa and compares its predictive power with other commonly used variables such as the growth rate of real money supply changes in stock prices and the index of leading economic. Bloomberg –The coronavirus crisis is scratching old fiscal wounds in South Africa as investor concern about a gaping budget hole and resurgent inflation helps to steepen the sovereign yield curve.

Source: mdpi.com

Source: mdpi.com

It confirms Aziakpono and Khomos finding that the yield curve falsely predicted a downswing in 200203 but provides evidence that the yield curve has not lost its predictive powers in the most recent. Normal Convexity in Long-Term vs Short-Term Maturities. 27 11 486 1946 Facsimile. The South Africa credit rating is BB- according. It confirms Aziakpono and Khomos finding that the yield curve falsely predicted a downswing in 200203 but provides evidence that the yield curve has not lost its predictive powers in the most recent.

Source: mdpi.com

Source: mdpi.com

And in most cases the inverted yield curve signals a pending economic contraction. Historical data is currently unavailable. Bloomberg –The coronavirus crisis is scratching old fiscal wounds in South Africa as investor concern about a gaping budget hole and resurgent inflation helps to steepen the sovereign yield curve. The spread between 20-year and two-year debt has risen 48 basis points over the past month amid renewed electricity blackouts a second-wave of. Rates displayed are indicative only and are delayed by 15 minutes.

Source: hu.pinterest.com

Source: hu.pinterest.com

South Africa Government Bond 10Y Generally a government bond is issued by a national government and is denominated in the countrys own currency. South Africa Government Bond 10Y Generally a government bond is issued by a national government and is denominated in the countrys own currency. Central Bank Rate is 350 last modification in July 2020. Rates displayed are indicative only and are delayed by 15 minutes. 27 11 486 1946 Facsimile.

Source: futuregrowth.co.za

Source: futuregrowth.co.za

Normal Convexity in Long-Term vs Short-Term Maturities. Stay on top of current and historical data relating to South Africa 10-Year Bond Yield. 10 Years vs 2 Years bond spread is 359 bp. The South Africa 10Y Government Bond has a 8900 yield. In the graphic above bond yields reached their peak in June 2008 and 9 months later South Africas economy was in the middle of a recession with annualised growth sitting at.

Source: mdpi.com

Source: mdpi.com

10 Years vs 2 Years bond spread is 359 bp. In the graphic above bond yields reached their peak in June 2008 and 9 months later South Africas economy was in the middle of a recession with annualised growth sitting at. 5 Jul 2021 1215 GMT0. Bloomberg – The coronavirus crisis is scratching old fiscal wounds in South Africa as investor concern about a gaping budget hole and resurgent inflation helps to steepen the sovereign yield curve. The information set out above has been compiled in good faith based on facts and information supplied to RMB using sources believed by RMB to be reliable.

Source: researchgate.net

Source: researchgate.net

The premium of 30-year yields over two-year yields in Africas most-industrialized economy is among the highest in. Central Bank Rate is 350 last modification in July 2020. Yield changed -25 bp during last week -50 bp during last month -610 bp during last year. Yield changed -430 bp during last week -790 bp during last month. The South Africa 10Y Government Bond has a 8900 yield.

Source: elibrary.imf.org

Source: elibrary.imf.org

The South Africa 3 Months Government Bond has a 3750 yield last update 5 Jul 2021 215 GMT0. Stay on top of current and historical data relating to South Africa 10-Year Bond Yield. Bloomberg –The coronavirus crisis is scratching old fiscal wounds in South Africa as investor concern about a gaping budget hole and resurgent inflation helps to steepen the sovereign yield curve. Central Bank Rate is 350 last modification in July 2020. 51 rows Back to South Africa Government Bonds - Yields Curve.

Source: sanlam.co.za

Source: sanlam.co.za

It confirms Aziakpono and Khomos finding that the yield curve falsely predicted a downswing in 200203 but provides evidence that the yield curve has not lost its predictive powers in the most recent downturn of 200709. While all but one of the 17 economists in a Bloomberg survey expect policy makers to. Central Bank Rate is 350 last modification in July 2020. Rates displayed are indicative only and are delayed by 15 minutes. 27 11 486 1946 Facsimile.

Source: elibrary.imf.org

Source: elibrary.imf.org

This paper uses the standard probit model proposed by A. 27 11 486 1946 Facsimile. It confirms Aziakpono and Khomos finding that the yield curve falsely predicted a downswing in 200203 but provides evidence that the yield curve has not lost its predictive powers in the most recent. And in most cases the inverted yield curve signals a pending economic contraction. South Africa Government Bond 10Y Generally a government bond is issued by a national government and is denominated in the countrys own currency.

Source: zaeconomist.com

Source: zaeconomist.com

It confirms Aziakpono and Khomos finding that the yield curve falsely predicted a downswing in 200203 but provides evidence that the yield curve has not lost its predictive powers in the most recent downturn of 200709. Rates displayed are indicative only and are delayed by 15 minutes. The South Africa credit rating is BB- according. The spread between 20-year and two-year debt has risen 48 basis points over the past month amid renewed electricity blackouts a second-wave of. Mishkin 1996 as well as the modified probit model suggested by Dueker 1997 to examine the ability of the yield curve to predict recessions in South Africa and compares its predictive power with other commonly used variables such as the growth rate of real money supply changes in stock prices and the index of leading economic.

South Africas yield curve makes long bonds attractive for JPMorgan. The South Africa 3 Months Government Bond has a 3750 yield last update 5 Jul 2021 215 GMT0. And in most cases the inverted yield curve signals a pending economic contraction. Bloomberg –The coronavirus crisis is scratching old fiscal wounds in South Africa as investor concern about a gaping budget hole and resurgent inflation helps to steepen the sovereign yield curve. Two other important drivers of the bearish steepening had been the precarious South African fiscal situation and the rise until recently of US Treasury yields.

The spread between 20-year and two-year debt has risen 48 basis points over the past month amid renewed electricity blackouts a second-wave of. 51 rows Back to South Africa Government Bonds - Yields Curve. It confirms Aziakpono and Khomos finding that the yield curve falsely predicted a downswing in 200203 but provides evidence that the yield curve has not lost its predictive powers in the most recent. South Africa Government Bond 10Y South Africa Government Bond Yield 10Y was 896 percent on Friday June 18 according to over-the-counter interbank yield quotes for this government bond maturity. It confirms Aziakpono and Khomos finding that the yield curve falsely predicted a downswing in 200203 but provides evidence that the yield curve has not lost its predictive powers in the most recent downturn of 200709.

Source: pinterest.com

Source: pinterest.com

Central Bank Rate is 350 last modification in July 2020. The information set out above has been compiled in good faith based on facts and information supplied to RMB using sources believed by RMB to be reliable. The South Africa credit rating is BB- according. Yield changed -430 bp during last week -790 bp during last month. Central Bank Rate is 350 last modification in July 2020.

Source: futuregrowth.co.za

Source: futuregrowth.co.za

10 Years vs 2 Years bond spread is 359 bp. The study builds on the earlier work of Nel 1996 and Aziakpono and Khomo 2007 who found that the yield curve does accurately forecast downswings in the South African economy. 51 rows Back to South Africa Government Bonds - Yields Curve. The South African Reserve Bank targets inflation between 3 and 6. And in most cases the inverted yield curve signals a pending economic contraction.

Source: moneyweb.co.za

Source: moneyweb.co.za

It confirms Aziakpono and Khomos finding that the yield curve falsely predicted a downswing in 200203 but provides evidence that the yield curve has not lost its predictive powers in the most recent. 51 rows Back to South Africa Government Bonds - Yields Curve. This is also known as bearish yield curve steepening. Stay on top of current and historical data relating to South Africa 10-Year Bond Yield. Two other important drivers of the bearish steepening had been the precarious South African fiscal situation and the rise until recently of US Treasury yields.

Source: mdpi.com

Source: mdpi.com

South Africas yield curve makes long bonds attractive for JPMorgan. Stay on top of current and historical data relating to South Africa 10-Year Bond Yield. This is also known as bearish yield curve steepening. 27 11 339 6640 Email. The South Africa 10Y Government Bond has a 8900 yield.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title south africa yield curve by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Child tax credit payments bill information

- Child tax credit july 2021 portal information

- Finance of america stock information

- Team usa in olympics information

- Mel gibson christ movie information

- Child tax credit portal down information

- Stephen a smith i dont care gif information

- Usa basketball in olympics information

- Social security yuba city information

- Stephen a smith megan olivi information