Irs child tax credit divorced parents information

Home » » Irs child tax credit divorced parents informationYour Irs child tax credit divorced parents images are ready. Irs child tax credit divorced parents are a topic that is being searched for and liked by netizens today. You can Get the Irs child tax credit divorced parents files here. Find and Download all free images.

If you’re searching for irs child tax credit divorced parents images information connected with to the irs child tax credit divorced parents interest, you have pay a visit to the ideal site. Our site frequently gives you suggestions for seeking the highest quality video and image content, please kindly search and find more informative video content and images that match your interests.

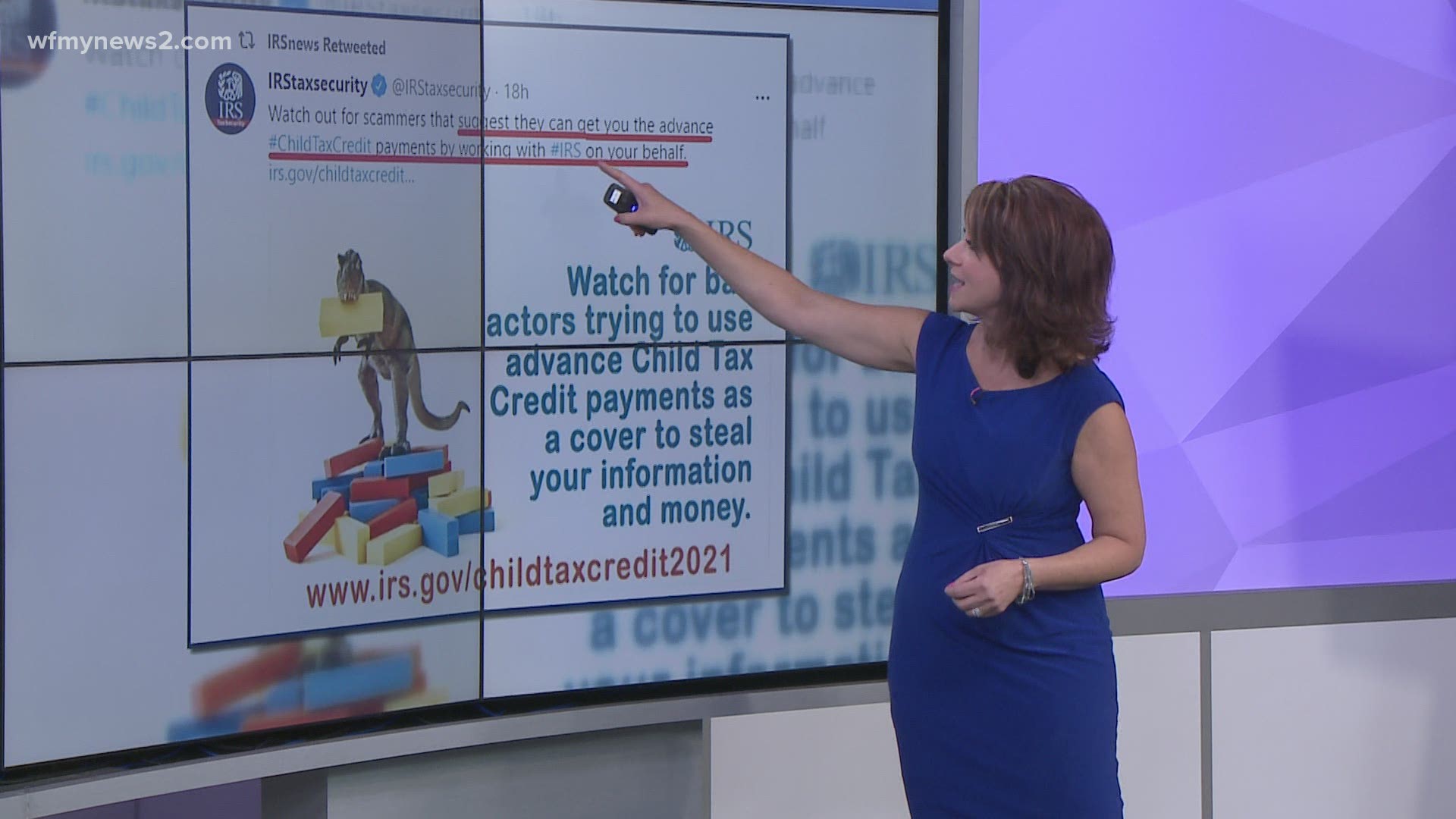

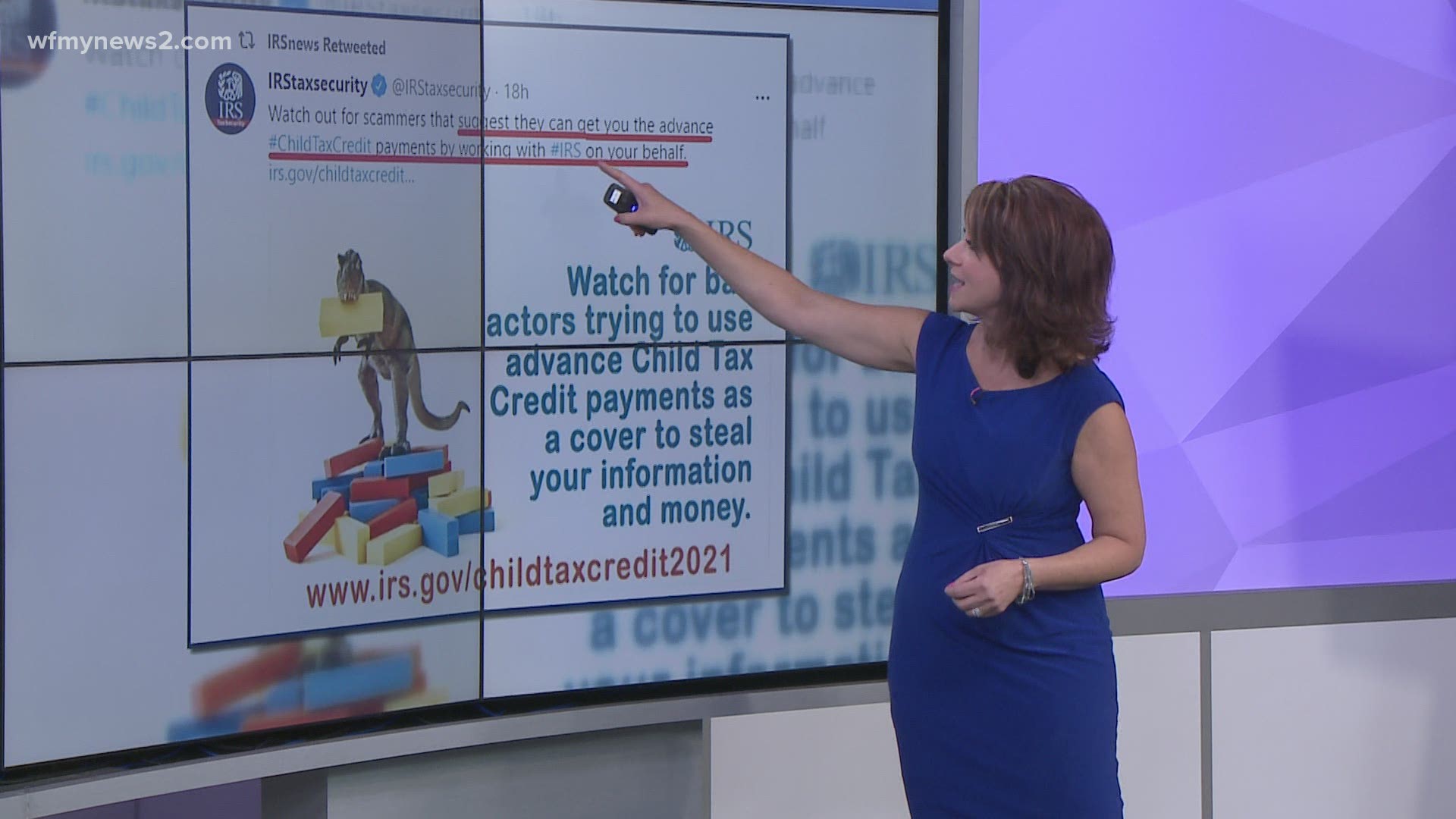

Irs Child Tax Credit Divorced Parents. Its already difficult co-parenting with someone you chose to no longer share a romantic life with but with the child tax credit you and your ex-spouses finances may seem connected again. The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for children under age 6 and 3000 for other children under age 18. Divorced parents and the child tax credit Per the IRS each child can only be claimed as a dependent by one taxpayer. The new 3000 and 3600 Child Tax Credit CTC could be a problem for divorced couples who share custody of minor children.

How Do I Manage The Child Tax Credit Monthly Payment 9news Com From 9news.com

How Do I Manage The Child Tax Credit Monthly Payment 9news Com From 9news.com

The IRS will use tax. The credit amount has been increased. The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for children under age 6 and 3000 for other children under age 18. Divorced parents and the child tax credit Per the IRS each child can only be claimed as a dependent by one taxpayer. Yurii Kibalnik - Adobe Stock. To qualify for advance Child Tax Credit payments you and your spouse if you filed a joint return must have.

Only one parent can claim a child per year.

When the dependency exemption was suspended for 2018-2025 the IRS provided for a number of tax benefits related to dependents including the child tax credit. When couples with children divorce the parent the children are with for the majority of the year with exceptions for college and other temporary absences is generally deemed the custodial parent for tax purposes regardless of who is the primary financial provider. You will claim the other half when you file your 2021 income tax return. Typically the parent who has custody of the child for. Two parents divorced in 2020 and share legal custody of a 17-year old child. The new 3000 and 3600 Child Tax Credit CTC could be a problem for divorced couples who share custody of minor children.

Source: communitytax.com

Source: communitytax.com

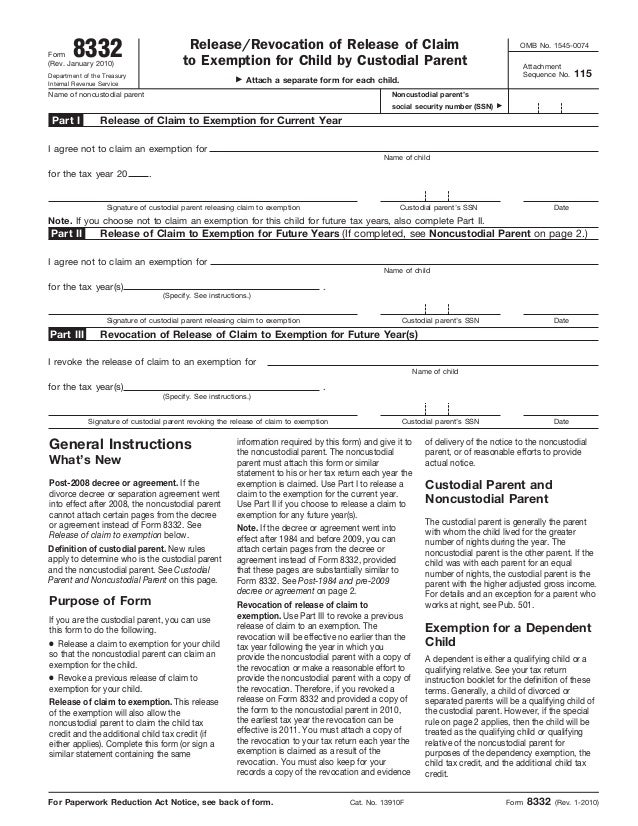

The American Rescue Plan passed earlier this year increasing the existing maximum child tax credit to 3600 for children under 6 and 3000 per. But divorced parents and those who arent married face a challenge. No there is not currently guidance for divorced parents claiming the Advance Child Tax Credit The IRS will start sending automatic monthly Advance Child Tax Credit payments to parents on July 15. The credits scope has been expanded. If parents are divorced the custodial parent may release a claim to exemption for a child which allows the noncustodial parent to claim the child as a dependent and claim the child tax credit for the child if the requirements are met.

Source: fox2now.com

Source: fox2now.com

You will claim the other half when you file your 2021 income tax return. If parents are divorced the custodial parent may release a claim to exemption for a child which allows the noncustodial parent to claim the child as a dependent and claim the child tax credit for the child if the requirements are met. When parents are divorced generally the parent who has custody for most of the time claims the child tax credit. The American Rescue Plan passed earlier this year increasing the existing maximum child tax credit to 3600 for children under 6 and 3000 per. Thats because many judges during divorce proceedings order parents to alternate years the child tax credit is claimed.

Source: cnet.com

Source: cnet.com

The child tax credit. Divorced parents and the child tax credit Per the IRS each child can only be claimed as a dependent by one taxpayer. The mother claimed the child as a dependent on her tax return for 2020 and the father will claim the child as a. When couples with children divorce the parent the children are with for the majority of the year with exceptions for college and other temporary absences is generally deemed the custodial parent for tax purposes regardless of who is the primary financial provider. The new 3000 and 3600 Child Tax Credit CTC could be a problem for divorced couples who share custody of minor children.

Source: king5.com

Source: king5.com

Under the legislation the child tax credit is 3000 per child from ages 6 through 17 and 3600 per child for those under the age of 6 said Jeralyn Lawrence a family law attorney with Lawrence Law in Watchung. Under the legislation the child tax credit is 3000 per child from ages 6 through 17 and 3600 per child for those under the age of 6 said Jeralyn Lawrence a family law attorney with Lawrence Law in Watchung. The IRS will use tax. When couples with children divorce the parent the children are with for the majority of the year with exceptions for college and other temporary absences is generally deemed the custodial parent for tax purposes regardless of who is the primary financial provider. No there is not currently guidance for divorced parents claiming the Advance Child Tax Credit The IRS will start sending automatic monthly Advance Child Tax Credit payments to parents on July 15.

Source:

Source:

The child tax credit. The expanded child tax credit from the American Rescue Plan is a big benefit for families with children. Some couples may agree to a 5050 custody arrangement. As of right now the expanded child tax credit is only a perk for 2021. You will claim the other half when you file your 2021 income tax return.

Source: irs.gov

Source: irs.gov

The child tax credit. The new 3000 and 3600 Child Tax Credit CTC could be a problem for divorced couples who share custody of minor children. The American Rescue Plan passed earlier this year increasing the existing maximum child tax credit to 3600 for children under 6 and 3000 per. The credits scope has been expanded. You will claim the other half when you file your 2021 income tax return.

Source: 9news.com

Source: 9news.com

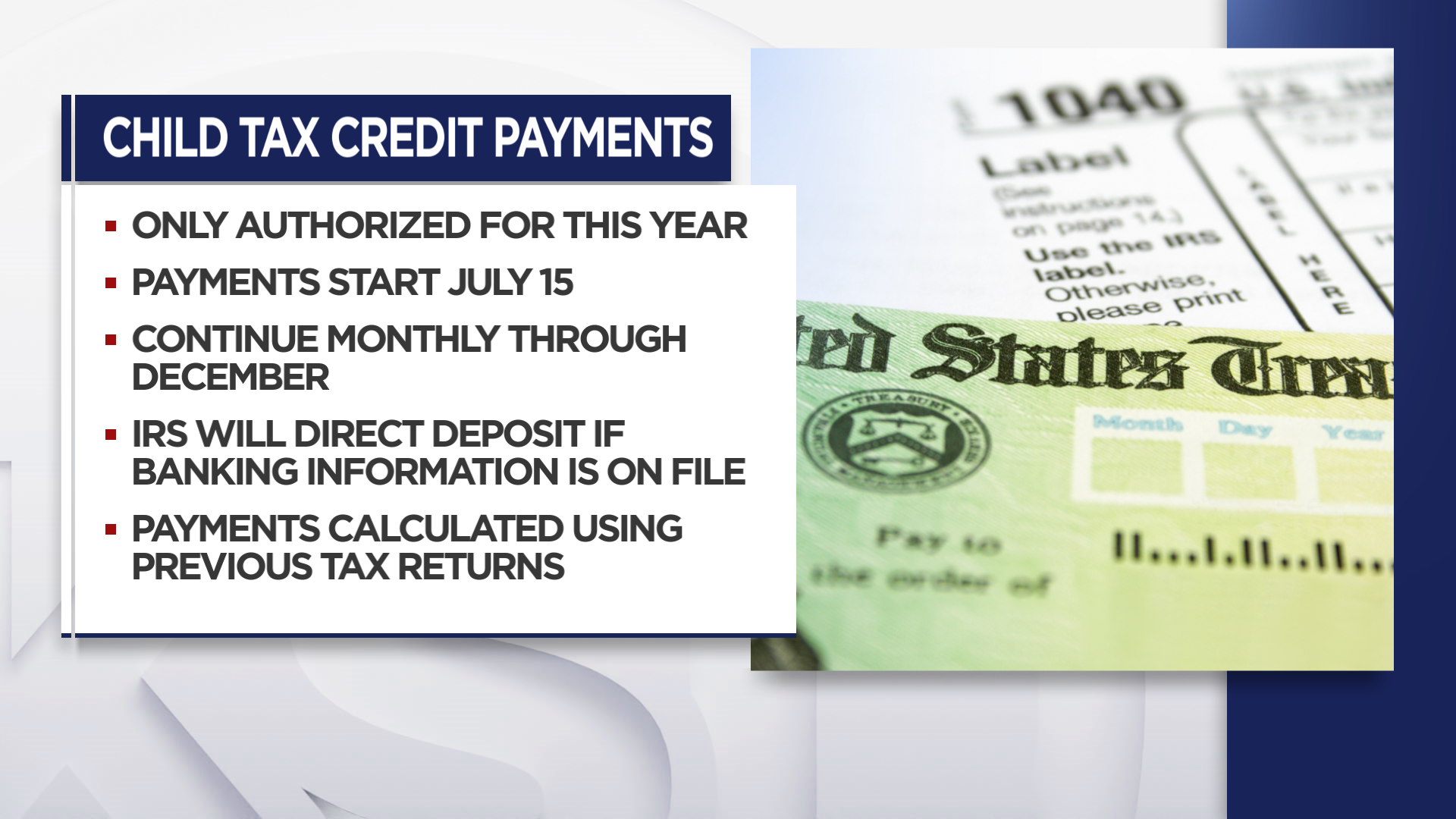

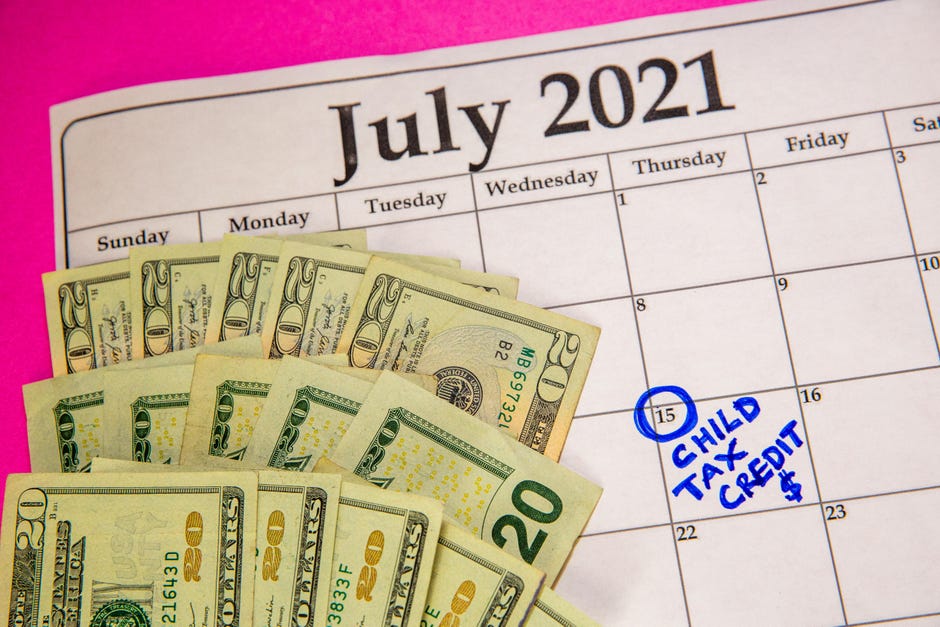

The IRS will pay half the total credit amount in advance monthly payments beginning July 15. When couples with children divorce the parent the children are with for the majority of the year with exceptions for college and other temporary absences is generally deemed the custodial parent for tax purposes regardless of who is the primary financial provider. When parents are divorced generally the parent who has custody for most of the time claims the child tax credit. The expanded child tax credit from the American Rescue Plan is a big benefit for families with children. The Child Tax Credit and Divorced Parents The child tax credit can only be claimed by one taxpayer and though this is not a problem for couples who are married and file jointly this has long been a sore subject for parents who split custody of their children.

Source: cnbc.com

Source: cnbc.com

Two parents divorced in 2020 and share legal custody of a 17-year old child. Only one parent can claim a child per year. Its already difficult co-parenting with someone you chose to no longer share a romantic life with but with the child tax credit you and your ex-spouses finances may seem connected again. The IRS Rules relating to the earned income tax credit for divorced parents state that the parent who has the child for more than 50 of the time is entitled to claim the credit. The American Rescue Plan passed earlier this year increasing the existing maximum child tax credit to 3600 for children under 6 and 3000 per.

Source: pinterest.com

Source: pinterest.com

But divorced parents and those who arent married face a challenge. Thats because many judges during divorce proceedings order parents to alternate years the child tax credit is claimed. The Child Tax Credit and Divorced Parents The child tax credit can only be claimed by one taxpayer and though this is not a problem for couples who are married and file jointly this has long been a sore subject for parents who split custody of their children. The new 3000 and 3600 Child Tax Credit CTC could be a problem for divorced couples who share custody of minor children. The custodial parent will claim the children each year on their taxes.

Source: al.com

Source: al.com

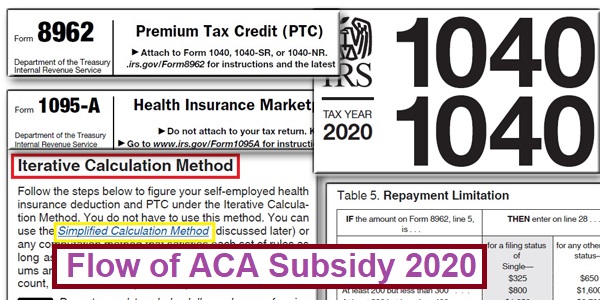

Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the. Yurii Kibalnik - Adobe Stock. Some couples may agree to a 5050 custody arrangement. When the dependency exemption was suspended for 2018-2025 the IRS provided for a number of tax benefits related to dependents including the child tax credit. Two parents divorced in 2020 and share legal custody of a 17-year old child.

Source: id.pinterest.com

Source: id.pinterest.com

If parents are divorced the custodial parent may release a claim to exemption for a child which allows the noncustodial parent to claim the child as a dependent and claim the child tax credit for the child if the requirements are met. When the dependency exemption was suspended for 2018-2025 the IRS provided for a number of tax benefits related to dependents including the child tax credit. To qualify for advance Child Tax Credit payments you and your spouse if you filed a joint return must have. But divorced parents and those who arent married face a challenge. When couples with children divorce the parent the children are with for the majority of the year with exceptions for college and other temporary absences is generally deemed the custodial parent for tax purposes regardless of who is the primary financial provider.

Source: slideshare.net

Source: slideshare.net

The credits scope has been expanded. The American Rescue Plan passed earlier this year increasing the existing maximum child tax credit to 3600 for children under 6 and 3000 per. The new 3000 and 3600 Child Tax Credit CTC could be a problem for divorced couples who share custody of minor children. Two parents divorced in 2020 and share legal custody of a 17-year old child. The credit amount has been increased.

Source:

The expanded child tax credit from the American Rescue Plan is a big benefit for families with children. The IRS will pay half the total credit amount in advance monthly payments beginning July 15. The American Rescue Plan passed earlier this year increasing the existing maximum child tax credit to 3600 for children under 6 and 3000 per. When parents are divorced generally the parent who has custody for most of the time claims the child tax credit. As of right now the expanded child tax credit is only a perk for 2021.

Source: thebalance.com

Source: thebalance.com

The expanded child tax credit from the American Rescue Plan is a big benefit for families with children. The credits scope has been expanded. No there is not currently guidance for divorced parents claiming the Advance Child Tax Credit The IRS will start sending automatic monthly Advance Child Tax Credit payments to parents on July 15. The IRS will pay half the total credit amount in advance monthly payments beginning July 15. These changes apply to tax year 2021 only.

Source: cnet.com

Source: cnet.com

As of right now the expanded child tax credit is only a perk for 2021. You will claim the other half when you file your 2021 income tax return. The credit amount has been increased. No there is not currently guidance for divorced parents claiming the Advance Child Tax Credit The IRS will start sending automatic monthly Advance Child Tax Credit payments to parents on July 15. If parents are divorced the custodial parent may release a claim to exemption for a child which allows the noncustodial parent to claim the child as a dependent and claim the child tax credit for the child if the requirements are met.

Source: insuremekevin.com

Source: insuremekevin.com

The IRS Rules relating to the earned income tax credit for divorced parents state that the parent who has the child for more than 50 of the time is entitled to claim the credit. The IRS Rules relating to the earned income tax credit for divorced parents state that the parent who has the child for more than 50 of the time is entitled to claim the credit. The credit amount has been increased. Two parents divorced in 2020 and share legal custody of a 17-year old child. You will claim the other half when you file your 2021 income tax return.

Source: the-sun.com

Source: the-sun.com

Two parents divorced in 2020 and share legal custody of a 17-year old child. The child tax credit. Some couples may agree to a 5050 custody arrangement. The custodial parent will claim the children each year on their taxes. As of right now the expanded child tax credit is only a perk for 2021.

Source: nationalinterest.org

Source: nationalinterest.org

The American Rescue Plan passed earlier this year increasing the existing maximum child tax credit to 3600 for children under 6 and 3000 per. If parents are divorced the custodial parent may release a claim to exemption for a child which allows the noncustodial parent to claim the child as a dependent and claim the child tax credit for the child if the requirements are met. The new 3000 and 3600 Child Tax Credit CTC could be a problem for divorced couples who share custody of minor children. Thats because many judges during divorce proceedings order parents to alternate years the child tax credit is claimed. When couples with children divorce the parent the children are with for the majority of the year with exceptions for college and other temporary absences is generally deemed the custodial parent for tax purposes regardless of who is the primary financial provider.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title irs child tax credit divorced parents by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Child tax credit payments bill information

- Child tax credit july 2021 portal information

- Finance of america stock information

- Team usa in olympics information

- Mel gibson christ movie information

- Child tax credit portal down information

- Stephen a smith i dont care gif information

- Usa basketball in olympics information

- Social security yuba city information

- Stephen a smith megan olivi information