Irs child tax credit newborn information

Home » » Irs child tax credit newborn informationYour Irs child tax credit newborn images are ready. Irs child tax credit newborn are a topic that is being searched for and liked by netizens today. You can Get the Irs child tax credit newborn files here. Get all free photos and vectors.

If you’re searching for irs child tax credit newborn images information related to the irs child tax credit newborn keyword, you have visit the right site. Our website frequently gives you suggestions for downloading the maximum quality video and picture content, please kindly surf and find more informative video content and images that match your interests.

Irs Child Tax Credit Newborn. Use IRS Form 1040-X to change or correct the tax return you filed without claiming your baby. You will claim the other half when you file your 2021 income tax return. Therefore the child tax credit wont. However at this time the IRS has not completed this portion of the portal.

Irs Child Tax Credit Portals Check Eligibility Add Bank Info Opt Out And More Cnet From cnet.com

Irs Child Tax Credit Portals Check Eligibility Add Bank Info Opt Out And More Cnet From cnet.com

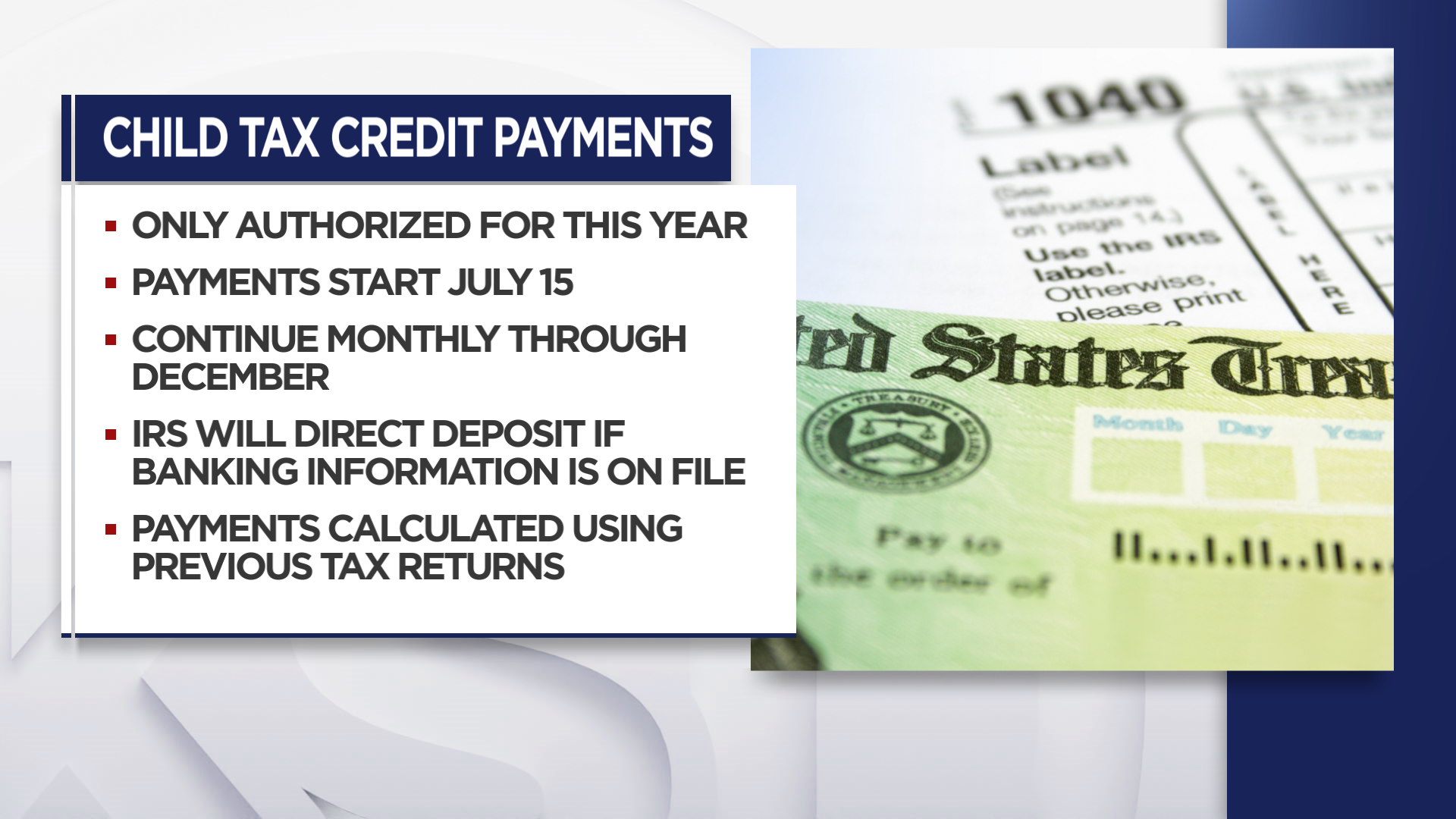

Parents with newborn babies will get 3600 in child tax credit payment. Is a toddler born in 2021 eligible for the advance Youngster Tax Credit score funds set to start in July. Use IRS Form 1040-X to change or correct the tax return you filed without claiming your baby. The new child tax credit for 2021 newborns will be capped at 3600 per eligible child going down from there as your income goes up. To qualify for advance Child Tax Credit payments you and your spouse if you filed a joint return must have. The Credit Is a Monthly Payment In 2021 The new Child Tax Credit is currently for 2021 only.

Use IRS Form 1040-X to change or correct the tax return you filed without claiming your baby.

Parents with newborn babies will get 3600 in child tax credit payment. An IRS spokesperson said that one of the planned enhancements for the Child Tax Credit Update Portal found on IRSgov will enable parents to add children who are born or adopted in 2021. For families that qualify it will be a 3600 credit for each child under age 6. The Credit Is a Monthly Payment In 2021 The new Child Tax Credit is currently for 2021 only. Getty They can update their details on the new IRS portal that is due to launch on July 1. For children ages 6 to.

Source: the-sun.com

Source: the-sun.com

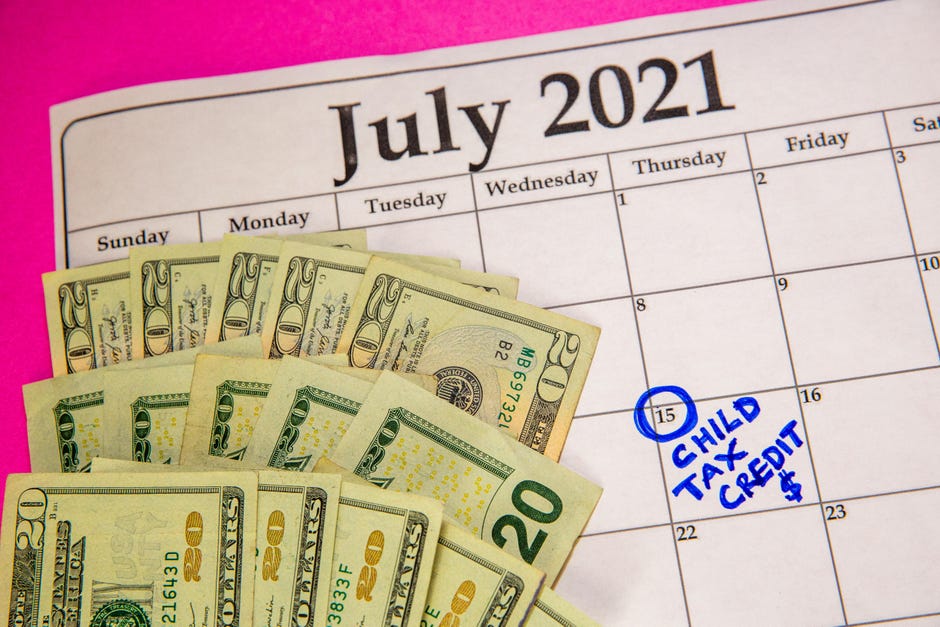

For children ages 6 to. Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021. Add your child in Part 1 Exemptions and Dependents on page 2 of form 1040-X. Well issue the first advance payment on July 15 2021. If youre doing your 2020 taxes heres what you should know about the Child Tax Credit For 2020 a new baby also delivers a tax credit of up 2000 even if the child was born late in the year.

Source: refundtalk.com

Source: refundtalk.com

Unlike a deduction that reduces the amount of income the government gets to tax a credit reduces your tax bill dollar-for-dollar. Is a toddler born in 2021 eligible for the advance Youngster Tax Credit score funds set to start in July. These changes apply to tax year 2021 only. Child Tax Credit amounts will be different for each family Your amount changes based on the age of your children. Those who are in this situation should check the Advance Child Tax Credit Payments in 2021 web page to find out when the enhancement is up and.

Source: id.pinterest.com

Source: id.pinterest.com

Those who are in this situation should check the Advance Child Tax Credit Payments in 2021 web page to find out when the enhancement is up and. The other parent should opt out or unenroll from advance payments. Although eligibility is based on your 2020 or 2019 tax returns the IRS is opening two online portals by July 1 for registering for to the child tax credit. Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021. The IRS will pay half the total credit amount in advance monthly payments beginning July 15.

Source: forbes.com

Source: forbes.com

Money is coming to millions of households with children in less than three weeks. How much is the child tax credit worth for new parents. Although eligibility is based on your 2020 or 2019 tax returns the IRS is opening two online portals by July 1 for registering for to the child tax credit. Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021. To qualify for advance Child Tax Credit payments you and your spouse if you filed a joint return must have.

Source: fi.pinterest.com

Source: fi.pinterest.com

Fill in line 25 with the original number of dependents on your previous return the net change in dependents and the correct number of dependents. Unlike a deduction that reduces the amount of income the government gets to tax a credit reduces your tax bill dollar-for-dollar. On July 15 the first advance child tax credit payment gets sent by mail or deposited into bank accounts for. The parent who claims or will claim the child in 2021 is the one who should get the CTC. According to the IRS spokesperson.

Source:

Source:

Any credit that isnt received for a newborn child or due to the 2020 tax return not being filed currently will be received upon filing the 2021 tax return. An IRS spokesperson said that one of the planned enhancements for the Child Tax Credit Update Portal found on IRSgov will enable parents to add children who are born or adopted in 2021. The new child tax credit for 2021 newborns will be capped at 3600 per eligible child going down from there as your income goes up. Add your child in Part 1 Exemptions and Dependents on page 2 of form 1040-X. Money is coming to millions of households with children in less than three weeks.

Source: cnet.com

Source: cnet.com

The Credit Is a Monthly Payment In 2021 The new Child Tax Credit is currently for 2021 only. For families that qualify it will be a 3600 credit for each child under age 6. The IRS will pay half the total credit amount in advance monthly payments beginning July 15. You will claim the other half when you file your 2021 income tax return. For children ages 6 to.

Source: pinterest.com

Source: pinterest.com

Alternatively families can claim the amount when they file their 2021 tax returns. An IRS spokesperson said that one of the planned enhancements for the Child Tax Credit Update Portal found on IRSgov will enable parents to add children who are born or adopted in 2021. For children ages 6 to. To qualify for advance Child Tax Credit payments you and your spouse if you filed a joint return must have. Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the.

Source: pinterest.com

Source: pinterest.com

On July 15 the first advance child tax credit payment gets sent by mail or deposited into bank accounts for. Add your child in Part 1 Exemptions and Dependents on page 2 of form 1040-X. The IRS will pay half the total credit amount in advance monthly payments beginning July 15. On July 15 the first advance child tax credit payment gets sent by mail or deposited into bank accounts for. According to the IRS spokesperson.

Source: marca.com

Source: marca.com

However at this time the IRS has not completed this portion of the portal. An IRS spokesperson said that one of the planned enhancements for the Child Tax Credit Update Portal found on IRSgov will enable parents to add children who are born or adopted in 2021. Child Tax Credit amounts will be different for each family Your amount changes based on the age of your children. Fill in line 25 with the original number of dependents on your previous return the net change in dependents and the correct number of dependents. On July 15 the first advance child tax credit payment gets sent by mail or deposited into bank accounts for.

Source: hrblock.com

Source: hrblock.com

For families that qualify it will be a 3600 credit for each child under age 6. If you are a new parent you will need to. The Credit Is a Monthly Payment In 2021 The new Child Tax Credit is currently for 2021 only. Use IRS Form 1040-X to change or correct the tax return you filed without claiming your baby. If youre doing your 2020 taxes heres what you should know about the Child Tax Credit For 2020 a new baby also delivers a tax credit of up 2000 even if the child was born late in the year.

Source:

Source:

Well issue the first advance payment on July 15 2021. If you are a new parent you will need to. Money is coming to millions of households with children in less than three weeks. Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021. If youre doing your 2020 taxes heres what you should know about the Child Tax Credit For 2020 a new baby also delivers a tax credit of up 2000 even if the child was born late in the year.

Source: pinterest.com

Source: pinterest.com

However at this time the IRS has not completed this portion of the portal. These changes apply to tax year 2021 only. To qualify for advance Child Tax Credit payments you and your spouse if you filed a joint return must have. An IRS spokesperson said that one of the planned enhancements for the Child Tax Credit Update Portal found on IRSgov will enable parents to add children who are born or adopted in 2021. The Credit Is a Monthly Payment In 2021 The new Child Tax Credit is currently for 2021 only.

Source: wdtn.com

Source: wdtn.com

You can only enroll on the IRS website. Those who are in this situation should check the Advance Child Tax Credit Payments in 2021 web page to find out when the enhancement is up and. An IRS spokesperson said that one of the planned enhancements for the Child Tax Credit Update Portal found on IRSgov will enable parents to add children who are born or adopted in 2021. Half the total credit amount will be paid in advance monthly payments and you will claim the other half when you file your 2021 income tax return. If youre doing your 2020 taxes heres what you should know about the Child Tax Credit For 2020 a new baby also delivers a tax credit of up 2000 even if the child was born late in the year.

Source: cnet.com

Source: cnet.com

If you are a new parent you will need to. Parents with newborn babies will get 3600 in child tax credit payment. Add your child in Part 1 Exemptions and Dependents on page 2 of form 1040-X. However at this time the IRS has not completed this portion of the portal. According to the IRS spokesperson.

Source: wfxrtv.com

Source: wfxrtv.com

According to the IRS spokesperson. How much is the child tax credit worth for new parents. Money is coming to millions of households with children in less than three weeks. Any credit that isnt received for a newborn child or due to the 2020 tax return not being filed currently will be received upon filing the 2021 tax return. The payment for children.

Source: cnet.com

Source: cnet.com

On July 15 the first advance child tax credit payment gets sent by mail or deposited into bank accounts for. Any credit that isnt received for a newborn child or due to the 2020 tax return not being filed currently will be received upon filing the 2021 tax return. Families with newborn babies can also claim child tax credits Credit. On July 15 the first advance child tax credit payment gets sent by mail or deposited into bank accounts for. Those who are in this situation should check the Advance Child Tax Credit Payments in 2021 web page to find out when the enhancement is up and.

Source: fox2now.com

Source: fox2now.com

Well issue the first advance payment on July 15 2021. Any credit that isnt received for a newborn child or due to the 2020 tax return not being filed currently will be received upon filing the 2021 tax return. Unlike a deduction that reduces the amount of income the government gets to tax a credit reduces your tax bill dollar-for-dollar. Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021. Use IRS Form 1040-X to change or correct the tax return you filed without claiming your baby.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title irs child tax credit newborn by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Child tax credit payments bill information

- Child tax credit july 2021 portal information

- Finance of america stock information

- Team usa in olympics information

- Mel gibson christ movie information

- Child tax credit portal down information

- Stephen a smith i dont care gif information

- Usa basketball in olympics information

- Social security yuba city information

- Stephen a smith megan olivi information