Irs child tax credit july payments information

Home » » Irs child tax credit july payments informationYour Irs child tax credit july payments images are available in this site. Irs child tax credit july payments are a topic that is being searched for and liked by netizens today. You can Get the Irs child tax credit july payments files here. Find and Download all royalty-free photos.

If you’re looking for irs child tax credit july payments pictures information connected with to the irs child tax credit july payments interest, you have pay a visit to the ideal blog. Our site frequently gives you suggestions for viewing the highest quality video and picture content, please kindly hunt and find more informative video articles and images that match your interests.

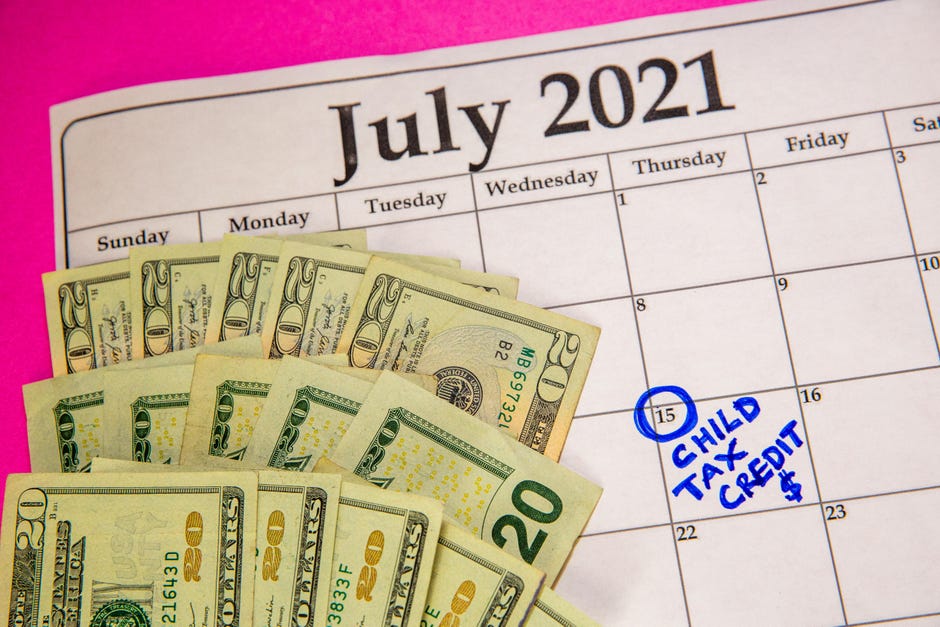

Irs Child Tax Credit July Payments. You will claim the other half when you file your 2021 income tax return. Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021. The rest will come with your 2021 tax refund when you file in 2022. About 39 million households will be eligible for the payments.

Second Stimulus Check Update June 23rd Video President Trump Commits To 2nd Stimulus Nichola Personal Development Plan Ideas Personal Development Plan Ebt From pinterest.com

Second Stimulus Check Update June 23rd Video President Trump Commits To 2nd Stimulus Nichola Personal Development Plan Ideas Personal Development Plan Ebt From pinterest.com

Advance Payment Process of the Child Tax Credit. After that payments will be disbursed on a monthly basis through December 2021. The IRS has confirmed that from 15 July they will begin automatically distributing the new Child Tax Credit monthly payments worth up to 300 per child to. These changes apply to tax year 2021 only. The credit will go to roughly 39 million households with about 65. IRS Will Start 3000 Child Tax Credit Payments in July As part of the 19 trillion American Rescue Plan Act signed into law by President Biden back in March the IRS is preparing to launch the.

The IRS has confirmed that from 15 July they will begin automatically distributing the new Child Tax Credit monthly payments worth up to 300 per child to.

The IRS plans to begin sending monthly payments from the new 3000 child tax credit in July Commissioner Charles Rettig said Tuesday during a hearing with the Senate Finance Committee. To qualify for advance Child Tax Credit payments you and your spouse if you filed a joint return must have. Monthly payments through the new federal enhanced child tax credit will begin July 15. The increased CTC payments will be made on the 15th of each month from July to December of 2021 unless the 15th falls on a weekend or holiday. Half the total credit amount will be paid in advance monthly payments and you will claim the other half when you file your 2021 income tax return. Treasury will start sending payments for the expanded child tax credit July 15 and eligible taxpayers could receive as much as 300 a month per eligible child through December.

Source: taxpayeradvocate.irs.gov

Source: taxpayeradvocate.irs.gov

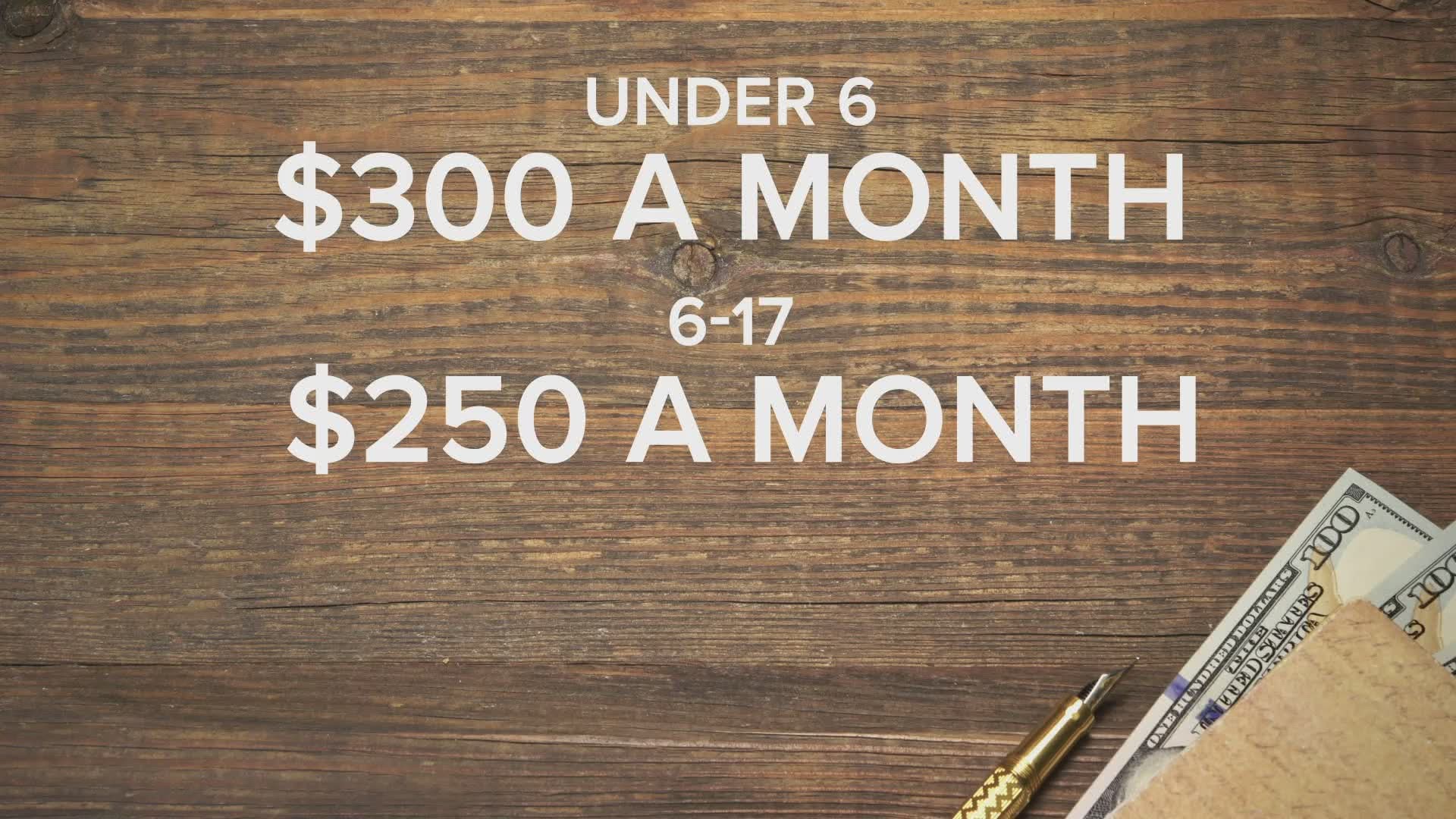

Eligible families will receive a payment of up to 300 per month for each child under age 6 and up to 250 per month for each child age 6 and above. It also ballparks how much. The IRS plans to begin sending monthly payments from the new 3000 child tax credit in July Commissioner Charles Rettig said Tuesday during a hearing with the Senate Finance Committee. Treasury will start sending payments for the expanded child tax credit July 15 and eligible taxpayers could receive as much as 300 a month per eligible child through December. The IRS will begin disbursing advance Child Tax Credit payments on July 15.

Source: forbes.com

Source: forbes.com

Half the total credit amount will be paid in advance monthly payments and you will claim the other half when you file your 2021 income tax return. The rest will come with your 2021 tax refund when you file in 2022. If you do get the go-ahead from the IRS to receive child tax credit payments which start July 15 youll be treated to a second letter that confirms your eligibility. Half the total credit amount will be paid in advance monthly payments and you will claim the other half when you file your 2021 income tax return. En español The US.

Source: marca.com

Source: marca.com

If you meet the requirements the first advance payment for this years child tax credit will be automatically deposited into your account or sent by mail in a little over two weeks. Good news for parents. The IRS is set to begin advanced payments of the enhanced child tax credit CTC on July 15 and 88 of families with children in the US. About 39 million households will be eligible for the payments. The IRS plans to begin sending monthly payments from the new 3000 child tax credit in July Commissioner Charles Rettig said Tuesday during a hearing with the Senate Finance Committee.

Source: aarp.org

Source: aarp.org

These changes apply to tax year 2021 only. The IRS plans to begin sending monthly payments from the new 3000 child tax credit in July Commissioner Charles Rettig said Tuesday during a hearing with the Senate Finance Committee. Its time to choose your health insurance plan. Tax returns processed by June 28 will be reflected in the first batch of monthly payments scheduled for July 15. After that payments will be disbursed on a monthly basis through December 2021.

Source: cnet.com

Source: cnet.com

The first advance monthly child tax credit payment comes July 15 with recurring checks through the end of 2021. These changes apply to tax year 2021 only. The credit will be. The rest will come with your 2021 tax refund when you file in 2022. For more information regarding how advance Child Tax Credit payments are disbursed see Topic E.

Source: forbes.com

Source: forbes.com

IRS Will Start 3000 Child Tax Credit Payments in July As part of the 19 trillion American Rescue Plan Act signed into law by President Biden back in March the IRS is preparing to launch the. You will claim the other half when you file your 2021 income tax return. Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the. In 2021 the maximum enhanced child tax credit is 3600 for children younger than age 6 and 3000 for those between 6 and 17. About 39 million households will be eligible for the payments.

Source: wusa9.com

Source: wusa9.com

The increased CTC payments will be made on the 15th of each month from July to December of 2021 unless the 15th falls on a weekend or holiday. Well issue the first advance payment on July 15 2021. It also ballparks how much. The Child Tax Credit is slated to begin its first-ever monthly cash payments on July 15 when the IRS will begin sending checks to eligible families with children ages 17 or younger. The first advance monthly child tax credit payment comes July 15 with recurring checks through the end of 2021.

Source: cnet.com

Source: cnet.com

The first advance monthly child tax credit payment comes July 15 with recurring checks through the end of 2021. The credit will go to roughly 39 million households with about 65. Good news for parents. En español The US. Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the.

Source: finance.yahoo.com

Advance Payment Process of the Child Tax Credit. For more information regarding how advance Child Tax Credit payments are disbursed see Topic E. The IRS will issue advance Child Tax Credit payments on these dates. Monthly payments through the new federal enhanced child tax credit will begin July 15. En español The US.

Source: cnet.com

Source: cnet.com

If you meet the requirements the first advance payment for this years child tax credit will be automatically deposited into your account or sent by mail in a little over two weeks. The IRS is set to begin advanced payments of the enhanced child tax credit CTC on July 15 and 88 of families with children in the US. The IRS will begin disbursing advance Child Tax Credit payments on July 15. Its time to choose your health insurance plan. IRS Will Start 3000 Child Tax Credit Payments in July As part of the 19 trillion American Rescue Plan Act signed into law by President Biden back in March the IRS is preparing to launch the.

Source: ktla.com

Source: ktla.com

Its time to choose your health insurance plan. The Child Tax Credit is slated to begin its first-ever monthly cash payments on July 15 when the IRS will begin sending checks to eligible families with children ages 17 or younger. You will claim the other half when you file your 2021 income tax return. About 39 million households will be eligible for the payments. Tax returns processed by June 28 will be reflected in the first batch of monthly payments scheduled for July 15.

Source: pinterest.com

Source: pinterest.com

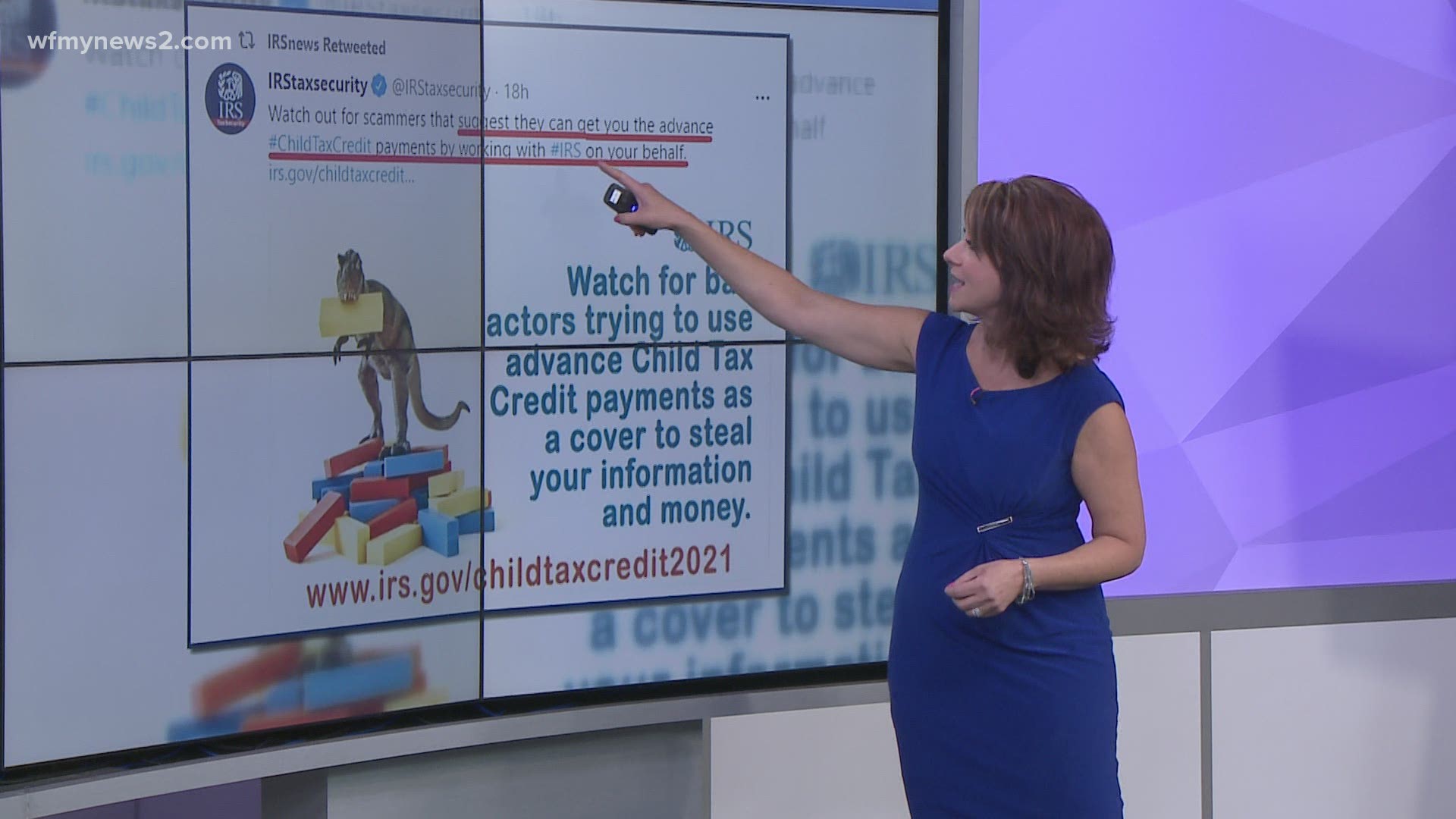

If you do get the go-ahead from the IRS to receive child tax credit payments which start July 15 youll be treated to a second letter that confirms your eligibility. These changes apply to tax year 2021 only. The IRS will pay half the total credit amount in advance monthly payments beginning July 15. Tax returns processed by June 28 will be reflected in the first batch of monthly payments scheduled for July 15. The IRS will begin disbursing advance Child Tax Credit payments on July 15.

Source: fox2now.com

Source: fox2now.com

Treasury will start sending payments for the expanded child tax credit July 15 and eligible taxpayers could receive as much as 300 a month per eligible child through December. En español The US. The Child Tax Credit is slated to begin its first-ever monthly cash payments on July 15 when the IRS will begin sending checks to eligible families with children ages 17 or younger. The increased CTC payments will be made on the 15th of each month from July to December of 2021 unless the 15th falls on a weekend or holiday. The IRS will pay half the total credit amount in advance monthly payments beginning July 15.

Source: 9news.com

Source: 9news.com

The IRS has confirmed that from 15 July they will begin automatically distributing the new Child Tax Credit monthly payments worth up to 300 per child to. About 39 million households will be eligible for the payments. The Child Tax Credit is slated to begin its first-ever monthly cash payments on July 15 when the IRS will begin sending checks to eligible families with children ages 17 or younger. After that payments will be disbursed on a monthly basis through December 2021. IRS Will Start 3000 Child Tax Credit Payments in July As part of the 19 trillion American Rescue Plan Act signed into law by President Biden back in March the IRS is preparing to launch the.

Source: pinterest.com

Source: pinterest.com

The credit will be. About 39 million households will be eligible for the payments. The rest will come with your 2021 tax refund when you file in 2022. Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the. Good news for parents.

Source: cnet.com

Source: cnet.com

The IRS has confirmed that from 15 July they will begin automatically distributing the new Child Tax Credit monthly payments worth up to 300 per child to. If you do get the go-ahead from the IRS to receive child tax credit payments which start July 15 youll be treated to a second letter that confirms your eligibility. The credit will go to roughly 39 million households with about 65. The IRS plans to begin sending monthly payments from the new 3000 child tax credit in July Commissioner Charles Rettig said Tuesday during a hearing with the Senate Finance Committee. Advance Payment Process of the Child Tax Credit.

Source: cnet.com

Source: cnet.com

The IRS will begin disbursing advance Child Tax Credit payments on July 15. The IRS has confirmed that from 15 July they will begin automatically distributing the new Child Tax Credit monthly payments worth up to 300 per child to. The credit will be. These changes apply to tax year 2021 only. The first advance monthly child tax credit payment comes July 15 with recurring checks through the end of 2021.

Source: cnet.com

Source: cnet.com

The credit will go to roughly 39 million households with about 65. The first advance monthly child tax credit payment comes July 15 with recurring checks through the end of 2021. IRS Will Start 3000 Child Tax Credit Payments in July As part of the 19 trillion American Rescue Plan Act signed into law by President Biden back in March the IRS is preparing to launch the. The IRS has confirmed that from 15 July they will begin automatically distributing the new Child Tax Credit monthly payments worth up to 300 per child to. You will claim the other half when you file your 2021 income tax return.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title irs child tax credit july payments by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Child tax credit payments bill information

- Child tax credit july 2021 portal information

- Finance of america stock information

- Team usa in olympics information

- Mel gibson christ movie information

- Child tax credit portal down information

- Stephen a smith i dont care gif information

- Usa basketball in olympics information

- Social security yuba city information

- Stephen a smith megan olivi information