Irs child tax credit reddit information

Home » » Irs child tax credit reddit informationYour Irs child tax credit reddit images are available in this site. Irs child tax credit reddit are a topic that is being searched for and liked by netizens today. You can Get the Irs child tax credit reddit files here. Find and Download all royalty-free images.

If you’re searching for irs child tax credit reddit pictures information linked to the irs child tax credit reddit topic, you have come to the right site. Our site frequently gives you hints for seeking the highest quality video and picture content, please kindly hunt and locate more enlightening video articles and graphics that match your interests.

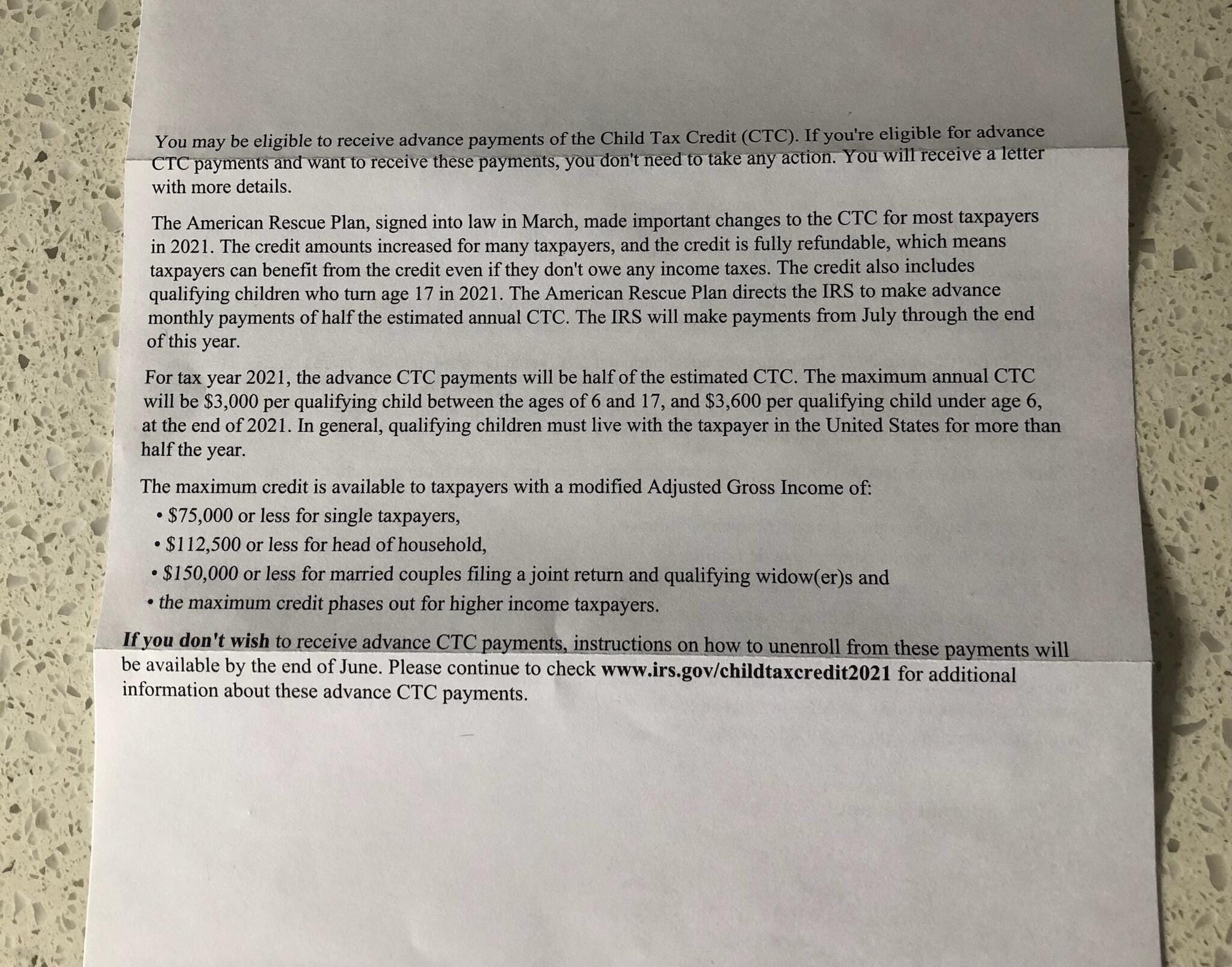

Irs Child Tax Credit Reddit. The maximum credit in 2021 is 3600 for children under 6 and 3000 for children between 6 and 17. 1800 for younger children. This sub-reddit is about news questions and well-reasoned answers for maintaining compliance with the Internal Revenue Service IRS. The IRS will pay half the total credit amount in advance monthly payments beginning July 15.

The Irs 1040 Hotline Is Answering Only 1 Out Of Every 50 Calls The Washington Post From washingtonpost.com

The Irs 1040 Hotline Is Answering Only 1 Out Of Every 50 Calls The Washington Post From washingtonpost.com

The enhanced child tax credit for 2021 is worth 3000 per child between ages six and 17. This sub-reddit is about news questions and well-reasoned answers for maintaining compliance with the Internal Revenue Service IRS. Americans can also check their eligibility using an additional tool the IRS introduced on Tuesday. For children under age six an extra 600 will be included in your familys tax credit payments. They said you dont have to do anything to get the CTC payments supposedly starting in July. Grandparents who work and are also raising grandchildren might benefit from the earned income tax creditThe IRS encourages these grandparents to find out if they qualify for this creditThis is important because grandparents who care for children are often not aware that they could claim these children for the EITC.

Originally started by John Dundon an Enrolled Agent who represents people against the IRS rIRS has grown into an excellent portal for quality information from any number of tax professionals and Reddit.

The IRS plans to begin sending monthly payments from the new 3000 child tax credit in July Commissioner Charles Rettig said Tuesday during a. You will claim the other half when you file your 2021 income tax return. Child Tax Credit 2021. This sub-reddit is about news questions and well-reasoned answers for maintaining compliance with the Internal Revenue Service IRS. Under the full tax credit monthly payments will be 300 per child under age 6 and 250 per child ages 6 to 17. In this case you may have to repay the.

Originally started by John Dundon an Enrolled Agent who represents people against the IRS rIRS has grown into an excellent portal for quality information from any number of tax professionals and Reddit contributing members. What about the people who havent even gotten their 2019 or 2020 returns before then or by the summer. RIRS has grown into an excellent portal for quality information from any number of tax professionals and Reddit contributing members. This sub-reddit is about news questions and well-reasoned answers for maintaining compliance with the Internal Revenue Service IRS. Since the IRS uses your 2019 or 2020 tax return your family may not qualify for the child tax credit payment when you file your 2021 tax return in 2022.

Source: insuremekevin.com

Source: insuremekevin.com

Butwhat about the people who would rather get a lump sum of money when they file their 2021 taxes in 2222. These payments will amount to half of the credit. Under the full tax credit monthly payments will be 300 per child under age 6 and 250 per child ages 6 to 17. Families can now opt out of the monthly Child Tax Credit CTC payments through an online tool on the Internal Revenue Services website just over three weeks before the agency sends out the first payments. That comes out to 300 per month and 1800 at tax time.

Source: reddit.com

Source: reddit.com

These payments will amount to half of the credit. For children under age six an extra 600 will be included in your familys tax credit payments. That comes out to 300 per month and 1800 at tax time. Originally started by John Dundon an Enrolled Agent who represents people against the IRS rIRS has grown into an excellent portal for quality information from any number of tax professionals and Reddit. 9 details to know about IRS tax refunds on.

Source: pinterest.com

Source: pinterest.com

June 22 2021 1255 PM 4 min read. RIRS has grown into an excellent portal for quality information from any number of tax professionals and Reddit contributing members. Advance Child Tax Credit Payments in 2021. What about the people who havent even gotten their 2019 or 2020 returns before then or by the summer. This sub-reddit is about news questions and well-reasoned answers for maintaining compliance with the Internal Revenue Service IRS.

Advance Child Tax Credit Payments in 2021. Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer. These payments will amount to half of the credit. Americans can also check their eligibility using an additional tool the IRS introduced on Tuesday. Most folks who qualified for the child tax credit on their 2019 or 2020 taxes or who signed up specifically for a stimulus payment because they didnt have to pay taxes wont have to do anything unless their address or bank has changed.

Source: hrblock.com

Source: hrblock.com

What about the people who havent even gotten their 2019 or 2020 returns before then or by the summer. What about the people who havent even gotten their 2019 or 2020 returns before then or by the summer. Originally started by John Dundon an Enrolled Agent who represents people against the IRS rIRS has grown into an excellent portal for quality information from any number of tax professionals and Reddit. The IRS plans to begin sending monthly payments from the new 3000 child tax credit in July Commissioner Charles Rettig said Tuesday during a. Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer.

Source: fuentitech.com

Source: fuentitech.com

They said you dont have to do anything to get the CTC payments supposedly starting in July. Child Tax Credit 2021. Grandparents who work and are also raising grandchildren might benefit from the earned income tax creditThe IRS encourages these grandparents to find out if they qualify for this creditThis is important because grandparents who care for children are often not aware that they could claim these children for the EITC. This sub-reddit is about news questions and well-reasoned answers for maintaining compliance with the Internal Revenue Service IRS. Since the IRS uses your 2019 or 2020 tax return your family may not qualify for the child tax credit payment when you file your 2021 tax return in 2022.

Source: whnt.com

Source: whnt.com

For parents of children up to age five the IRS will pay 3600 per child half as six monthly payments and half as a 2021 tax credit. For parents of children up to age five the IRS will pay 3600 per child half as six monthly payments and half as a 2021 tax credit. Tax Tip 2018-10 January 23 2018. Originally started by John Dundon an Enrolled Agent who represents people against the IRS rIRS has grown into an excellent portal for quality information from any number of tax professionals and Reddit. 9 details to know about IRS tax refunds on.

Source: washingtonpost.com

Source: washingtonpost.com

What about the people who havent even gotten their 2019 or 2020 returns before then or by the summer. For children under age six an extra 600 will be included in your familys tax credit payments. Under the full tax credit monthly payments will be 300 per child under age 6 and 250 per child ages 6 to 17. In 2021 the maximum enhanced child tax credit is 3600 for children. What about the people who havent even gotten their 2019 or 2020 returns before then or by the summer.

Source: reddit.com

Source: reddit.com

Butwhat about the people who would rather get a lump sum of money when they file their 2021 taxes in 2222. 9 details to know about IRS tax refunds on. The IRS will pay half the total credit amount in advance monthly payments beginning July 15. Most folks who qualified for the child tax credit on their 2019 or 2020 taxes or who signed up specifically for a stimulus payment because they didnt have to pay taxes wont have to do anything unless their address or bank has changed. Tax Tip 2018-10 January 23 2018.

Source: fuentitech.com

Source: fuentitech.com

The IRS plans to begin sending monthly payments from the new 3000 child tax credit in July Commissioner Charles Rettig said Tuesday during a. Under the full tax credit monthly payments will be 300 per child under age 6 and 250 per child ages 6 to 17. 1800 for younger children. The maximum Child Tax Credit in 2021 to 3600 for children under the age of 6 and to 3000 per child for children between ages 6 and 17. This sub-reddit is about news questions and well-reasoned answers for maintaining compliance with the Internal Revenue Service IRS.

Source: reddit.com

Source: reddit.com

And if youre a parent expecting your first child tax credit payment on July 15 we can tell you how those payments could affect your taxes next year. This sub-reddit is about news questions and well-reasoned answers for maintaining compliance with the Internal Revenue Service IRS. This sub-reddit is about news questions and well-reasoned answers for maintaining compliance with the Internal Revenue Service IRS. Advance Child Tax Credit Payments in 2021. RIRS does not represent the IRS.

Source:

Source:

Since the IRS uses your 2019 or 2020 tax return your family may not qualify for the child tax credit payment when you file your 2021 tax return in 2022. Most folks who qualified for the child tax credit on their 2019 or 2020 taxes or who signed up specifically for a stimulus payment because they didnt have to pay taxes wont have to do anything unless their address or bank has changed. RIRS has grown into an excellent portal for quality information from any number of tax professionals and Reddit contributing members. Originally started by John Dundon an Enrolled Agent who represents people against the IRS rIRS has grown into an excellent portal for quality information from any number of tax professionals and Reddit contributing members. What about the people who havent even gotten their 2019 or 2020 returns before then or by the summer.

Source: hrblock.com

Source: hrblock.com

Originally started by John Dundon an Enrolled Agent who represents people against the IRS rIRS has grown into an excellent portal for quality information from any number of tax professionals and Reddit. 1800 for younger children. Originally started by John Dundon an Enrolled Agent who represents people against the IRS rIRS has grown into an excellent portal for quality information from any number of tax professionals and Reddit. Originally started by John Dundon an Enrolled Agent who represents people against the IRS rIRS has grown into an excellent portal for quality information from any number of tax professionals and Reddit. These payments will amount to half of the credit.

Source: finance.yahoo.com

Since the IRS uses your 2019 or 2020 tax return your family may not qualify for the child tax credit payment when you file your 2021 tax return in 2022. Tax Tip 2018-10 January 23 2018. In this case you may have to repay the. Originally started by John Dundon an Enrolled Agent who represents people against the IRS rIRS has grown into an excellent portal for quality information from any number of tax professionals and Reddit. 9 details to know about IRS tax refunds on.

Source: yolocounty.org

They said you dont have to do anything to get the CTC payments supposedly starting in July. They said you dont have to do anything to get the CTC payments supposedly starting in July. RIRS does not represent the IRS. Originally started by John Dundon an Enrolled Agent who represents people against the IRS rIRS has grown into an excellent portal for quality information from any number of tax professionals and Reddit. Families can now opt out of the monthly Child Tax Credit CTC payments through an online tool on the Internal Revenue Services website just over three weeks before the agency sends out the first payments.

Source: sheridanmedia.com

Source: sheridanmedia.com

The IRS will pay half the total credit amount in advance monthly payments beginning July 15. In this case you may have to repay the. Most folks who qualified for the child tax credit on their 2019 or 2020 taxes or who signed up specifically for a stimulus payment because they didnt have to pay taxes wont have to do anything unless their address or bank has changed. The expanded credit was established in the American Rescue Plan signed into law in March. Families can now opt out of the monthly Child Tax Credit CTC payments through an online tool on the Internal Revenue Services website just over three weeks before the agency sends out the first payments.

Source: newsweek.com

Source: newsweek.com

The IRS will pay half the total credit amount in advance monthly payments beginning July 15. June 22 2021 1255 PM 4 min read. This sub-reddit is about news questions and well-reasoned answers for maintaining compliance with the Internal Revenue Service IRS. Households covering more than 65 million children will receive the monthly CTC payments through direct deposit paper check or debit cards and IRS and Treasury are committed to maximizing the use of direct. RIRS does not represent the IRS.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title irs child tax credit reddit by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Child tax credit payments bill information

- Child tax credit july 2021 portal information

- Finance of america stock information

- Team usa in olympics information

- Mel gibson christ movie information

- Child tax credit portal down information

- Stephen a smith i dont care gif information

- Usa basketball in olympics information

- Social security yuba city information

- Stephen a smith megan olivi information