Social security tax limit 2020 information

Home » » Social security tax limit 2020 informationYour Social security tax limit 2020 images are ready. Social security tax limit 2020 are a topic that is being searched for and liked by netizens now. You can Find and Download the Social security tax limit 2020 files here. Download all free photos.

If you’re looking for social security tax limit 2020 images information connected with to the social security tax limit 2020 topic, you have visit the right site. Our website always provides you with suggestions for seeking the maximum quality video and picture content, please kindly search and find more informative video content and graphics that match your interests.

Social Security Tax Limit 2020. If you earned more than 137700 in 2020 you wont have to pay any tax on the income above this limit. The Social Security tax rate remains at 62 percent. Section 179 expensings 2020 limit is at 104 million an increase from 102 million in 2019. For high salaries only the first 132900 of income is subject to the Social Security tax for 2019.

The 2020 Guide To Social Security Spousal Benefits Simplywise From simplywise.com

The 2020 Guide To Social Security Spousal Benefits Simplywise From simplywise.com

For 2020 the maximum wage base jumps to 137700 an increase of 4800 or 36 over the max of 132900 that was in place for 2019. SSI Student Exclusion Monthly limit. How is this increase calculated. Estimated Average Monthly Social Security Benefits Payable in January 2020 Before. If that total is more than 32000 then part of their Social Security may be taxable. Social Security Tax Limit Wage Base for 2020 - SmartAsset The wage base or earnings limit for the 62 Social Security tax rises every year.

Each year the federal government sets a limit on the amount of earnings subject to Social Security tax.

For high salaries only the first 132900 of income is subject to the Social Security tax for 2019. How is this increase calculated. If You Work More Than One Job Keep the wage base in mind if you work for more than one employer. Social Security Tax Limit Wage Base for 2020 - SmartAsset The wage base or earnings limit for the 62 Social Security tax rises every year. SSI Resource Limits Individual. The Social Security Wage Base means that youll only ever pay Social Security taxes on 137700 and nothing else.

Source: smartasset.com

Source: smartasset.com

For taxes due in 2021 refer to the Social Security income maximum of 137700 as youre filing for the 2020 tax year. Self-employed people pay 124. In 2021 the Social Security tax limit is 142800 up from 137700 in 2020. For 2020 the maximum wage base jumps to 137700 an increase of 4800 or 36 over the max of 132900 that was in place for 2019. If that total is more than 32000 then part of their Social Security may be taxable.

Source: taxslayerpro.com

Source: taxslayerpro.com

All Retired Workers. All Retired Workers. This is 297 higher than the 2019 max of 8240. The maximum Social Security tax you could owe in 2020 is 853740 for employees and 1707480 for those who are self-employed. Given the new income limit for Social Security tax is 137700 for 2020 and the Social Security tax born by the employee is 62 the maximum Social Security tax payable by an employee is 137700 X 62 853740.

Source: socialsecurityintelligence.com

Source: socialsecurityintelligence.com

There is no limit on the amount of earnings subject to Medicare hospital insurance tax. If that total is more than 32000 then part of their Social Security may be taxable. Social Security Tax Limit Wage Base for 2020 - SmartAsset The wage base or earnings limit for the 62 Social Security tax rises every year. Given the new income limit for Social Security tax is 137700 for 2020 and the Social Security tax born by the employee is 62 the maximum Social Security tax payable by an employee is 137700 X 62 853740. Self-employed people pay 124.

Source: investopedia.com

Source: investopedia.com

Employees must be credited with a certain amount of work earned under Social Security to qualify for benefits. Then once you retire current workers will keep contributing to the fund while you receive benefits. This limit is an increase from the level set in 2019 which was 132900. The maximum Social Security tax employees and employers will each pay in 2020 is 853740. Employees must be credited with a certain amount of work earned under Social Security to qualify for benefits.

Source: controller.berkeley.edu

Source: controller.berkeley.edu

For taxes due in 2021 refer to the Social Security income maximum of 137700 as youre filing for the 2020 tax year. In 2021 the Social Security tax limit is 142800 up from 137700 in 2020. How the tax is calculated. There is no limit on the amount of earnings subject to Medicare hospital insurance tax. If You Work More Than One Job Keep the wage base in mind if you work for more than one employer.

Source: investopedia.com

Source: investopedia.com

SSI Student Exclusion Monthly limit. All Retired Workers. For taxes due in 2021 refer to the Social Security income maximum of 137700 as youre filing for the 2020 tax year. You cant pay more than 8537 in taxes for Social Security in 2020. There is no limit on the amount of earnings subject to Medicare hospital insurance tax.

Source: investopedia.com

Source: investopedia.com

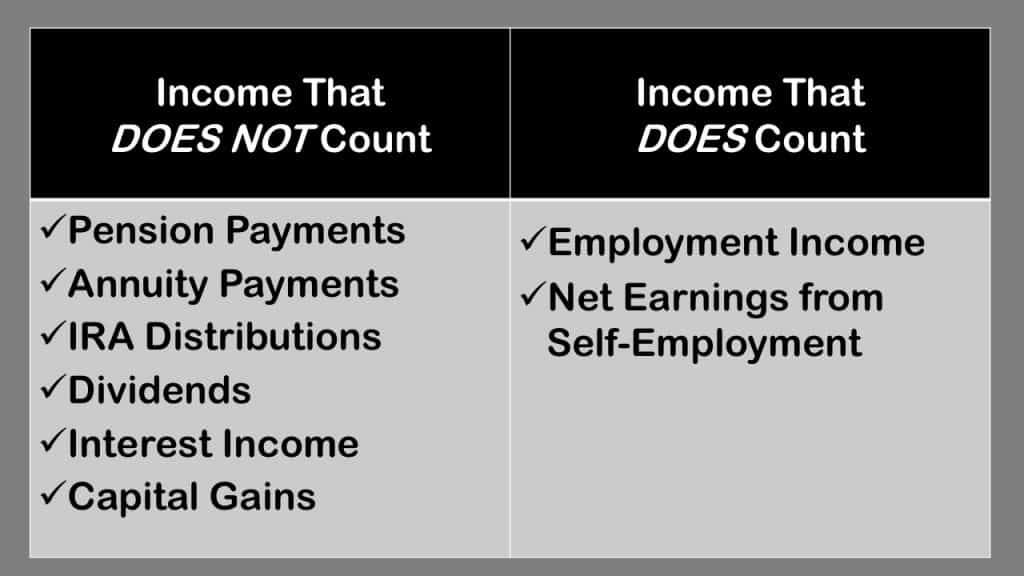

Self-employed people pay 124. The earnings limit applies only to workers who retire in the year they reach retirement age. How is this increase calculated. The resulting maximum Social Security tax for 2020 is 853740. Filing single single head of household or qualifying widow or widower with 25000 to 34000 income.

Source: simplywise.com

Source: simplywise.com

If your combined income was more than 34000 you will pay taxes on up to 85 of your Social Security benefits. SSI Student Exclusion Monthly limit. Given the new income limit for Social Security tax is 137700 for 2020 and the Social Security tax born by the employee is 62 the maximum Social Security tax payable by an employee is 137700 X 62 853740. In 2021 the Social Security tax limit is 142800 up from 137700 in 2020. Estimated Average Monthly Social Security Benefits Payable in January 2020 Before.

Source: socialsecurityintelligence.com

Source: socialsecurityintelligence.com

The amount of employees earnings that are subject to the Social Security tax limit for 2020 has been set at 137700. If You Work More Than One Job Keep the wage base in mind if you work for more than one employer. All Retired Workers. This limit is an increase from the level set in 2019 which was 132900. Social Security benefits are paid for through a tax on workers and their companies.

Source: tax.thomsonreuters.com

Source: tax.thomsonreuters.com

Employees must be credited with a certain amount of work earned under Social Security to qualify for benefits. For the 2019 and 2020 tax years single filers with a combined income of 25000 to 34000 must pay income taxes on up to 50 of their Social Security benefits. Employees must be credited with a certain amount of work earned under Social Security to qualify for benefits. For high salaries only the first 132900 of income is subject to the Social Security tax for 2019. The earnings limit applies only to workers who retire in the year they reach retirement age.

Source: simplywise.com

Source: simplywise.com

The Federal Insurance Contributions Act FICA tax rate which is the combined Social Security tax rate of 62 and the Medicare tax rate of 145 will be 765 for 2020 up to the Social Security wage base. There is no limit on the amount of earnings subject to Medicare hospital insurance tax. The maximum Social Security tax you could owe in 2020 is 853740 for employees and 1707480 for those who are self-employed. Filing single single head of household or qualifying widow or widower with 25000 to 34000 income. Aged Couple Both Receiving Benefits.

Source: investopedia.com

Source: investopedia.com

If you earned more than 137700 in 2020 you wont have to pay any tax on the income above this limit. If your combined income was more than 34000 you will pay taxes on up to 85 of your Social Security benefits. Employees must be credited with a certain amount of work earned under Social Security to qualify for benefits. For high salaries only the first 132900 of income is subject to the Social Security tax for 2019. Filing single single head of household or qualifying widow or widower with 25000 to 34000 income.

Source: yeoandyeo.com

Source: yeoandyeo.com

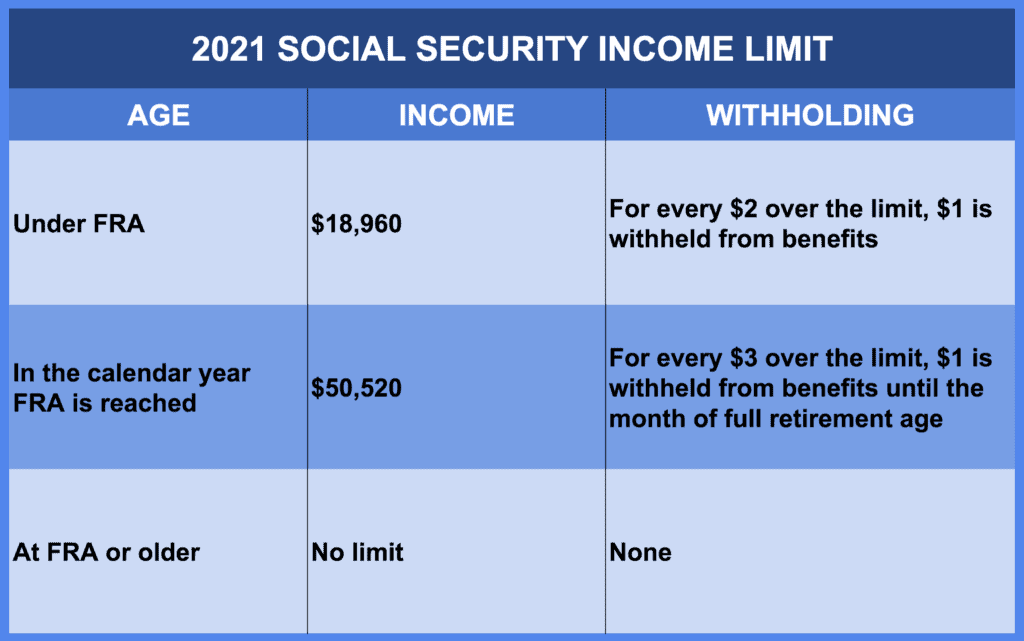

This limit is an increase from the level set in 2019 which was 132900. There is no limit on the amount of earnings subject to Medicare hospital insurance tax. For the 2019 and 2020 tax years single filers with a combined income of 25000 to 34000 must pay income taxes on up to 50 of their Social Security benefits. The Social Security earnings limit for workers who reach full retirement age increases to 48600 in 2020 up from 46920 in 2019 the SSA said. Self-employed people pay 124.

Source: stanfieldodell.com

Source: stanfieldodell.com

The Maximum Social Security Tax Amount And Benefits. Aged Couple Both Receiving Benefits. If You Work More Than One Job Keep the wage base in mind if you work for more than one employer. If you earned more than 137700 in 2020 you wont have to pay any tax on the income above this limit. For 2020 the maximum wage base jumps to 137700 an increase of 4800 or 36 over the max of 132900 that was in place for 2019.

Source: socialsecurityintelligence.com

Source: socialsecurityintelligence.com

This limit is an increase from the level set in 2019 which was 132900. The amount of employees earnings that are subject to the Social Security tax limit for 2020 has been set at 137700. For taxes due in 2021 refer to the Social Security income maximum of 137700 as youre filing for the 2020 tax year. How are the deductions affected. For the 2019 and 2020 tax years single filers with a combined income of 25000 to 34000 must pay income taxes on up to 50 of their Social Security benefits.

Source: greatwatersfinancial.com

Source: greatwatersfinancial.com

The resulting maximum Social Security tax for 2020 is 853740. Given the new income limit for Social Security tax is 137700 for 2020 and the Social Security tax born by the employee is 62 the maximum Social Security tax payable by an employee is 137700 X 62 853740. The resulting maximum Social Security tax for 2020 is 853740. Then once you retire current workers will keep contributing to the fund while you receive benefits. If that total is more than 32000 then part of their Social Security may be taxable.

Source: investopedia.com

Source: investopedia.com

How is this increase calculated. Filing single single head of household or qualifying widow or widower with 25000 to 34000 income. You cant pay more than 8537 in taxes for Social Security in 2020. There is no limit on the amount of earnings subject to Medicare hospital insurance tax. All Retired Workers.

Source: greatwatersfinancial.com

Source: greatwatersfinancial.com

The Social Security earnings limit for workers who reach full retirement age increases to 48600 in 2020 up from 46920 in 2019 the SSA said. The Federal Insurance Contributions Act FICA tax rate which is the combined Social Security tax rate of 62 and the Medicare tax rate of 145 will be 765 for 2020 up to the Social Security wage base. This limit is an increase from the level set in 2019 which was 132900. In 2021 the Social Security tax limit is 142800 up from 137700 in 2020. How are the deductions affected.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title social security tax limit 2020 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.