Irs child tax credit notice information

Home » » Irs child tax credit notice informationYour Irs child tax credit notice images are available. Irs child tax credit notice are a topic that is being searched for and liked by netizens now. You can Get the Irs child tax credit notice files here. Get all free images.

If you’re searching for irs child tax credit notice pictures information connected with to the irs child tax credit notice topic, you have pay a visit to the ideal blog. Our website always provides you with hints for refferencing the maximum quality video and image content, please kindly search and find more enlightening video content and images that fit your interests.

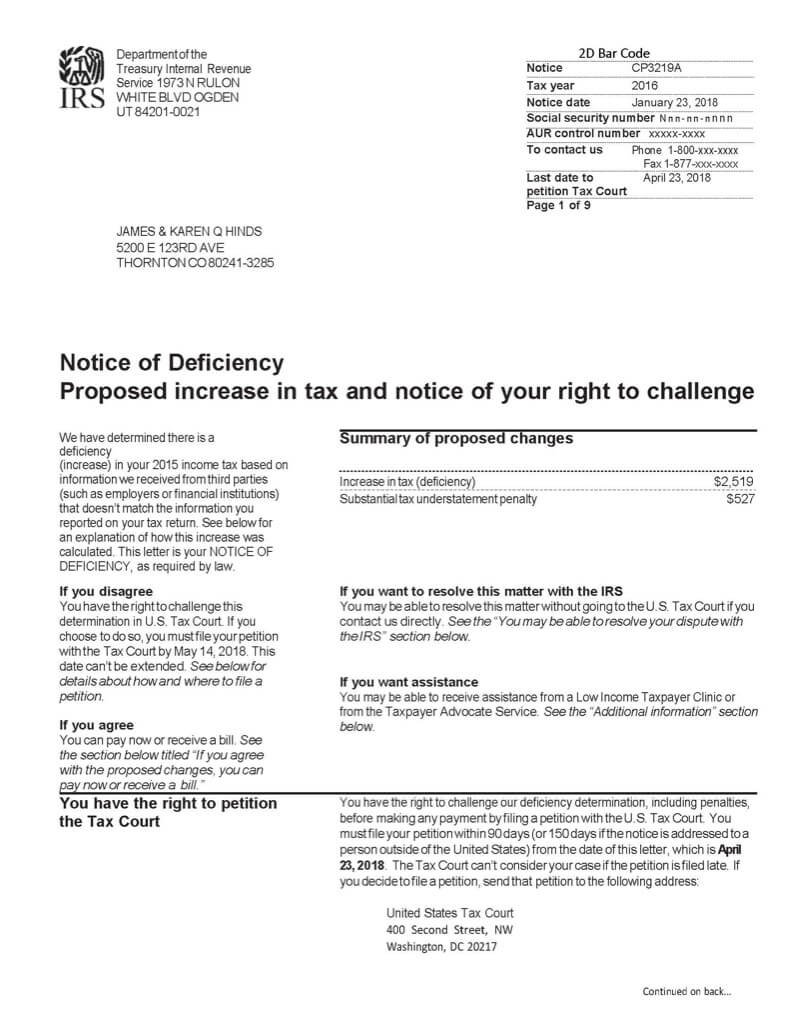

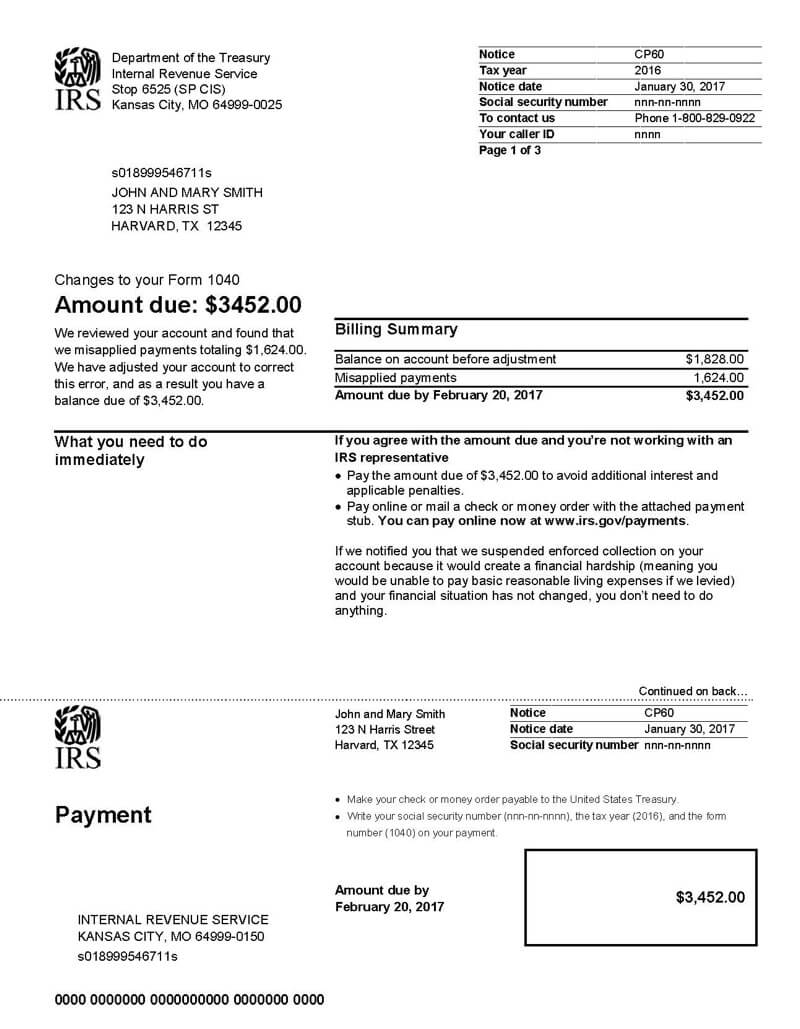

Irs Child Tax Credit Notice. The IRS will pay half the total credit amount in advance monthly payments beginning July 15. In this case you may have to repay the IRS. Miscalculation of Earned Income Tax Credit or Child Tax Credit. The IRS will have your information on file to pay your monthly child tax credit payments.

What Is A Cp05 Letter From The Irs And What Should I Do From thecollegeinvestor.com

What Is A Cp05 Letter From The Irs And What Should I Do From thecollegeinvestor.com

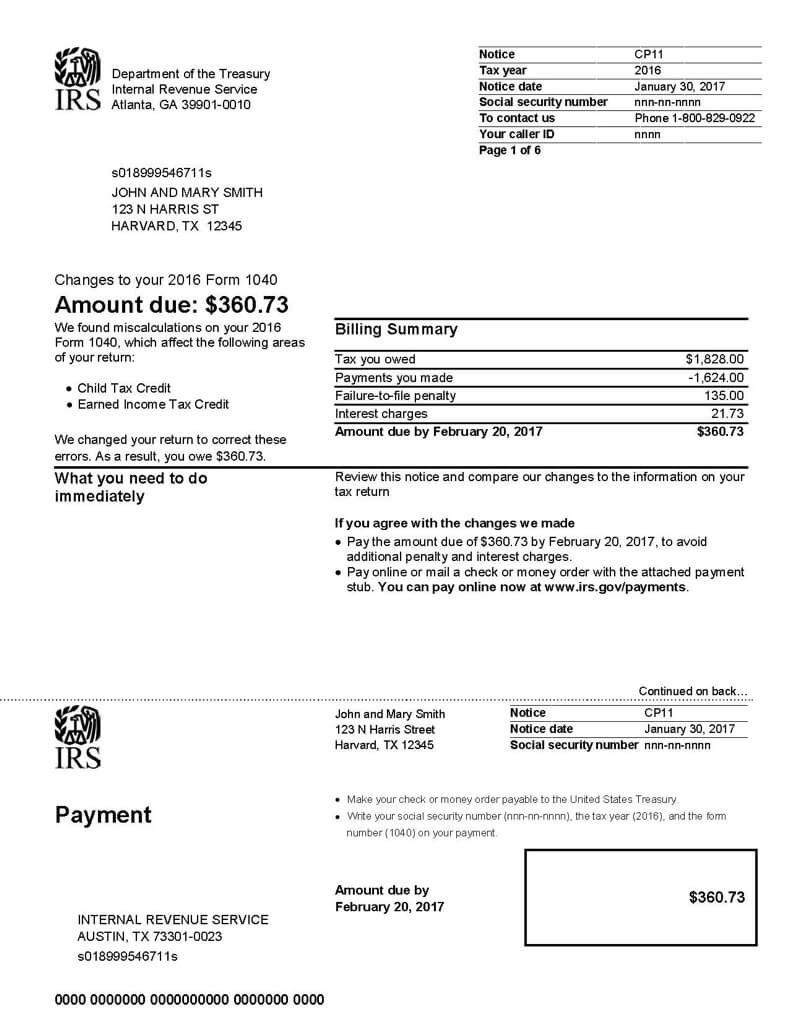

Enter Payment Info Here tool in 2020 to qualify for advance payments of the Child Tax Credit. The IRS sent CP79 to notify you that the credit was. July 15 August 13 September 15 October 15 November 15 and December 15. Half the total credit amount will be paid in advance monthly payments and you will claim the other half when you file your 2021 income tax return. If youve received a CP11 Notice the IRS believes you made a mistake on your. The IRS will have your information on file to pay your monthly child tax credit payments.

The credit was disallowed because you did not meet the eligibility requirements.

To file a tax return and become eligible see Non-filer Sign-up. To file a tax return and become eligible see Non-filer Sign-up. In most cases the IRS requires you to file a tax return if your income is at least 12400 for single. The IRS urges any family who hasnt yet filed their 2020 return or 2019 return to do so as soon as possible so they can receive any advance payment theyre eligible for. The credit was disallowed because you did not meet the eligibility requirements. As many as 92 of households with children will qualify for this direct economic aid under the American Rescue Plan which increased the child tax credit from 2000 to 3600 max per child.

Source: forst.tax

Source: forst.tax

Miscalculation of Earned Income Tax Credit or Child Tax Credit. The credit was disallowed because you did not meet the eligibility requirements. To file a tax return and become eligible see Non-filer Sign-up. Enter Payment Info Here tool in 2020 to qualify for advance payments of the Child Tax Credit. Since the IRS uses your 2019 or 2020 tax return your family may not qualify for the child tax credit payment when you file your 2021 tax return in 2022.

Source: thecollegeinvestor.com

Source: thecollegeinvestor.com

The IRS will issue advance Child Tax Credit payments on these dates. You filed a tax return requesting the Earned Income Tax Credit EITC American Opportunities Tax Credit AOTC Child Tax Credit CTC andor Additional Child Tax Credit ACTC. Enter Payment Info Here tool in 2020 to qualify for advance payments of the Child Tax Credit. The IRS sent CP79 to notify you that the credit was. The latest Child Tax Credit Update Portal currently allows families to view their.

Source: jacksonhewitt.com

Source: jacksonhewitt.com

Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021. I may receive a fee if you choose to use linked products and services. Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the. Well issue the first advance payment on July 15 2021. Follow the directions on your letter.

Source: thecollegeinvestor.com

Source: thecollegeinvestor.com

The maximum enhanced credit which was established by the American Rescue Plan in March is 3600 for children younger than age 6 and 3000 for those between 6 and 17 for 2021. Half the total credit amount will be paid in advance monthly payments and you will claim the other half when you file your 2021 income tax return. The IRS will pay half the total credit amount in advance monthly payments beginning July 15. Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021. To file a tax return and become eligible see Non-filer Sign-up.

Source: forst.tax

Source: forst.tax

If you received a letter from the IRS about the Earned Income Tax Credit EITC also called EIC the Child Tax CreditAdditional Child Tax Credit CTCACTC or the American Opportunity Tax Credit AOTC dont ignore the letter notice. Before 2021 the credit was worth up to 2000 per eligible child and 17 year-olds were not considered as qualifying children for the credit. On July 15 the first advance child tax credit payment gets sent by mail or deposited into bank accounts for. As many as 92 of households with children will qualify for this direct economic aid under the American Rescue Plan which increased the child tax credit from 2000 to 3600 max per child. The IRS will pay half the total credit amount in advance monthly payments beginning July 15.

Source: hrblock.com

Source: hrblock.com

You filed a tax return requesting the Earned Income Tax Credit EITC American Opportunities Tax Credit AOTC Child Tax Credit CTC andor Additional Child Tax Credit ACTC. The maximum enhanced credit which was established by the American Rescue Plan in March is 3600 for children younger than age 6 and 3000 for those between 6 and 17 for 2021. The IRS will pay half the total credit amount in advance monthly payments beginning July 15. In most cases the IRS requires you to file a tax return if your income is at least 12400 for single. If youve received a CP11 Notice the IRS believes you made a mistake on your.

Source: taxaudit.com

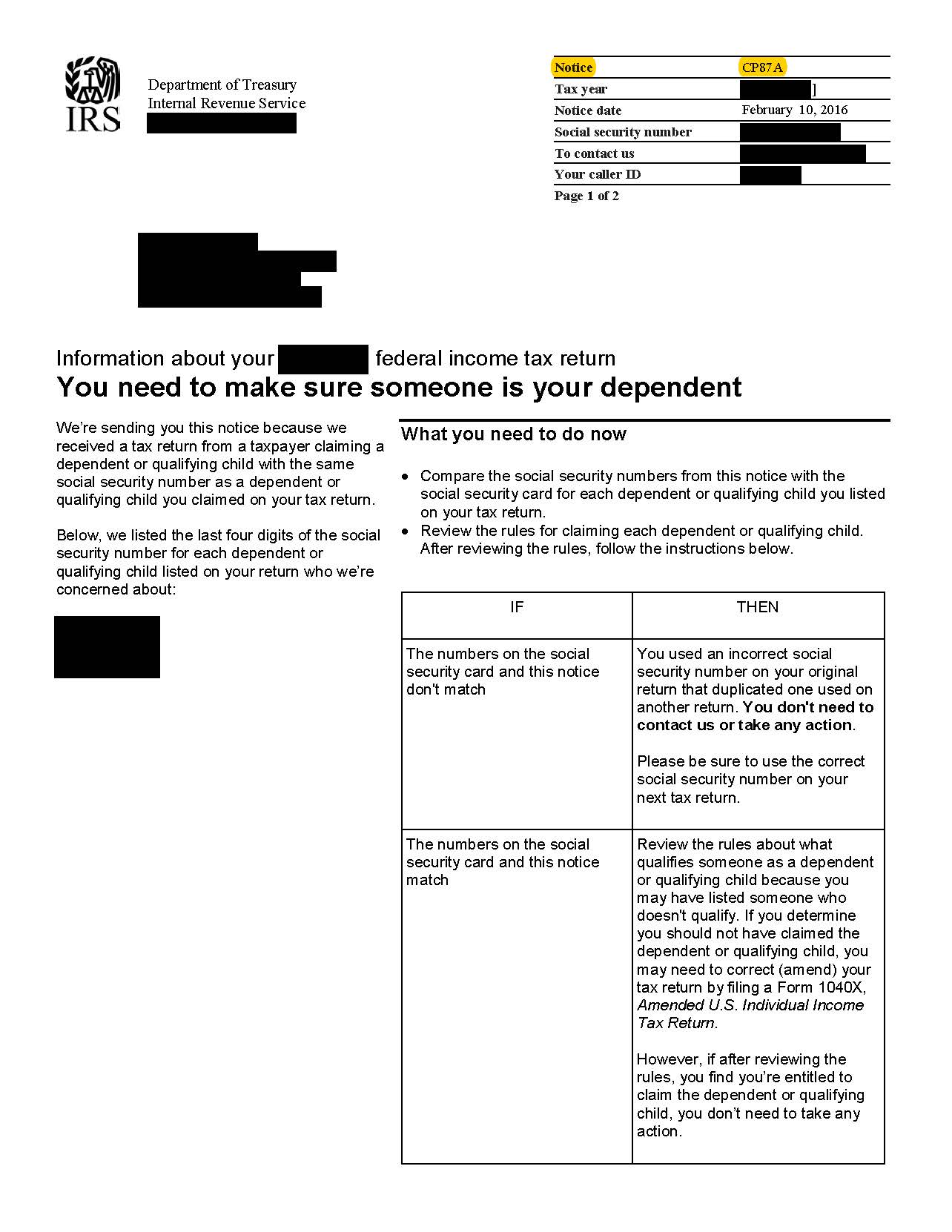

The American Rescue Plan raised the maximum Child Tax Credit in 2021 to 3600 for qualifying children under the age of 6 and to 3000 per child for qualifying children between ages 6 and 17. Advance payments for the Child Tax Credit start July 15 Families can expect the first payments to be received by direct deposit on or around July 15 2021. Money is coming to millions of households with children in less than three weeks. If you received a letter from the IRS about the Earned Income Tax Credit EITC also called EIC the Child Tax CreditAdditional Child Tax Credit CTCACTC or the American Opportunity Tax Credit AOTC dont ignore the letter notice. Why you received IRS Notice CP79.

Source: taxhelpaudit.com

Source: taxhelpaudit.com

July 15 August 13 September 15 October 15 November 15 and December 15. I may receive a fee if you choose to use linked products and services. The IRS will issue advance Child Tax Credit payments on these dates. If youve received a CP11 Notice the IRS believes you made a mistake on your. The IRS sent CP79 to notify you that the credit was.

Source: jacksonhewitt.com

Source: jacksonhewitt.com

Advance payments for the Child Tax Credit start July 15 Families can expect the first payments to be received by direct deposit on or around July 15 2021. Use our Child Tax Credit calculator to estimate how much of the credit you can expect monthly and when you file your return next year. The child tax credit formerly up to 2000 per child was revamped and increased for 2021 when the American Rescue Plan pandemic relief bill was approved by Congress in March. The IRS notes that above these income thresholds the extra amount above the original 2000 credit either 1000 or 1600 per child is reduced by 50 for every extra 1000 in. Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the.

Source: jacksonhewitt.com

Source: jacksonhewitt.com

The IRS will issue advance Child Tax Credit payments on these dates. In this case you may have to repay the IRS. The new Child Tax Credit Eligibility Assistant tool helps families quickly determine whether they qualify. The IRS will issue advance Child Tax Credit payments on these dates. The IRS will pay half the total credit amount in advance monthly payments beginning July 15.

Source: taxaudit.com

If youve received a CP11 Notice the IRS believes you made a mistake on your. You filed a tax return requesting the Earned Income Tax Credit EITC American Opportunities Tax Credit AOTC Child Tax Credit CTC andor Additional Child Tax Credit ACTC. The IRS urges any family who hasnt yet filed their 2020 return or 2019 return to do so as soon as possible so they can receive any advance payment theyre eligible for. All the information you need is in your letter. The child tax credit formerly up to 2000 per child was revamped and increased for 2021 when the American Rescue Plan pandemic relief bill was approved by Congress in March.

Source: jacksonhewitt.com

Source: jacksonhewitt.com

Before 2021 the credit was worth up to 2000 per eligible child and 17 year-olds were not considered as qualifying children for the credit. The IRS notes that above these income thresholds the extra amount above the original 2000 credit either 1000 or 1600 per child is reduced by 50 for every extra 1000 in. Well issue the first advance payment on July 15 2021. Child Tax Credit calculator. Money is coming to millions of households with children in less than three weeks.

Source: legacytaxresolutionservices.com

Source: legacytaxresolutionservices.com

Unless you unenroll from or opt out of the monthly child tax credit payments youll automatically get half of your estimated amount this year from the IRS. These changes apply to tax year 2021 only. The new Child Tax Credit Eligibility Assistant tool helps families quickly determine whether they qualify. The credit was disallowed because you did not meet the eligibility requirements. The child tax credit formerly up to 2000 per child was revamped and increased for 2021 when the American Rescue Plan pandemic relief bill was approved by Congress in March.

Source: legacytaxresolutionservices.com

Source: legacytaxresolutionservices.com

Money is coming to millions of households with children in less than three weeks. The IRS will pay half the total credit amount in advance monthly payments beginning July 15. Well issue the first advance payment on July 15 2021. You filed a tax return requesting the Earned Income Tax Credit EITC American Opportunities Tax Credit AOTC Child Tax Credit CTC andor Additional Child Tax Credit ACTC. The maximum enhanced credit which was established by the American Rescue Plan in March is 3600 for children younger than age 6 and 3000 for those between 6 and 17 for 2021.

Source: landmarktaxgroup.com

Source: landmarktaxgroup.com

The child tax credit formerly up to 2000 per child was revamped and increased for 2021 when the American Rescue Plan pandemic relief bill was approved by Congress in March. The IRS urges any family who hasnt yet filed their 2020 return or 2019 return to do so as soon as possible so they can receive any advance payment theyre eligible for. Miscalculation of Earned Income Tax Credit or Child Tax Credit. Money is coming to millions of households with children in less than three weeks. The latest Child Tax Credit Update Portal currently allows families to view their.

Source: hrblock.com

Source: hrblock.com

The new Child Tax Credit Eligibility Assistant tool helps families quickly determine whether they qualify. The American Rescue Plan raised the maximum Child Tax Credit in 2021 to 3600 for qualifying children under the age of 6 and to 3000 per child for qualifying children between ages 6 and 17. You will claim the other half when you file your 2021 income tax return. Use our Child Tax Credit calculator to estimate how much of the credit you can expect monthly and when you file your return next year. Miscalculation of Earned Income Tax Credit or Child Tax Credit.

Source: hrblock.com

Source: hrblock.com

The IRS will issue advance Child Tax Credit payments on these dates. To file a tax return and become eligible see Non-filer Sign-up. Unless you unenroll from or opt out of the monthly child tax credit payments youll automatically get half of your estimated amount this year from the IRS. In this case you may have to repay the IRS. July 15 August 13 September 15 October 15 November 15 and December 15.

Source: hrblock.com

Source: hrblock.com

Well issue the first advance payment on July 15 2021. Why you received IRS Notice CP79. I may receive a fee if you choose to use linked products and services. You filed a tax return requesting the Earned Income Tax Credit EITC American Opportunities Tax Credit AOTC Child Tax Credit CTC andor Additional Child Tax Credit ACTC. In this case you may have to repay the IRS.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title irs child tax credit notice by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Child tax credit payments bill information

- Child tax credit july 2021 portal information

- Finance of america stock information

- Team usa in olympics information

- Mel gibson christ movie information

- Child tax credit portal down information

- Stephen a smith i dont care gif information

- Usa basketball in olympics information

- Social security yuba city information

- Stephen a smith megan olivi information