Irs child tax credit tracker information

Home » » Irs child tax credit tracker informationYour Irs child tax credit tracker images are available in this site. Irs child tax credit tracker are a topic that is being searched for and liked by netizens today. You can Download the Irs child tax credit tracker files here. Get all free images.

If you’re searching for irs child tax credit tracker pictures information connected with to the irs child tax credit tracker topic, you have visit the right site. Our site always provides you with hints for downloading the highest quality video and picture content, please kindly hunt and locate more enlightening video articles and images that fit your interests.

Irs Child Tax Credit Tracker. Needs further review in general. Your Social Security number or Individual Taxpayer Identification Number your. The first child tax credit. Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer.

Get A Record Of Your Past Tax Returns Also Referred To As Transcripts Irs Transcripts Are Often Used To Validate Income And Tax Fili Tax Return Tax Tax Forms From pinterest.com

Get A Record Of Your Past Tax Returns Also Referred To As Transcripts Irs Transcripts Are Often Used To Validate Income And Tax Fili Tax Return Tax Tax Forms From pinterest.com

The latest Child Tax Credit Update Portal currently allows families to view their. THE IRS has launched a new tracking tool that will help low-income American families file for child tax credits. Among other things it provides direct links to the Child Tax Credit Update Portal as well as two other online tools the Non-filer Sign-up Tool and the Child Tax Credit Eligibility Assistant a set of frequently asked questions. The American Rescue plan increased the maximum Child Tax Credit amount in 2021 to 3600 per child for children under the age of 6 and to 3000 per child for children. Monthly payments worth up to 300 will be sent out to homes across the country from July 15. Child Tax Credit Non-filer Sign-up Tool.

The Internal Revenue Service is on track to start sending stimulus-enhanced child tax credits to millions of families in July the agencys head said Tuesday.

The latest Child Tax Credit Update Portal currently allows families to view their. These changes apply to tax year 2021 only. The Internal Revenue Service is on track to start sending stimulus-enhanced child tax credits to millions of families in July the agencys head said Tuesday. The Internal Revenue Service is on track to send the monthly advanced payments for the Child Tax Credit CTC starting in July according to IRS Commissioner Charles Rettig. Yes you can track your checks delivery but heres more information about the IRS service. Read our stimulus checks live blog for the latest updates on Covid-19 relief.

Source:

Source:

According to the IRS. Monthly payments worth up to 300 will be sent out to homes across the country from July 15. Anyone who filed a tax return in the last two years or has used the IRS Non-Filer tool will be. The changes increased the child tax credit from 2000 to 3000 for children over 6 and to 3600 for children under 6. You will only need to.

Source: pinterest.com

Source: pinterest.com

According to the IRS. And the Child Tax Credit Eligibility Assistant tool helps families quickly determine whether they qualify. Most parents dont have to do anything to get the funds since the IRS already has their 2020 or 2019 returns showing they claimed the regular child tax credit. The IRS will pay half the total credit amount in advance monthly payments beginning July 15. This one requires authentication of your identity.

Source: pinterest.com

Source: pinterest.com

Youll be able to see your history of payments as well. The agency is also launching a portal where taxpayers will be able to update their information by July 1. If you did not file a 2020 tax return this tool may help you get these payments. The changes increased the child tax credit from 2000 to 3000 for children over 6 and to 3600 for children under 6. Anyone who filed a tax return in the last two years or has used the IRS Non-Filer tool will be.

Source: ar.pinterest.com

Source: ar.pinterest.com

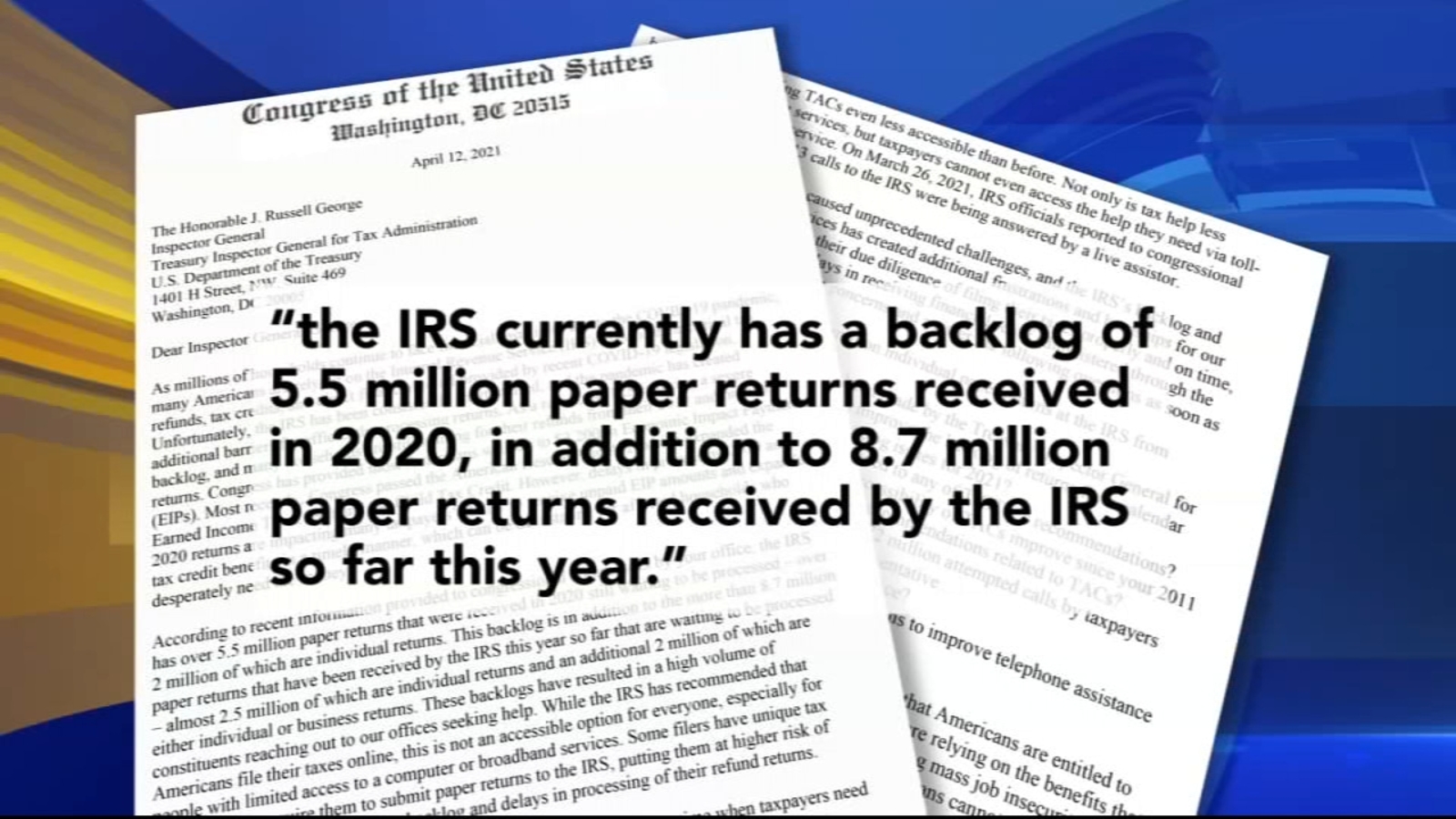

The IRS has set up three helpful online tools for families to use to manage their payments from the 2021 Child Tax Credit check eligibility and register for the payments. For the latest information on IRS refund processing during the COVID-19 pandemic see the IRS Operations. If you did not file a 2020 tax return this tool may help you get these payments. These changes apply to tax year 2021 only. The payments are worth up to 300 per child.

Source: abc7news.com

Source: abc7news.com

Includes a claim filed for an Earned Income Tax Credit or an Additional Child Tax Credit using 2019 income. The Internal Revenue Service is on track to start sending stimulus-enhanced child tax credits to millions of families in July the agencys head said Tuesday. The enhanced credit gives families up to 3600 for each child under 6 and 3000 for each one under age 18. Youll be able to see your history of payments as well. Yes you can track your checks delivery but heres more information about the IRS service.

Source: 6abc.com

Source: 6abc.com

This is up from the existing credit of up to 2000 per child under age 17. Yes you can track your checks delivery but heres more information about the IRS service. The IRS has created a special Advance Child Tax Credit 2021 page designed to provide the most up-to-date information about the credit and the advance payments. Both the Child Tax Credit Eligibility Assistant and Child Tax Credit Update Portal are available now on IRSgov. If you did not file a 2020 tax return this tool may help you get these payments.

Source: cnet.com

Source: cnet.com

The changes increased the child tax credit from 2000 to 3000 for children over 6 and to 3600 for children under 6. Half the total credit amount will be paid in advance monthly payments and you will claim the other half when you file your 2021 income tax return. For more on stimulus payments and relief aid here is information about the child tax credit for up to 3600 per child and details on who qualifies. Although the initial button says Unenroll me which is a bit scary-sounding it really just helps you manage the tax credit. The IRS will pay half the total credit amount in advance monthly payments beginning July 15.

Source: pinterest.com

Source: pinterest.com

The agency is also launching a portal where taxpayers will be able to update their information by July 1. Your Social Security number or Individual Taxpayer Identification Number your. Among other things it provides direct links to the Child Tax Credit Update Portal as well as two other online tools the Non-filer Sign-up Tool and the Child Tax Credit Eligibility Assistant a set of frequently asked questions. You will only need to. Half the total credit amount will be paid in advance monthly payments and you will claim the other half when you file your 2021 income tax return.

Source: krqe.com

Source: krqe.com

You will only need to. Well issue the first advance payment on July 15 2021. For tax year 2021 the Child Tax Credit is. Includes a claim filed for an Earned Income Tax Credit or an Additional Child Tax Credit using 2019 income. According to the IRS.

Source: cnet.com

Source: cnet.com

Read our stimulus checks live blog for the latest updates on Covid-19 relief. Well issue the first advance payment on July 15 2021. These changes apply to tax year 2021 only. But cutting child poverty in half means getting money to those hardest to reach. The Internal Revenue Service is on track to start sending stimulus-enhanced child tax credits to millions of families in July the agencys head said Tuesday.

Source: br.pinterest.com

Source: br.pinterest.com

Although the initial button says Unenroll me which is a bit scary-sounding it really just helps you manage the tax credit. The Internal Revenue Service is on track to send the monthly advanced payments for the Child Tax Credit CTC starting in July according to IRS Commissioner Charles Rettig. For the latest information on IRS refund processing during the COVID-19 pandemic see the IRS Operations. For more on stimulus payments and relief aid here is information about the child tax credit for up to 3600 per child and details on who qualifies. The payments are worth up to 300 per child.

Source: the-sun.com

Source: the-sun.com

The IRS has set up three helpful online tools for families to use to manage their payments from the 2021 Child Tax Credit check eligibility and register for the payments. Child Tax Credit Update Portal. Needs further review in general. Child tax credit money comes in three days. The American Rescue plan increased the maximum Child Tax Credit amount in 2021 to 3600 per child for children under the age of 6 and to 3000 per child for children.

Source: pinterest.com

Source: pinterest.com

Track vaccinations Comparing vaccines. Your Social Security number or Individual Taxpayer Identification Number your. The enhanced credit gives families up to 3600 for each child under 6 and 3000 for each one under age 18. Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer. Among other things it provides direct links to the Child Tax Credit Update Portal as well as two other online tools the Non-filer Sign-up Tool and the Child Tax Credit Eligibility Assistant a set of frequently asked questions.

Source: pinterest.com

Source: pinterest.com

The enhanced credit gives families up to 3600 for each child under 6 and 3000 for each one under age 18. This one requires authentication of your identity. Well issue the first advance payment on July 15 2021. The first child tax credit. For tax year 2021 the Child Tax Credit is.

Source: cnet.com

Source: cnet.com

Child Tax Credit Update Portal. Your Social Security number or Individual Taxpayer Identification Number your. The American Rescue plan increased the maximum Child Tax Credit amount in 2021 to 3600 per child for children under the age of 6 and to 3000 per child for children. Track vaccinations Comparing vaccines. The IRS has created a special Advance Child Tax Credit 2021 page designed to provide the most up-to-date information about the credit and the advance payments.

Source: pinterest.com

Source: pinterest.com

Child tax credit money comes in three days. This one requires authentication of your identity. And the Child Tax Credit Eligibility Assistant tool helps families quickly determine whether they qualify. Includes a Form 8379 Injured Spouse Allocation PDF which could take up to 14 weeks to process. Youll be able to see your history of payments as well.

Source: philadelphia.cbslocal.com

Source: philadelphia.cbslocal.com

Includes a claim filed for an Earned Income Tax Credit or an Additional Child Tax Credit using 2019 income. Youll be able to see your history of payments as well. Read our stimulus checks live blog for the latest updates on Covid-19 relief. Most parents dont have to do anything to get the funds since the IRS already has their 2020 or 2019 returns showing they claimed the regular child tax credit. The payments are worth up to 300 per child.

Source: technohoop.com

Source: technohoop.com

But cutting child poverty in half means getting money to those hardest to reach. The first child tax credit. Child tax credit money comes in three days. Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021. Anyone who filed a tax return in the last two years or has used the IRS Non-Filer tool will be.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title irs child tax credit tracker by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Child tax credit payments bill information

- Child tax credit july 2021 portal information

- Finance of america stock information

- Team usa in olympics information

- Mel gibson christ movie information

- Child tax credit portal down information

- Stephen a smith i dont care gif information

- Usa basketball in olympics information

- Social security yuba city information

- Stephen a smith megan olivi information