Fidelity donor advised fund information

Home » » Fidelity donor advised fund informationYour Fidelity donor advised fund images are ready. Fidelity donor advised fund are a topic that is being searched for and liked by netizens now. You can Find and Download the Fidelity donor advised fund files here. Download all royalty-free vectors.

If you’re searching for fidelity donor advised fund pictures information connected with to the fidelity donor advised fund keyword, you have visit the right site. Our website frequently provides you with hints for seeking the maximum quality video and picture content, please kindly hunt and find more enlightening video content and graphics that match your interests.

Fidelity Donor Advised Fund. Fidelity Charitable allows you to give as little as 50 at a time compared to Vanguards 500 minimum. A donor-advised fund is like a charitable investment account for the sole purpose of supporting charitable organizations you care about. On average three-quarters of donors contribution dollars are granted within five years of receipt. When you contribute to a donor advised fund during your lifetime you are eligible for an immediate income tax deduction.

Fidelity S Donor Advised Fund Is Shaking Up Charitable Giving From slate.com

Fidelity S Donor Advised Fund Is Shaking Up Charitable Giving From slate.com

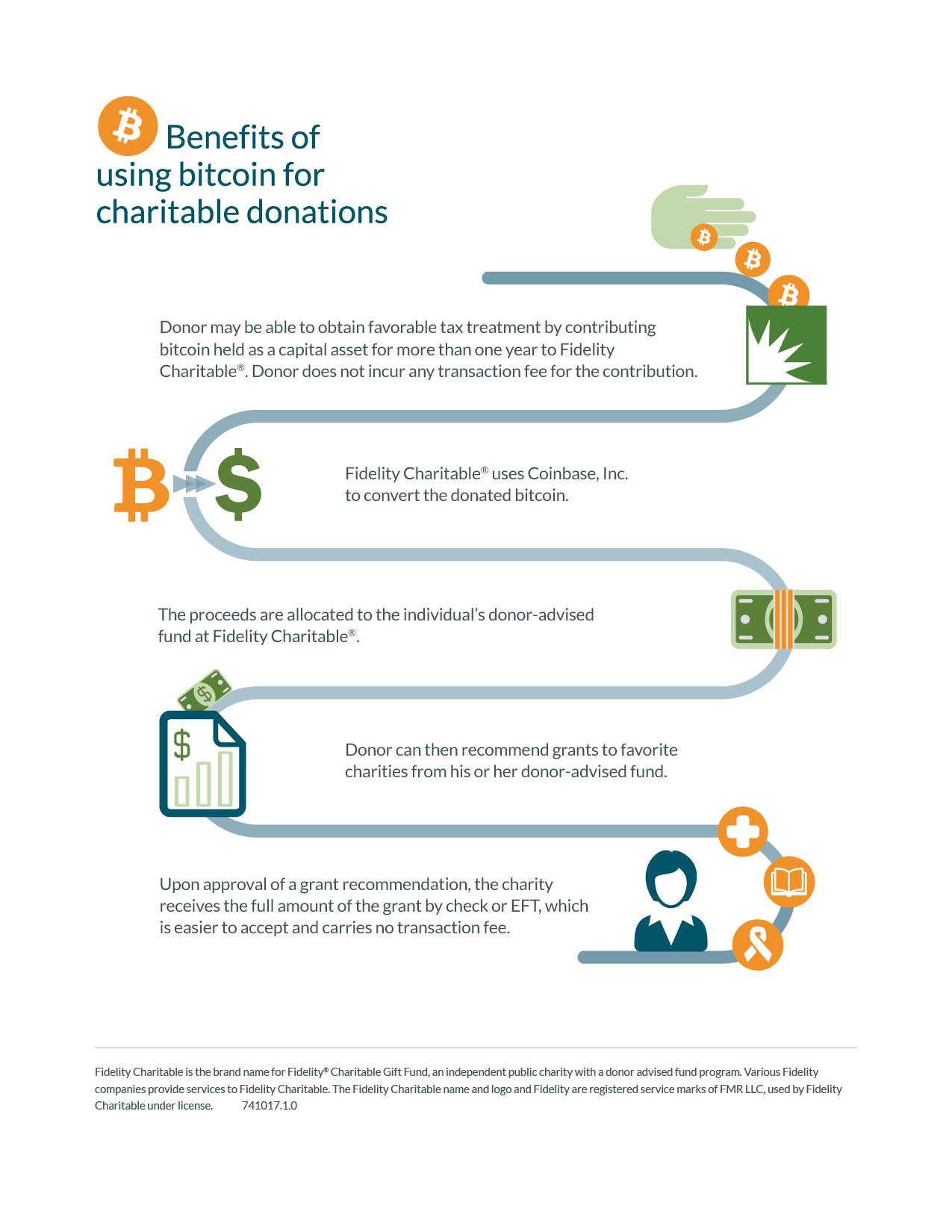

The cumulative lifetime giving of Fidelity Charitables Donor Advised Funds is over 51 billion to 328000 unique charities. Fidelity Charitable allows you to give as little as 50 at a time compared to Vanguards 500 minimum. The Fairbairns filed the lawsuit in 2018 accusing Fidelity Charitable of mishandling a contribution to their donor-advised fund account of 100 million of stock in late 2017. Your donor-advised fund allows you to involve your family and children during your. Theres another upside to donating bitcoin to a public charity with a donor-advised fund program such as Fidelity Charitable. The opportunity to recommend how the contribution is invested and potentially grow it tax-free ultimately providing greater charitablephilanthropic support.

When you contribute cash securities or other assets to a donor-advised fund at a public charity like Fidelity Charitable you are generally eligible to take an immediate tax deduction.

The Fidelity Charitable name and logo and Fidelity are registered service marks of FMR LLC used by Fidelity Charitable under license. The Fidelity Charitable name and logo and Fidelity are registered service marks of FMR LLC used by Fidelity Charitable under license. Donor advised fund money is moving. Fidelity Charitable is the brand name for Fidelity Investments Charitable Gift Fund an independent public charity with a donor-advised fund program. The opportunity to recommend how the contribution is invested and potentially grow it tax-free ultimately providing greater charitablephilanthropic support. The fund said it made the change to.

Source: businesswire.com

Source: businesswire.com

Consider a donor-advised fund to help simplify the process by using a single contribution of long-term securities to create a giving plan and support multiple charities. A DAF is a dedicated charitable fund maintained by a public charity a sponsored organization that is exclusively dedicated to charitable giving. The Fairbairns filed the lawsuit in 2018 accusing Fidelity Charitable of mishandling a contribution to their donor-advised fund account of 100 million of stock in late 2017. Theres another upside to donating bitcoin to a public charity with a donor-advised fund program such as Fidelity Charitable. What is a donor advised fund.

Source: chiefmomofficer.org

Source: chiefmomofficer.org

The cumulative lifetime giving of Fidelity Charitables Donor Advised Funds is over 51 billion to 328000 unique charities. Various Fidelity companies provide services to Fidelity Charitable. Fidelity Charitable is the brand name for Fidelity Investments Charitable Gift Fund an independent public charity with a donor-advised fund program. Fidelity Charitable is the brand name for the Fidelity Investments Charitable Gift Fund an independent public charity with a donor-advised fund program. By leaving instructions with the donor-advised fund sponsor you can support multiple charities with one bequest.

Source: businesswire.com

Source: businesswire.com

On average three-quarters of donors contribution dollars are granted within five years of receipt. When you contribute to a donor advised fund during your lifetime you are eligible for an immediate income tax deduction. The cumulative lifetime giving of Fidelity Charitables Donor Advised Funds is over 51 billion to 328000 unique charities. A donor-advised fund is like a charitable investment account for the sole purpose of supporting charitable organizations you care about. Opening the fund using a grant from Vanguard Charitable was simple.

Source: complexstories.com

Source: complexstories.com

When you contribute cash securities or other assets to a donor-advised fund sponsoring organization like Fidelity Charitable you. The fund said it made the change to. Consider a donor-advised fund to help simplify the process by using a single contribution of long-term securities to create a giving plan and support multiple charities. Theres another upside to donating bitcoin to a public charity with a donor-advised fund program such as Fidelity Charitable. The Fairbairns filed the lawsuit in 2018 accusing Fidelity Charitable of mishandling a contribution to their donor-advised fund account of 100 million of stock in late 2017.

Source:

Donors increased from 88672 in 2011 to 254655 donors in 2020. The Fairbairns filed the lawsuit in 2018 accusing Fidelity Charitable of mishandling a contribution to their donor-advised fund account of 100 million of stock in late 2017. Fidelity Charitable allows you to give as little as 50 at a time compared to Vanguards 500 minimum. The Fidelity Charitable name and logo and Fidelity are registered service marks of FMR LLC used by Fidelity Charitable under license. Various Fidelity companies provide services to Fidelity Charitable.

Source: moneyblawg.com

Source: moneyblawg.com

You can incorporate your donor-advised fund into estate planning by making a bequest in your will to the donor-advised fund sponsor or by making the sponsor a beneficiary of a retirement plan life insurance policy or charitable trust. By leaving instructions with the donor-advised fund sponsor you can support multiple charities with one bequest. Opening the fund using a grant from Vanguard Charitable was simple. Various Fidelity companies provide services to Fidelity Charitable. A DAF is a dedicated charitable fund maintained by a public charity a sponsored organization that is exclusively dedicated to charitable giving.

Source: forbes.com

Source: forbes.com

Opening the fund using a grant from Vanguard Charitable was simple. A DAF is a dedicated charitable fund maintained by a public charity a sponsored organization that is exclusively dedicated to charitable giving. Fidelity Charitable allows you to give as little as 50 at a time compared to Vanguards 500 minimum. The Fidelity Charitable name and logo and Fidelity are registered service marks of FMR LLC used by Fidelity Charitable under license. Your donor-advised fund allows you to involve your family and children during your.

Source: businesswire.com

Source: businesswire.com

Donors increased from 88672 in 2011 to 254655 donors in 2020. The Fidelity Charitable name and logo and Fidelity are registered service marks of FMR LLC used by Fidelity Charitable under license. You can incorporate your donor-advised fund into estate planning by making a bequest in your will to the donor-advised fund sponsor or by making the sponsor a beneficiary of a retirement plan life insurance policy or charitable trust. Emily and Malcolm Fairbairn donors sued Fidelity Investments Charitable Gift Fund Fidelity alleging contract and tort claims based on their 100 million donation to Fidelitys. Consider a donor-advised fund to help simplify the process by using a single contribution of long-term securities to create a giving plan and support multiple charities.

Source: fidelitycharitable.org

Source: fidelitycharitable.org

Consider a donor-advised fund to help simplify the process by using a single contribution of long-term securities to create a giving plan and support multiple charities. Fidelity Charitable allows you to give as little as 50 at a time compared to Vanguards 500 minimum. On average three-quarters of donors contribution dollars are granted within five years of receipt. Big cities such as Seattle and Tacoma and other community organizations may offer DAF programs to. Donor advised fund money is moving.

Source: businesswire.com

Source: businesswire.com

The Fidelity Charitable name and logo and Fidelity are registered service marks of FMR LLC used by Fidelity Charitable under license. The opportunity to recommend how the contribution is invested and potentially grow it tax-free ultimately providing greater charitablephilanthropic support. Once individuals transfer assets into a donor-advised fund allowing them to claim an immediate tax break that money is technically the property of Fidelitys affiliated charity Mittendorf. What is a donor advised fund. When you contribute cash securities or other assets to a donor-advised fund sponsoring organization like Fidelity Charitable you.

Source: youtube.com

Source: youtube.com

A donor-advised fund is like a charitable investment account for the sole purpose of supporting charitable organizations you care about. Fidelity Charitable allows you to give as little as 50 at a time compared to Vanguards 500 minimum. Fidelity Charitable offers Fidelity donor-advised funds and Schwab Charitable offers Schwab donor-advised funds. Opening the fund using a grant from Vanguard Charitable was simple. Various Fidelity companies provide services to Fidelity Charitable.

Source: whitecoatinvestor.com

Source: whitecoatinvestor.com

You can incorporate your donor-advised fund into estate planning by making a bequest in your will to the donor-advised fund sponsor or by making the sponsor a beneficiary of a retirement plan life insurance policy or charitable trust. Fidelity Charitable is the brand name for Fidelity Investments Charitable Gift Fund an independent public charity with a donor-advised fund program. The fund said it made the change to. By leaving instructions with the donor-advised fund sponsor you can support multiple charities with one bequest. Once individuals transfer assets into a donor-advised fund allowing them to claim an immediate tax break that money is technically the property of Fidelitys affiliated charity Mittendorf.

Source: ecoviva.org

Source: ecoviva.org

Once individuals transfer assets into a donor-advised fund allowing them to claim an immediate tax break that money is technically the property of Fidelitys affiliated charity Mittendorf. Donor advised fund money is moving. On average three-quarters of donors contribution dollars are granted within five years of receipt. Consider a donor-advised fund to help simplify the process by using a single contribution of long-term securities to create a giving plan and support multiple charities. The Fairbairns filed the lawsuit in 2018 accusing Fidelity Charitable of mishandling a contribution to their donor-advised fund account of 100 million of stock in late 2017.

Source: youtube.com

When you contribute to a donor advised fund during your lifetime you are eligible for an immediate income tax deduction. When you contribute cash securities or other assets to a donor-advised fund at a public charity like Fidelity Charitable you are generally eligible to take an immediate tax deduction. Your donor-advised fund allows you to involve your family and children during your. Giving to charitable causes that are close to your heart is rewarding. Consider a donor-advised fund to help simplify the process by using a single contribution of long-term securities to create a giving plan and support multiple charities.

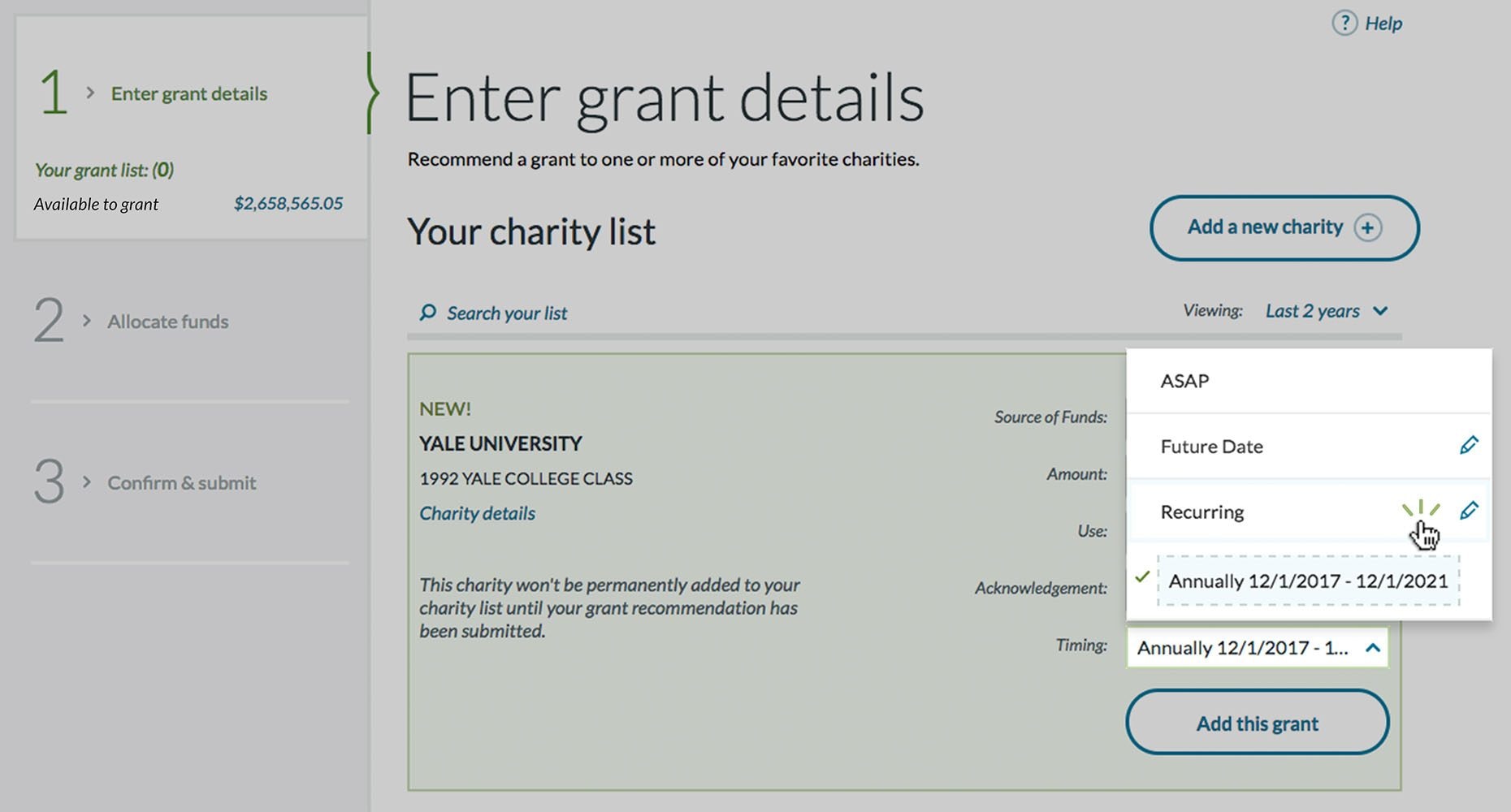

Source: demo-charitablegift.com

Source: demo-charitablegift.com

When you contribute to a donor advised fund during your lifetime you are eligible for an immediate income tax deduction. A donor-advised fund is like a charitable investment account for the sole purpose of supporting charitable organizations you care about. Various Fidelity companies provide services to Fidelity Charitable. You can incorporate your donor-advised fund into estate planning by making a bequest in your will to the donor-advised fund sponsor or by making the sponsor a beneficiary of a retirement plan life insurance policy or charitable trust. The Fidelity Charitable name and logo and Fidelity are registered service marks of FMR LLC used by Fidelity Charitable under license.

Source: aefonline.org

Source: aefonline.org

Emily and Malcolm Fairbairn donors sued Fidelity Investments Charitable Gift Fund Fidelity alleging contract and tort claims based on their 100 million donation to Fidelitys. These sponsors serve donors nationwide and can distribute donations to nearly any qualified public charity. Fidelity Charitable offers Fidelity donor-advised funds and Schwab Charitable offers Schwab donor-advised funds. Big cities such as Seattle and Tacoma and other community organizations may offer DAF programs to. The opportunity to recommend how the contribution is invested and potentially grow it tax-free ultimately providing greater charitablephilanthropic support.

Source: slate.com

Source: slate.com

When you contribute to a donor advised fund during your lifetime you are eligible for an immediate income tax deduction. When you contribute to a donor advised fund during your lifetime you are eligible for an immediate income tax deduction. Theres another upside to donating bitcoin to a public charity with a donor-advised fund program such as Fidelity Charitable. A donor-advised fund is like a charitable investment account for the sole purpose of supporting charitable organizations you care about. The fees in both programs are nearly identical.

Source: youtube.com

Source: youtube.com

When you contribute cash securities or other assets to a donor-advised fund sponsoring organization like Fidelity Charitable you. Various Fidelity companies provide services to Fidelity Charitable. Consider a donor-advised fund to help simplify the process by using a single contribution of long-term securities to create a giving plan and support multiple charities. The Fidelity Charitable name and logo and Fidelity are registered service marks of FMR LLC used by Fidelity Charitable under license. The Fairbairns filed the lawsuit in 2018 accusing Fidelity Charitable of mishandling a contribution to their donor-advised fund account of 100 million of stock in late 2017.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title fidelity donor advised fund by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Child tax credit payments bill information

- Child tax credit july 2021 portal information

- Finance of america stock information

- Team usa in olympics information

- Mel gibson christ movie information

- Child tax credit portal down information

- Stephen a smith i dont care gif information

- Usa basketball in olympics information

- Social security yuba city information

- Stephen a smith megan olivi information