Irs child tax credit bank account update information

Home » » Irs child tax credit bank account update informationYour Irs child tax credit bank account update images are available. Irs child tax credit bank account update are a topic that is being searched for and liked by netizens now. You can Find and Download the Irs child tax credit bank account update files here. Get all royalty-free vectors.

If you’re looking for irs child tax credit bank account update images information linked to the irs child tax credit bank account update keyword, you have visit the right site. Our site always gives you hints for seeing the maximum quality video and image content, please kindly surf and locate more informative video content and graphics that fit your interests.

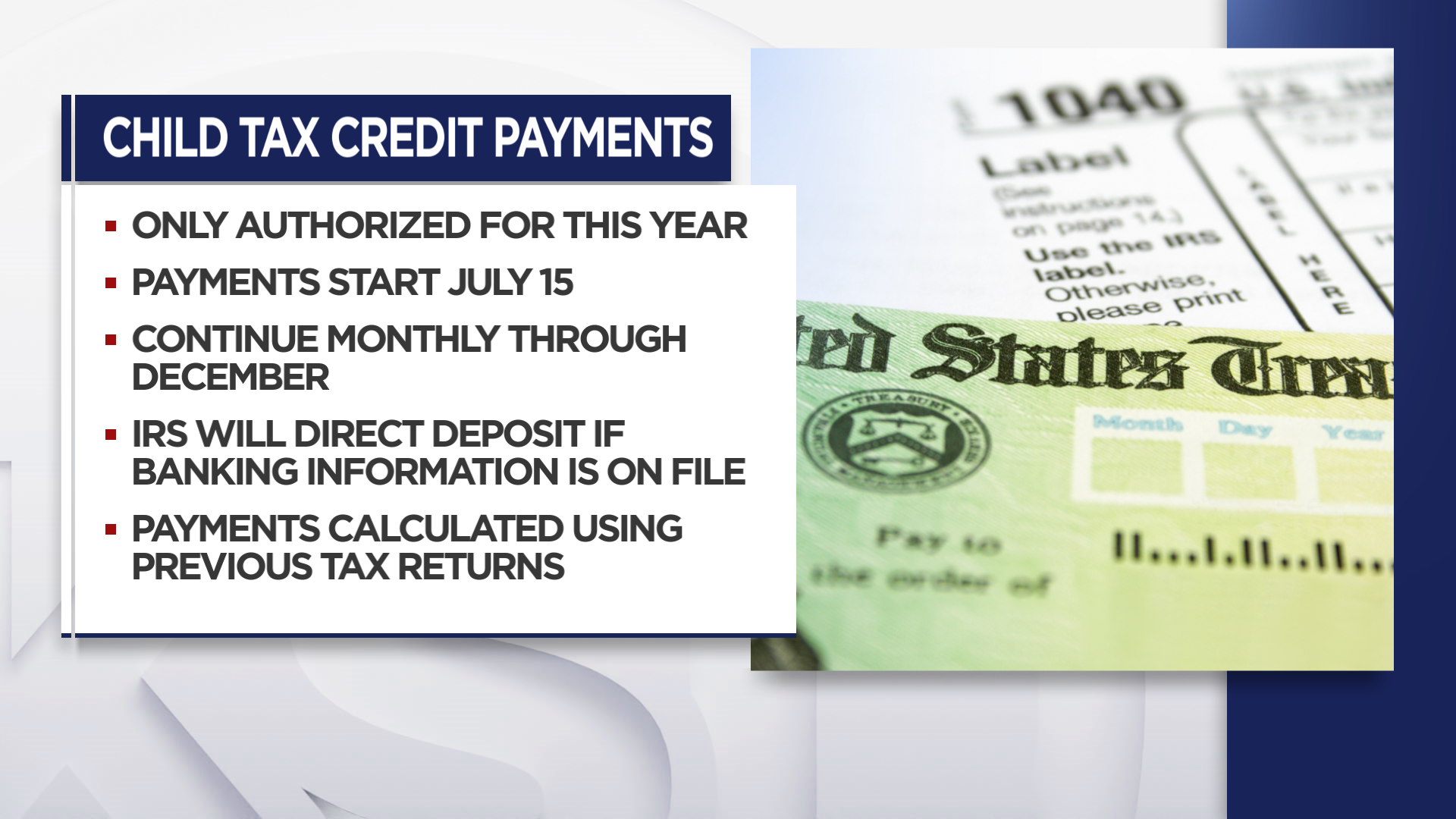

Irs Child Tax Credit Bank Account Update. Correct your direct deposit and banking details with the IRS. That means that instead of receiving monthly payments of say 300 for your 4. More functionality will be added later this year that will allow you to. You Can Now Change the Bank Account Where the IRS Sends Your Payments - Flipboard.

3 Quick Ways To See If You Re Eligible For The July 15 Child Tax Credit Payment Cnet From cnet.com

3 Quick Ways To See If You Re Eligible For The July 15 Child Tax Credit Payment Cnet From cnet.com

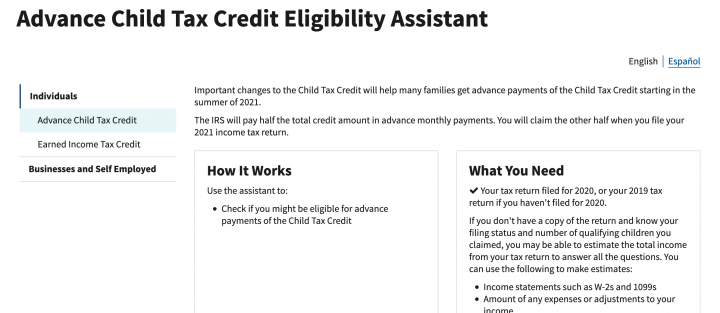

People without an existing account will be asked to verify their identity with a form of photo identification using IDme a trusted third party for the IRS. Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021. WASHINGTON The Internal Revenue Service today upgraded a key online tool to enable families to quickly and easily update their bank account information so they can receive their monthly Child Tax Credit payment. Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer. That means that instead of receiving monthly payments of say 300 for your 4. 13 payment and subsequent payments.

The IRS will pay half the total credit amount in advance monthly payments beginning July 15.

More functionality will be added later this year that will allow you to. Now through the Child Tax Credit Update Portal families can change the information the IRS has on file by updating the routing number and account number and indicating whether it is a savings or checking account according to a news release. The IRS said it will use what it has on file for the. People without an existing account will be asked to verify their identity with a form of photo identification using IDme a trusted third party for the IRS. More functionality will be added later this year that will allow you to. The Internal Revenue Service announced a new feature for the Child Tax Credit Update Portal this week that will.

Source: cnet.com

Source: cnet.com

While its too late to change the bank account that will receive the July 15 payment qualifying taxpayers can now use a tool on IRSgov to update their information before the August payment is issued. The IRS will pay half the total credit amount in advance monthly payments beginning July 15. The Internal Revenue Service announced a new feature for the Child Tax Credit Update Portal this week that will. That means that instead of receiving monthly payments of say 300 for your 4. The IRS said it will use what it has on file for the.

Source:

Source:

If a person has an existing IRS username or an IDme account with a verified identity they can use those accounts to easily sign in. Well issue the first advance payment on July 15 2021. Using the Child Tax Credit Update Portal you can now add your direct deposit information if the IRS. Accessing the Update Portal. While its too late to change the bank account that will receive the July 15 payment qualifying taxpayers can now use a tool on IRSgov to update their information before the August payment is issued.

Source: silive.com

Source: silive.com

The IRS will pay half the total credit amount in advance monthly payments beginning July 15. The Child Tax Credit Update Portal now lets you opt out of receiving the monthly child tax credit payments. Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer. Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021. To qualify for advance Child Tax Credit payments you and your.

Source: cnet.com

Source: cnet.com

WASHINGTON The Internal Revenue Service today upgraded a key online tool to enable families to quickly and easily update their bank account information so they can receive their monthly Child Tax Credit payment. The bank account update feature was added to the Child Tax Credit Update Portal available only on IRSgov. To qualify for advance Child Tax Credit payments you and your. The Child Tax Credit Update Portal now lets youopt out of receivingthe monthly child tax credit payments. Half of the credit will be sent in advance monthly payments starting July 15.

Source: cnet.com

Source: cnet.com

People without an existing account will be asked to verify their identity with a form of photo identification using IDme a trusted third party for the IRS. The Internal Revenue Service announced a new feature for the Child Tax Credit Update Portal this week that will. The bank account update feature was added to the Child Tax Credit Update Portal available only on IRSgov. Money - With roughly two weeks to go until the first monthly child tax credit payment hits Americans bank accounts the IRS has updated an online tool that. The IRS on Wednesday added a new feature to its Child Tax Credit Update Portal to allow individuals to update their bank account information in order to receive monthly advance child tax credit payments IR-2021-143.

Source:

Source:

Update your direct deposit and bank details Using the Child Tax Credit Update Portal you can now add your direct deposit information if the IRS doesnt have it from a recent tax return. The IRS launched on IRSgov a Child Tax Credit Update Portal CTC UP which will allow you to elect not to receive advance Child Tax Credit payments during 2021 and update your bank account information. People without an existing account will be asked to verify their identity with a form of photo identification using IDme a trusted third party for the IRS. 2 will be reflected in the scheduled Aug. The IRS said it will use what it has on file for the.

Source: cnet.com

Source: cnet.com

July 1 2021 1000 AM 2 min read With roughly two weeks to go until the first monthly child tax credit payment hits Americans bank accounts the IRS has updated an online tool that allows. Any updates made by August 2 will apply to the. That means that instead of receiving monthly payments of say 300 for your 4. The full benefit will be 300 per month for children under 6 and 250 per month for. Now through the Child Tax Credit Update Portal families can change the information the IRS has on file by updating the routing number and account number and indicating whether it is a savings or checking account according to a news release.

Source: abc7news.com

Source: abc7news.com

Monthly Advance Child Tax Credit payments are set to begin in two weeks. The IRS said it will use what it has on file for the. The IRS says any updates made by Aug. The bank account update feature was added to the Child Tax Credit Update Portal available only on IRSgov. More functionality will be added later this year that will allow you to.

Source: forbes.com

Source: forbes.com

13 payment and subsequent payments. Money - With roughly two weeks to go until the first monthly child tax credit payment hits Americans bank accounts the IRS has updated an online tool that. The IRS launched on IRSgov a Child Tax Credit Update Portal CTC UP which will allow you to elect not to receive advance Child Tax Credit payments during 2021 and update your bank account information. The IRS on Wednesday added a new feature to its Child Tax Credit Update Portal to allow individuals to update their bank account information in order to receive monthly advance child tax credit payments IR-2021-143. People without an existing account will be asked to verify their identity with a form of photo identification using IDme a trusted third party for the IRS.

Source: hrblock.com

Source: hrblock.com

The full benefit will be 300 per month for children under 6 and 250 per month for. The Child Tax Credit Update Portal now lets youopt out of receivingthe monthly child tax credit payments. More functionality will be added later this year that will allow you to. Monthly Advance Child Tax Credit payments are set to begin in two weeks. The bank account update feature was added to the Child Tax Credit Update Portal available only on IRSgov.

Source: mlive.com

Source: mlive.com

Accessing the Update Portal. The IRS on Wednesday added a new feature to its Child Tax Credit Update Portal to allow individuals to update their bank account information in order to receive monthly advance child tax credit payments IR-2021-143. Accessing the Update Portal. You will claim the other half when you file your 2021 income tax return. The Child Tax Credit Update Portal now lets you opt out of receiving the monthly child tax credit payments.

The IRS said it will use what it has on file for the. Using the Child Tax Credit Update Portal you can now add your direct deposit information if the IRS. While its too late to change the bank account that will receive the July 15 payment qualifying taxpayers can now use a tool on IRSgov to update their information before the August payment is issued. The IRS launched on IRSgov a Child Tax Credit Update Portal CTC UP which will allow you to elect not to receive advance Child Tax Credit payments during 2021 and update your bank account information. The Child Tax Credit Update Portal now lets youopt out of receivingthe monthly child tax credit payments.

Source: cnet.com

Source: cnet.com

The full benefit will be 300 per month for children under 6 and 250 per month for. Child Tax Credit Update. The Child Tax Credit Update Portal now lets you opt out of receiving the monthly child tax credit payments. Half the total credit amount will be paid in advance monthly payments and you will claim the other half when you file your 2021 income tax return. Well issue the first advance payment on July 15 2021.

Source: cnet.com

Source: cnet.com

Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021. If a person has an existing IRS username or an IDme account with a verified identity they can use those accounts to easily sign in. The IRS on Wednesday added a new feature to its Child Tax Credit Update Portal to allow individuals to update their bank account information in order to receive monthly advance child tax credit payments IR-2021-143. July 1 2021 1000 AM 2 min read With roughly two weeks to go until the first monthly child tax credit payment hits Americans bank accounts the IRS has updated an online tool that allows. People without an existing account will be asked to verify their identity with a form of photo identification using IDme a trusted third party for the IRS.

Source: philadelphia.cbslocal.com

Source: philadelphia.cbslocal.com

Accessing the Update Portal. Half of the credit will be sent in advance monthly payments starting July 15. Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer. Money - With roughly two weeks to go until the first monthly child tax credit payment hits Americans bank accounts the IRS has updated an online tool that. The bank account update feature was added to the Child Tax Credit Update Portal available only on IRSgov.

Source:

Source:

The IRS will pay half the total credit amount in advance monthly payments beginning July 15. The IRS said it will use what it has on file for the. To qualify for advance Child Tax Credit payments you and your. Any updates made by August 2 will apply to the. The full benefit will be 300 per month for children under 6 and 250 per month for.

Source: cpapracticeadvisor.com

Source: cpapracticeadvisor.com

2 will be reflected in the scheduled Aug. 2 will be reflected in the scheduled Aug. Well issue the first advance payment on July 15 2021. People without an existing account will be asked to verify their identity with a form of photo identification using IDme a trusted third party for the IRS. The IRS will pay half the total credit amount in advance monthly payments beginning July 15.

Source: wearegreenbay.com

Source: wearegreenbay.com

Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021. The bank account update feature was added to the Child Tax Credit Update Portal available only on IRSgov. Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer. 2 will be reflected in the scheduled Aug. Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title irs child tax credit bank account update by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Child tax credit payments bill information

- Child tax credit july 2021 portal information

- Finance of america stock information

- Team usa in olympics information

- Mel gibson christ movie information

- Child tax credit portal down information

- Stephen a smith i dont care gif information

- Usa basketball in olympics information

- Social security yuba city information

- Stephen a smith megan olivi information