Irs child tax credit portal open information

Home » » Irs child tax credit portal open informationYour Irs child tax credit portal open images are available in this site. Irs child tax credit portal open are a topic that is being searched for and liked by netizens now. You can Get the Irs child tax credit portal open files here. Download all free photos and vectors.

If you’re searching for irs child tax credit portal open pictures information connected with to the irs child tax credit portal open topic, you have visit the right site. Our site always provides you with suggestions for refferencing the highest quality video and image content, please kindly surf and locate more informative video content and graphics that fit your interests.

Irs Child Tax Credit Portal Open. These changes apply to tax year 2021 only. The IRS opened its nonfilers child tax credit portal this week to let families who arent normally required to file an income tax return provide the agency with information so. May 25 2021 at 425 pm CDT By Debbie Lord Cox Media Group National Content Desk. Half the total credit amount will be paid in advance monthly payments and you will claim the other half when you file your 2021 income tax return.

Child Tax Credit Parents With 2021 Babies Can Get Up To 3 600 Too Cnet From cnet.com

Child Tax Credit Parents With 2021 Babies Can Get Up To 3 600 Too Cnet From cnet.com

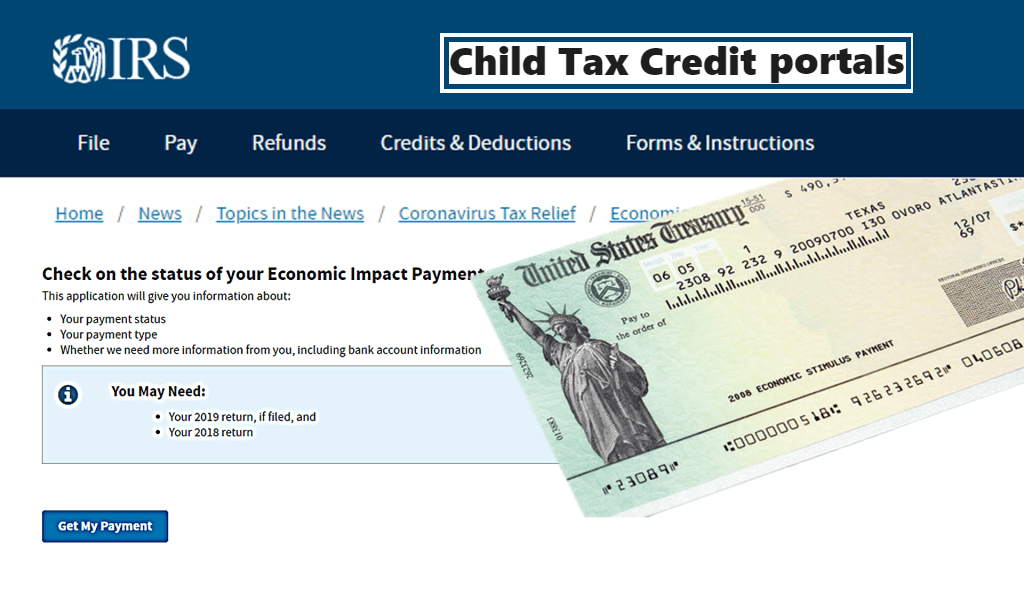

Posted Jun 15 2021 The IRS said monthly child tax credit. The agency opened the portal on its website as the White House announced Child Tax Credit Awareness Day on Monday to raise awareness about the extra stimulus funds for families. To do so visit the Child Tax Credit Update Portal and tap Manage Advance Payments. IRS child tax credit portal open to unenroll and check eligibility. The changes to the Child Tax Credit are. The Child Tax Credit Update Portal allows you to verify your eligibility for the payments.

The Child Tax Credit Update Portal now lets you opt out of receiving the monthly child tax credit payments.

The Child Tax Credit Update Portal now lets you opt out of receiving the monthly child tax credit payments. If a person has an existing IRS username or an IDme account with a verified identity they can use those. To help you get ready the IRS has opened up an online portal to make sure nonfilers receive that first check on. The Child Tax Credit Update Portal now lets you opt out of receiving the monthly child tax credit payments. Youll then need to sign in with your IRS username or IDme. Child Tax Credit.

Source: wate.com

Source: wate.com

To help you get ready the IRS has opened up an online portal to make sure nonfilers receive that first check on. THE IRS has opened an online portal allowing non-filers to register information to receive the 3600 child tax credit when first payments are issued on July 15. If a person has an existing IRS username or an IDme account with a verified identity they can use those. The Child Tax Credit Update Portal lets you verify that your family qualifies for the credit and opt out of receiving any payments in 2021. Youll then need to sign in with your IRS username or IDme.

Source: waow.com

Source: waow.com

The next deadline to opt out is Aug. To qualify for advance Child Tax Credit payments you and your spouse if you filed a joint return must have. The Child Tax Credit Update Portal now lets you opt out of receiving the monthly child tax credit payments. To access the Child Tax Credit Update Portal a person must first verify their identity. The next deadline to opt out is Aug.

Source: the-sun.com

Source: the-sun.com

Child Tax Credit. If a person has an existing IRS username or an IDme account with a verified identity they can use those. The Child Tax Credit Update Portal allows you to verify your eligibility for the payments. Youll then need to sign in with your IRS username or IDme. Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021.

Source: cnet.com

Source: cnet.com

Well issue the first advance payment on July 15 2021. The Child Tax Credit previously provided 2000 per child under 17 for single filers with incomes of 200000 or less and couples filing jointly with 400000 of adjusted gross income or less. IRS to open portals on July 1. The IRS opened its nonfilers child tax credit portal this week to let families who arent normally required to file an income tax return provide the agency with information so. Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the.

Source: newscentermaine.com

Source: newscentermaine.com

Well issue the first advance payment on July 15 2021. The IRS opened its nonfilers child tax credit portal this week to let families who arent normally required to file an income tax return provide the agency with information so. Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the. Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021. The Child Tax Credit previously provided 2000 per child under 17 for single filers with incomes of 200000 or less and couples filing jointly with 400000 of adjusted gross income or less.

Source: cnet.com

Source: cnet.com

Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021. To do so visit the Child Tax Credit Update Portal and tap Manage Advance Payments. This tool can be used by families that didnt file or dont plan to file a 2020 tax return and who need to notify the IRS of qualifying children born before 2021. IRS to open portals on July 1. The Child Tax Credit Update Portal allows you to verify your eligibility for the payments.

Source: the-sun.com

Source: the-sun.com

You will claim the other half when you file your 2021 income tax return. To help you get ready the IRS has opened up an online portal to make sure nonfilers receive that first check on. Youll then need to sign in with your IRS username or IDme. May 25 2021 at 425 pm CDT By Debbie Lord Cox Media Group National Content Desk. The Child Tax Credit previously provided 2000 per child under 17 for single filers with incomes of 200000 or less and couples filing jointly with 400000 of adjusted gross income or less.

Source: southernmarylandchronicle.com

Source: southernmarylandchronicle.com

THE IRS has opened an online portal allowing non-filers to register information to receive the 3600 child tax credit when first payments are issued on July 15. May 25 2021 at 425 pm CDT By Debbie Lord Cox Media Group National Content Desk. The next deadline to opt out is Aug. You will claim the other half when you file your 2021 income tax return. Checks will begin July 15.

Source: fox2now.com

Source: fox2now.com

The Child Tax Credit previously provided 2000 per child under 17 for single filers with incomes of 200000 or less and couples filing jointly with 400000 of adjusted gross income or less. To qualify for advance Child Tax Credit payments you and your spouse if you filed a joint return must have. Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the. Youll then need to sign in with your IRS username or IDme. To help you get ready the IRS has opened up an online portal to make sure nonfilers receive that first check on.

Source: cnet.com

Source: cnet.com

The Child Tax Credit Update Portal now lets you opt out of receiving the monthly child tax credit payments. Posted Jun 15 2021 The IRS said monthly child tax credit. To do so visit the Child Tax Credit Update Portal and tap Manage Advance Payments. The changes to the Child Tax Credit are. Open now the child tax credit Non-Filer Sign-Up Tool is a way for those who arent required to file a tax return to give the tax agency basic information on their dependents.

Source: legacytaxresolutionservices.com

Source: legacytaxresolutionservices.com

IRS opens portal to register for 300 a month child tax credit payments Updated Jun 15 2021. Well issue the first advance payment on July 15 2021. To access the Child Tax Credit Update Portal a person must first verify their identity. The Child Tax Credit Update Portal allows you to verify your eligibility for the payments. Checks will begin July 15.

Source: krqe.com

Source: krqe.com

The IRS will pay half the total credit amount in advance monthly payments beginning July 15. The first child tax credit payment is coming in a little over three weeks. Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the. The next deadline to opt out is Aug. The changes to the Child Tax Credit are.

Source:

Source:

Posted Jun 15 2021 The IRS said monthly child tax credit. Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the. To help you get ready the IRS has opened up an online portal to make sure nonfilers receive that first check on. The Child Tax Credit Update Portal allows you to verify your eligibility for the payments. To do so visit the Child Tax Credit Update Portal and tap Manage Advance Payments.

Source: the-sun.com

Source: the-sun.com

This tool can be used by families that didnt file or dont plan to file a 2020 tax return and who need to notify the IRS of qualifying children born before 2021. The Child Tax Credit Update Portal lets you verify that your family qualifies for the credit and opt out of receiving any payments in 2021. These changes apply to tax year 2021 only. Child Tax Credit. IRS opens portal to register for 300 a month child tax credit payments Updated Jun 15 2021.

Source: refundtalk.com

Source: refundtalk.com

This tool can be used by families that didnt file or dont plan to file a 2020 tax return and who need to notify the IRS of qualifying children born before 2021. To access the Child Tax Credit Update Portal a person must first verify their identity. Half the total credit amount will be paid in advance monthly payments and you will claim the other half when you file your 2021 income tax return. The Child Tax Credit Update Portal now lets you opt out of receiving the monthly child tax credit payments. To qualify for advance Child Tax Credit payments you and your spouse if you filed a joint return must have.

Source: cnet.com

Source: cnet.com

To help you get ready the IRS has opened up an online portal to make sure nonfilers receive that first check on. Half the total credit amount will be paid in advance monthly payments and you will claim the other half when you file your 2021 income tax return. IRS to open portals on July 1. Checks will begin July 15. To qualify for advance Child Tax Credit payments you and your spouse if you filed a joint return must have.

Source: king5.com

Source: king5.com

IRS child tax credit portal open to unenroll and check eligibility. You will claim the other half when you file your 2021 income tax return. Youll then need to sign in with your IRS username or IDme. June 28 2021. Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the.

Source: help.id.me

Source: help.id.me

Well issue the first advance payment on July 15 2021. That means that instead of receiving monthly payments of say 300 for your 4-year-old. Open now the child tax credit Non-Filer Sign-Up Tool is a way for those who arent required to file a tax return to give the tax agency basic information on their dependents. Posted Jun 15 2021 The IRS said monthly child tax credit. The Child Tax Credit previously provided 2000 per child under 17 for single filers with incomes of 200000 or less and couples filing jointly with 400000 of adjusted gross income or less.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title irs child tax credit portal open by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Child tax credit payments bill information

- Child tax credit july 2021 portal information

- Finance of america stock information

- Team usa in olympics information

- Mel gibson christ movie information

- Child tax credit portal down information

- Stephen a smith i dont care gif information

- Usa basketball in olympics information

- Social security yuba city information

- Stephen a smith megan olivi information