Child tax credit portal get my payment information

Home » » Child tax credit portal get my payment informationYour Child tax credit portal get my payment images are ready. Child tax credit portal get my payment are a topic that is being searched for and liked by netizens now. You can Download the Child tax credit portal get my payment files here. Find and Download all royalty-free vectors.

If you’re looking for child tax credit portal get my payment pictures information related to the child tax credit portal get my payment interest, you have come to the right blog. Our site frequently gives you suggestions for viewing the highest quality video and image content, please kindly hunt and locate more enlightening video articles and graphics that match your interests.

Child Tax Credit Portal Get My Payment. WASHINGTON The Internal Revenue Service today upgraded a key online tool to enable families to quickly and easily update their bank account information so they can receive their monthly Child Tax Credit payment. In 2021 the maximum enhanced child tax credit is 3600 for children younger than age 6 and 3000 for those between 6 and 17. 7 rows Child tax credit. Enter Payment Info Here tool.

Irs Child Tax Credit Portals Check Eligibility Add Bank Info Opt Out And More Cnet From cnet.com

Irs Child Tax Credit Portals Check Eligibility Add Bank Info Opt Out And More Cnet From cnet.com

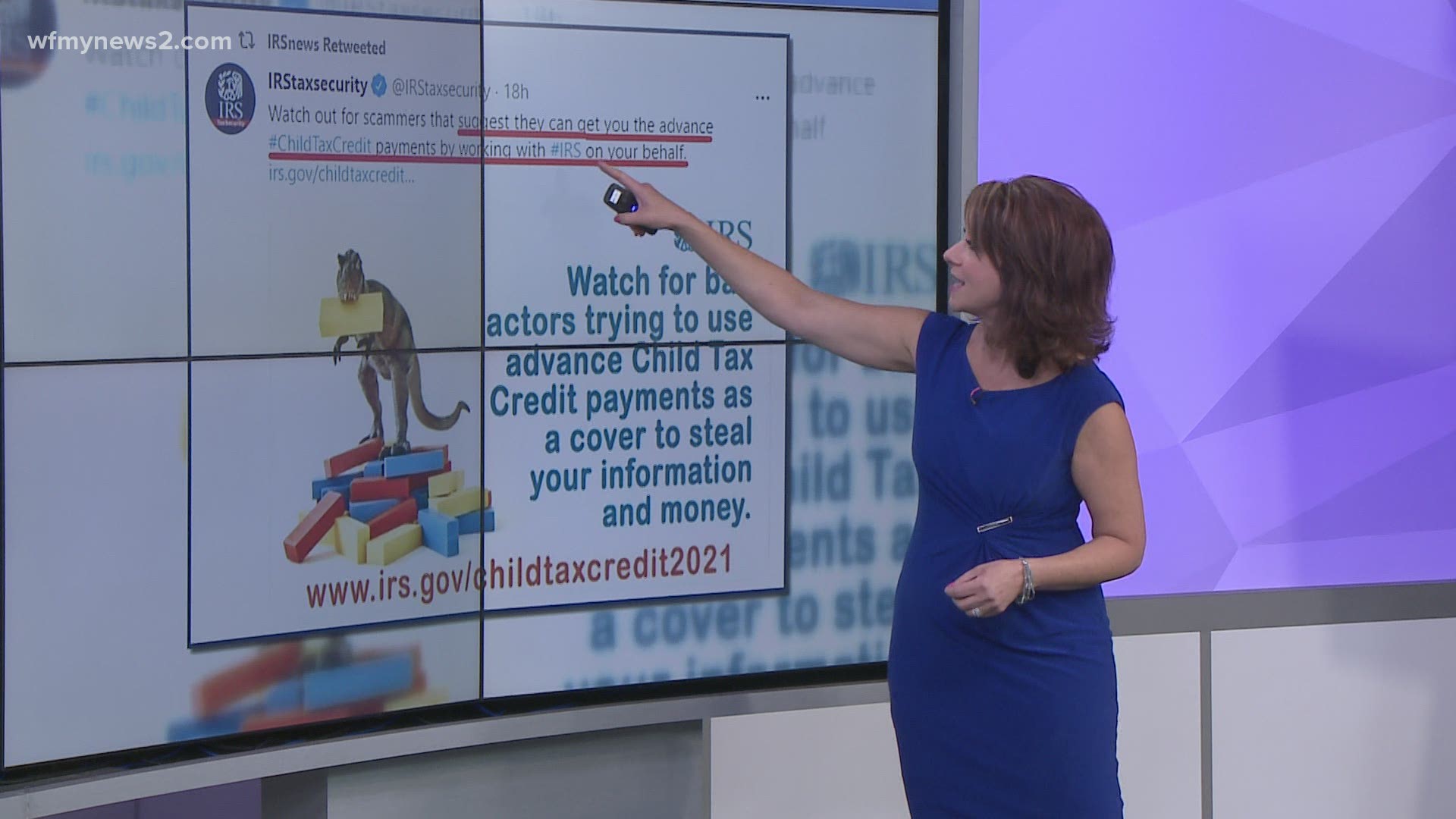

New parents can use the Child Tax Credit Update Portal. Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021. The American Rescue Plan passed in March upped the child tax credit amount to 3600 per child 300 a month for children under age and 3000 per child 250 per month for children. Nearly all working families will automatically get monthly payments starting July 15th no action needed. Enter Payment Info Here tool. The IRS will provide on IRSgov a Child Tax Credit Update Portal CTC UP before the first payments begin which initially will allow you solely to elect not to receive advance Child Tax Credit payments during 2021.

7 rows Child tax credit.

The new child tax credit is more generous than what it replaced 3600 per child aged 0 to 5 and 3000 for older kids with the amount decreasing on a prorated basis past income limits of 75000 for single filers 112500 for heads of household and 150000 for joint filers. This secure password-protected tool is available to any eligible family with internet access and a smart phone or computer. The new child tax credit is more generous than what it replaced 3600 per child aged 0 to 5 and 3000 for older kids with the amount decreasing on a prorated basis past income limits of 75000 for single filers 112500 for heads of household and 150000 for joint filers. In 2021 the maximum enhanced child tax credit is 3600 for children younger than age 6 and 3000 for those between 6 and 17. To get money to families sooner the IRS will send families half of their 2021 Child Tax Credit as monthly payments of 300 per child under age 6 and 250 per child between the ages of 6 and 17. The amount of the credit will decrease by 50 for every 1000 in income a filer makes beyond those limits.

Source: efile.com

Source: efile.com

WASHINGTON The Internal Revenue Service today upgraded a key online tool to enable families to quickly and easily update their bank account information so they can receive their monthly Child Tax Credit payment. To get money to families sooner the IRS will send families half of their 2021 Child Tax Credit as monthly payments of 300 per child under age 6 and 250 per child between the ages of 6 and 17. The American Rescue Plan passed in March upped the child tax credit amount to 3600 per child 300 a month for children under age and 3000 per child 250 per month for children. If you still have questions about whether you qualify for the scaled up. The advance Child Tax Credit or CTC payments are scheduled to begin in July 2021 and end by 2022.

Source: cnet.com

Source: cnet.com

WASHINGTON The Internal Revenue Service today upgraded a key online tool to enable families to quickly and easily update their bank account information so they can receive their monthly Child Tax Credit payment. The enhanced child tax credit payments are only set to last through 2021 but President Biden has suggested that this may be extended through as long as 2025 as part of the American Families Plan. Youll receive 1500 in advance split among six payments of 250 per each dependent over age 6 and under age 18. The amount of the credit will decrease by 50 for every 1000 in income a filer makes beyond those limits. Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the return.

Source: 9news.com

Source: 9news.com

To get money to families sooner the IRS will send families half of their 2021 Child Tax Credit as monthly payments of 300 per child under age 6 and 250 per child between the ages of 6 and 17. Enter Payment Info Here tool. Nearly all working families will automatically get monthly payments starting July 15th no action needed. Half the total credit amount will be paid in advance monthly payments and you will claim the other half when you file your 2021 income tax return. The new child tax credit is more generous than what it replaced 3600 per child aged 0 to 5 and 3000 for older kids with the amount decreasing on a prorated basis past income limits of 75000 for single filers 112500 for heads of household and 150000 for joint filers.

Source: bankrate.com

Source: bankrate.com

7 rows Child tax credit. The Child Tax Credit Update Portal allows families to verify their eligibility for the payments and if they choose to unenroll or opt out from receiving the monthly payments so they can receive a lump sum when they file their tax return next year. Any updates made by August 2 will apply to the August 13 payment and all subsequent monthly payments for the. This live feed is. Those payments will be sent out as an advance on 2021 taxes.

Source: cnet.com

Source: cnet.com

To get money to families sooner the IRS will send families half of their 2021 Child Tax Credit as monthly payments of 300 per child under age 6 and 250 per child between the ages of 6 and 17. The IRS will provide on IRSgov a Child Tax Credit Update Portal CTC UP before the first payments begin which initially will allow you solely to elect not to receive advance Child Tax Credit payments during 2021. Half the total credit amount will be paid in advance monthly payments and you will claim the other half when you file your 2021 income tax return. IRS Child Tax Credit Portal and Non-filers. The portal should allow parents to update their tax information and specify which parent should receive the advanced payments so that one parent is not getting the tax credit two years in a.

Source: en.as.com

Source: en.as.com

The new child tax credit is more generous than what it replaced 3600 per child aged 0 to 5 and 3000 for older kids with the amount decreasing on a prorated basis past income limits of 75000 for single filers 112500 for heads of household and 150000 for joint filers. This live feed is. In 2021 the maximum enhanced child tax credit is 3600 for children younger than age 6 and 3000 for those between 6 and 17. The advance Child Tax Credit or CTC payments are scheduled to begin in July 2021 and end by 2022. If you still have questions about whether you qualify for the scaled up.

Source: aarp.org

Source: aarp.org

Well issue the first advance payment on July 15 2021. Any updates made by August 2 will apply to the August 13 payment and all subsequent monthly payments for the. To qualify for advance Child Tax Credit payments you and your spouse if you filed a joint return must have. Latest news and information on the third stimulus check in President Bidens coronavirus relief bill and updates on a potential fourth direct payment on Tuesday 6 July. This secure password-protected tool is available to any eligible family with internet access and a smart phone or computer.

Source: people.com

Source: people.com

The advance Child Tax Credit or CTC payments are scheduled to begin in July 2021 and end by 2022. Any updates made by August 2 will apply to the August 13 payment and all subsequent monthly payments for the. WASHINGTON The Internal Revenue Service today upgraded a key online tool to enable families to quickly and easily update their bank account information so they can receive their monthly Child Tax Credit payment. Youll receive 1500 in advance split among six payments of 250 per each dependent over age 6 and under age 18. To qualify for advance Child Tax Credit payments you and your spouse if you filed a joint return must have.

Source: cnet.com

Source: cnet.com

If you still have questions about whether you qualify for the scaled up. The enhanced child tax credit payments are only set to last through 2021 but President Biden has suggested that this may be extended through as long as 2025 as part of the American Families Plan. New parents can use the Child Tax Credit Update Portal. To qualify for advance Child Tax Credit payments you and your spouse if you filed a joint return must have. IRS Child Tax Credit Portal and Non-filers.

Source: kxan.com

Source: kxan.com

The Child Tax Credit Update Portal allows families to verify their eligibility for the payments and if they choose to unenroll or opt out from receiving the monthly payments so they can receive a lump sum when they file their tax return next year. 7 rows Child tax credit. New parents can use the Child Tax Credit Update Portal. Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021. If you still have questions about whether you qualify for the scaled up.

Source: marca.com

Source: marca.com

This live feed is. Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the return. Non-tax filing parents can still get next months payments. 7 rows Child tax credit. The amount of the credit will decrease by 50 for every 1000 in income a filer makes beyond those limits.

Source: usatoday.com

Source: usatoday.com

This secure password-protected tool is available to any eligible family with internet access and a smart phone or computer. Well issue the first advance payment on July 15 2021. The Child Tax Credit means help directly in the bank accounts of the families who need it. The latest Child Tax Credit Update Portal currently allows families to view their eligibility manage their payments and unenroll from the advance monthly payments. Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the return.

Given us your information in 2020 to receive the Economic Impact Payment using the Non-Filers. Well issue the first advance payment on July 15 2021. This live feed is. Any updates made by August 2 will apply to the August 13 payment and all subsequent monthly payments for the. The bank account update feature was added to the Child Tax Credit Update Portal available only on IRSgov.

Source: cnbc.com

Source: cnbc.com

The latest Child Tax Credit Update Portal currently allows families to view their eligibility manage their payments and unenroll from the advance monthly payments. Enter Payment Info Here tool. Any updates made by August 2 will apply to the August 13 payment and all subsequent monthly payments for the. IRS Child Tax Credit Portal and Non-filers. Half the total credit amount will be paid in advance monthly payments and you will claim the other half when you file your 2021 income tax return.

Source: en.as.com

Source: en.as.com

The Child Tax Credit Update Portal allows families to verify their eligibility for the payments and if they choose to unenroll or opt out from receiving the monthly payments so they can receive a lump sum when they file their tax return next year. Youll receive 1500 in advance split among six payments of 250 per each dependent over age 6 and under age 18. Latest news and information on the third stimulus check in President Bidens coronavirus relief bill and updates on a potential fourth direct payment on Tuesday 6 July. If you still have questions about whether you qualify for the scaled up. The Child Tax Credit means help directly in the bank accounts of the families who need it.

Source: nymag.com

Source: nymag.com

This live feed is. The amount of the credit will decrease by 50 for every 1000 in income a filer makes beyond those limits. Those payments will be sent out as an advance on 2021 taxes. If you still have questions about whether you qualify for the scaled up. Given us your information in 2020 to receive the Economic Impact Payment using the Non-Filers.

Source: cnet.com

Source: cnet.com

Latest news and information on the third stimulus check in President Bidens coronavirus relief bill and updates on a potential fourth direct payment on Tuesday 6 July. Those payments will be sent out as an advance on 2021 taxes. Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the return. More functionality will be added later this year that will allow you to. Nearly all working families will automatically get monthly payments starting July 15th no action needed.

Source: cnet.com

Source: cnet.com

The enhanced child tax credit payments are only set to last through 2021 but President Biden has suggested that this may be extended through as long as 2025 as part of the American Families Plan. Any updates made by August 2 will apply to the August 13 payment and all subsequent monthly payments for the. This secure password-protected tool is available to any eligible family with internet access and a smart phone or computer. This live feed is. The bank account update feature was added to the Child Tax Credit Update Portal available only on IRSgov.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title child tax credit portal get my payment by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Child tax credit payments bill information

- Child tax credit july 2021 portal information

- Finance of america stock information

- Team usa in olympics information

- Mel gibson christ movie information

- Child tax credit portal down information

- Stephen a smith i dont care gif information

- Usa basketball in olympics information

- Social security yuba city information

- Stephen a smith megan olivi information