Social security tax rate 2021 information

Home » » Social security tax rate 2021 informationYour Social security tax rate 2021 images are available in this site. Social security tax rate 2021 are a topic that is being searched for and liked by netizens today. You can Download the Social security tax rate 2021 files here. Get all free photos and vectors.

If you’re searching for social security tax rate 2021 images information connected with to the social security tax rate 2021 topic, you have pay a visit to the ideal site. Our site frequently provides you with hints for seeing the maximum quality video and image content, please kindly search and find more enlightening video articles and images that fit your interests.

Social Security Tax Rate 2021. Data is also available for. Quarter of 2019 through the third quarter of 2020 Social Security and Supplemental Security Income SSI beneficiaries will receive a 13 percent COLA for 2021. On average the social security tax rate for employers in Europe in 2021 is 20. Social Security Rate in Indonesia is expected to reach 774 percent by the end of 2021 according to Trading Economics global macro models and analysts expectations.

Social Security Tax Definition From investopedia.com

Social Security Tax Definition From investopedia.com

Thinking about hiring in Europe or do you want to learn more about the costs and wages. Corporate tax rates indirect tax rates individual income and employee social security rates and you can try our interactive tax rates tool to compare tax rates by country jurisdiction or region. This is a lot higher than North American employers are used to. The deferred Social Security taxes will be withheld in the first five months of 2021 which will increase the tax rate slightly. The current rate for Medicare is 145 for. We pay taxes on the items we purchase and in some states a gas tax is also applied.

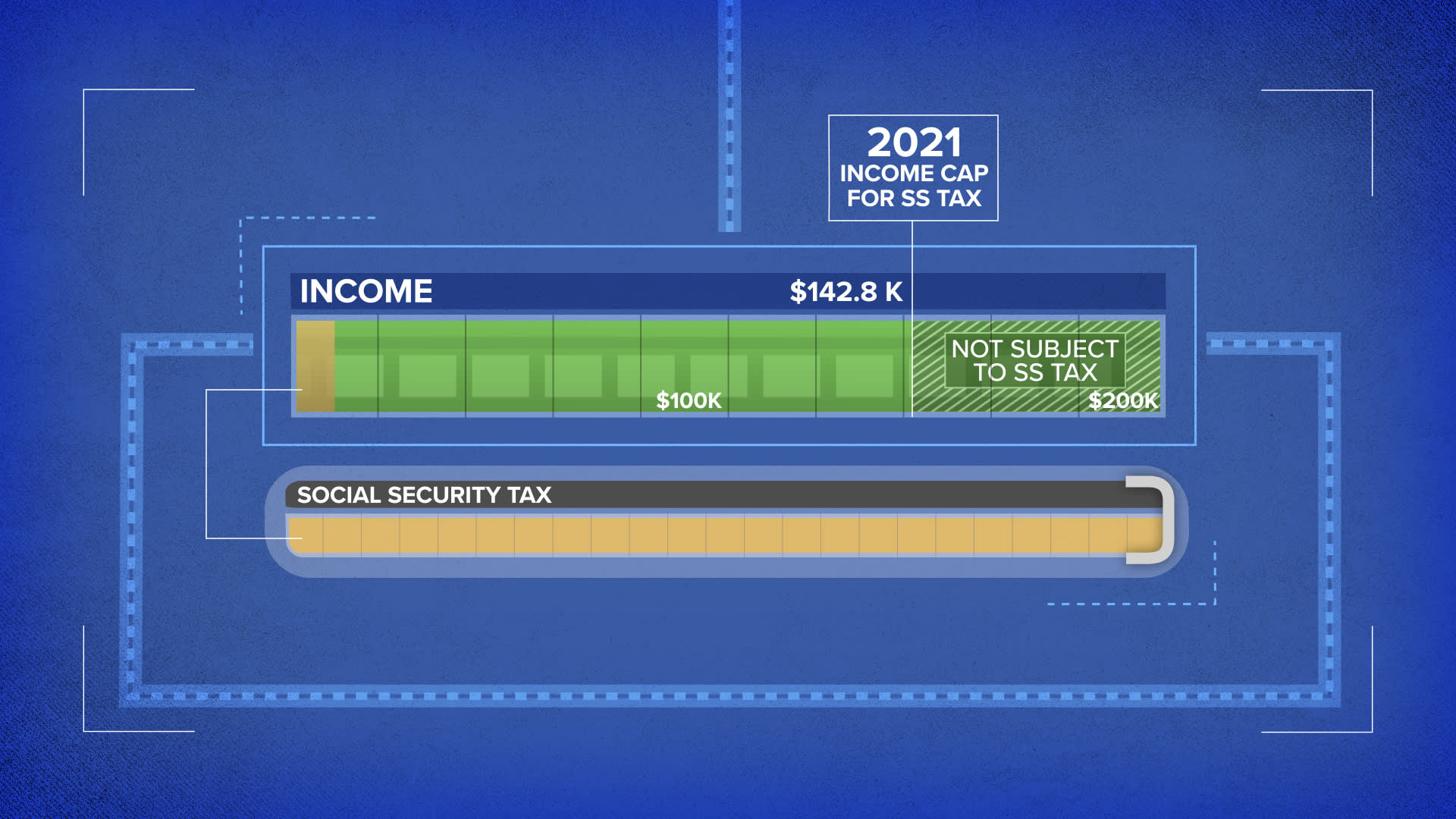

It was increased from 132900 to 137700 in 2020 and to 142800 for 2021.

This is a lot higher than North American employers are used to. Its collected by employers when processing payroll. Social security surcharge Contribution sociale généralisée CSG 05. Thats well below the minimum amount. In 2021 the Social Security tax rate is 62 for the employer and 62 for the employee. The Social Security Tax Wage Base All wages and self-employment income up to the Social Security wage base are subject to the 124 Social Security tax.

Source: gusto.com

Source: gusto.com

It was increased from 132900 to 137700 in 2020 and to 142800 for 2021. Social Security Tax Rate 2021. Rate Threshold Taxable Income Threshold. The corporate tax rate remains at 10 in 2021. Social Security benefits are also taxable.

Source: taxpolicycenter.org

Source: taxpolicycenter.org

The choices are 7 10 12 and 22. The corporate tax rate remains at 10 in 2021. Social Security tax is part of the Federal Insurance Contributions Act FICA tax. However you might pay more in Social Security taxes if this tax was deferred in the last quarter of 2020 with the payroll tax deferral. En español Social Security taxes in 2021 are 62 percent of gross wages up to 142800.

Source: businessinsider.com

If youre self-employed youre going to pay two times more than this rate. The corporate tax rate remains at 10 in 2021. Social Security Rate in Indonesia is expected to reach 774 percent by the end of 2021 according to Trading Economics global macro models and analysts expectations. The choices are 7 10 12 and 22. Its collected by employers when processing payroll.

Source: investopedia.com

Source: investopedia.com

The Social Security Tax Wage Base All wages and self-employment income up to the Social Security wage base are subject to the 124 Social Security tax. On average the social security tax rate for employers in Europe in 2021 is 20. In some states a state tax is also applied. Social Security benefits are also taxable. Chase Abrams Last Updated.

Source: investopedia.com

Source: investopedia.com

The deferred Social Security taxes will be withheld in the first five months of 2021 which will increase the tax rate slightly. Corporate tax rates indirect tax rates individual income and employee social security rates and you can try our interactive tax rates tool to compare tax rates by country jurisdiction or region. Across the nation up to 85 of your benefits can be taxed by the federal government. File Form W-4V with the Social Security Administration requesting an amount to be withheld for taxes. For 2021 the estimated average monthly Social Security check is 1543 which comes to 18516 per year.

Source: investopedia.com

Source: investopedia.com

These taxes are typically withheld by an employer and forwarded to the government on the employees behalf. The corporate tax rate remains at 10 in 2021. Social Security Rate in Indonesia is expected to reach 774 percent by the end of 2021 according to Trading Economics global macro models and analysts expectations. Corporate tax rates indirect tax rates individual income and employee social security rates and you can try our interactive tax rates tool to compare tax rates by country jurisdiction or region. For the entirety of the 2021 tax year the Social Security tax rate is 62 percent.

Source: investopedia.com

Source: investopedia.com

The employer social security rates tax table provides a view of tax rates around the world. The Social Security tax rate has been 62 percent for a long time and it isnt likely that it will change in the upcoming years. On average the social security tax rate for employers in Europe in 2021 is 20. The deferred Social Security taxes will be withheld in the first five months of 2021 which will increase the tax rate slightly. We pay taxes on the items we purchase and in some states a gas tax is also applied.

Source: whitecoatinvestor.com

Source: whitecoatinvestor.com

Chase Abrams Last Updated. However you might pay more in Social Security taxes if this tax was deferred in the last quarter of 2020 with the payroll tax deferral. The corporate tax rate remains at 10 in 2021. Quarter of 2019 through the third quarter of 2020 Social Security and Supplemental Security Income SSI beneficiaries will receive a 13 percent COLA for 2021. This was a short-term fixed and by April 30 2021 employers are required to collect all of the deferred Social Security taxes.

The wage base is adjusted periodically to keep pace with inflation. Here is a brief overview of 2021 tax rates and social security contributions in Bulgaria. The employer social security rates tax table provides a view of tax rates around the world. It was increased from 132900 to 137700 in 2020 and to 142800 for 2021. In 2021 the Social Security tax rate is 62 for the employer and 62 for the employee.

Source: forbes.com

Source: forbes.com

In 2021 the Social Security tax rate is 62 for the employer and 62 for the employee. Data is also available for. These taxes are typically withheld by an employer and forwarded to the government on the employees behalf. If youre self-employed youre going to pay two times more than this rate. The current rate for Medicare is 145 for.

Source: michaelkummer.com

Source: michaelkummer.com

File Form W-4V with the Social Security Administration requesting an amount to be withheld for taxes. Social Security benefits are also taxable. Across the nation up to 85 of your benefits can be taxed by the federal government. The Social Security Tax Wage Base All wages and self-employment income up to the Social Security wage base are subject to the 124 Social Security tax. These taxes are typically withheld by an employer and forwarded to the government on the employees behalf.

Source: investopedia.com

The choices are 7 10 12 and 22. Across the nation up to 85 of your benefits can be taxed by the federal government. If youre self-employed youre going to pay two times more than this rate. Rate Threshold Taxable Income Threshold. Chase Abrams Last Updated.

Source: whitecoatinvestor.com

Source: whitecoatinvestor.com

This is a lot higher than North American employers are used to. This is a lot higher than North American employers are used to. It was increased from 132900 to 137700 in 2020 and to 142800 for 2021. The choices are 7 10 12 and 22. The employer social security rates tax table provides a view of tax rates around the world.

Source: tax.thomsonreuters.com

Source: tax.thomsonreuters.com

The Social Security tax rate has been 62 percent for a long time and it isnt likely that it will change in the upcoming years. Calculating the Social Security tax is simple. For 2021 the estimated average monthly Social Security check is 1543 which comes to 18516 per year. The current rate for Medicare is 145 for. Social Security benefits are also taxable.

![]() Source: usatoday.com

Source: usatoday.com

Of the 50 states 13 states tax Social Security benefits. Quarter of 2019 through the third quarter of 2020 Social Security and Supplemental Security Income SSI beneficiaries will receive a 13 percent COLA for 2021. For the entirety of the 2021 tax year the Social Security tax rate is 62 percent. The choices are 7 10 12 and 22. Annual tax returns must be completed and submitted to the National Revenue Agency by no later than 30 June of the following.

Source: michaelkummer.com

Source: michaelkummer.com

For 2021 the estimated average monthly Social Security check is 1543 which comes to 18516 per year. Rate Threshold Taxable Income Threshold. The Social Security tax rate has been 62 percent for a long time and it isnt likely that it will change in the upcoming years. Social security surcharge Contribution sociale généralisée CSG 05. For 2021 the estimated average monthly Social Security check is 1543 which comes to 18516 per year.

Source: investopedia.com

Source: investopedia.com

Annual tax returns must be completed and submitted to the National Revenue Agency by no later than 30 June of the following. The employer social security rates tax table provides a view of tax rates around the world. Data is also available for. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. For the entirety of the 2021 tax year the Social Security tax rate is 62 percent.

Source: thecollegeinvestor.com

Source: thecollegeinvestor.com

In some states a state tax is also applied. Social security surcharge Contribution sociale généralisée CSG 05. Social Security tax is part of the Federal Insurance Contributions Act FICA tax. The average Social Security tax rate with the deferred Social Security taxes is expected to be about 8 to 10 percent on average for most workers. The tax rate is fixed at 62 for both employees and employers.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title social security tax rate 2021 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Child tax credit payments bill information

- Child tax credit july 2021 portal information

- Finance of america stock information

- Team usa in olympics information

- Mel gibson christ movie information

- Child tax credit portal down information

- Stephen a smith i dont care gif information

- Usa basketball in olympics information

- Social security yuba city information

- Stephen a smith megan olivi information