Child tax credit portal add dependent information

Home » » Child tax credit portal add dependent informationYour Child tax credit portal add dependent images are available. Child tax credit portal add dependent are a topic that is being searched for and liked by netizens today. You can Download the Child tax credit portal add dependent files here. Get all royalty-free vectors.

If you’re looking for child tax credit portal add dependent images information related to the child tax credit portal add dependent topic, you have pay a visit to the ideal blog. Our site frequently gives you suggestions for seeing the highest quality video and image content, please kindly hunt and locate more informative video content and images that fit your interests.

Child Tax Credit Portal Add Dependent. This tool can be used by low. Claiming Dependents and Filing Status. More functionality will be added later this year that will allow you to. If the spouse does not opt out see the link below.

Section 80dd Deduction For Expenses On Disabled Dependent Tax2win From tax2win.in

Section 80dd Deduction For Expenses On Disabled Dependent Tax2win From tax2win.in

The Child Tax Credit Update Portal will allow taxpayers to report any change in status dependents income throughout the year. You can create one on the page if. If the spouse does not opt out see the link below. 7 rows The total that eligible families with qualifying children will receive for the. The payment for children. Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021.

If the spouse does not opt out see the link below.

Youll then need to sign in with your IRS username or IDme account. After that the credit starts to phase out. The mother claimed the child as a dependent on her tax return for 2020 and the father will claim the child as a. To do so visit the Child Tax Credit Update Portal and tap Manage Advance Payments. Find out if you can claim a child or relative as a dependent with the Interactive Tax Assistant. The payment for children.

Source: storenfinancial.com

Source: storenfinancial.com

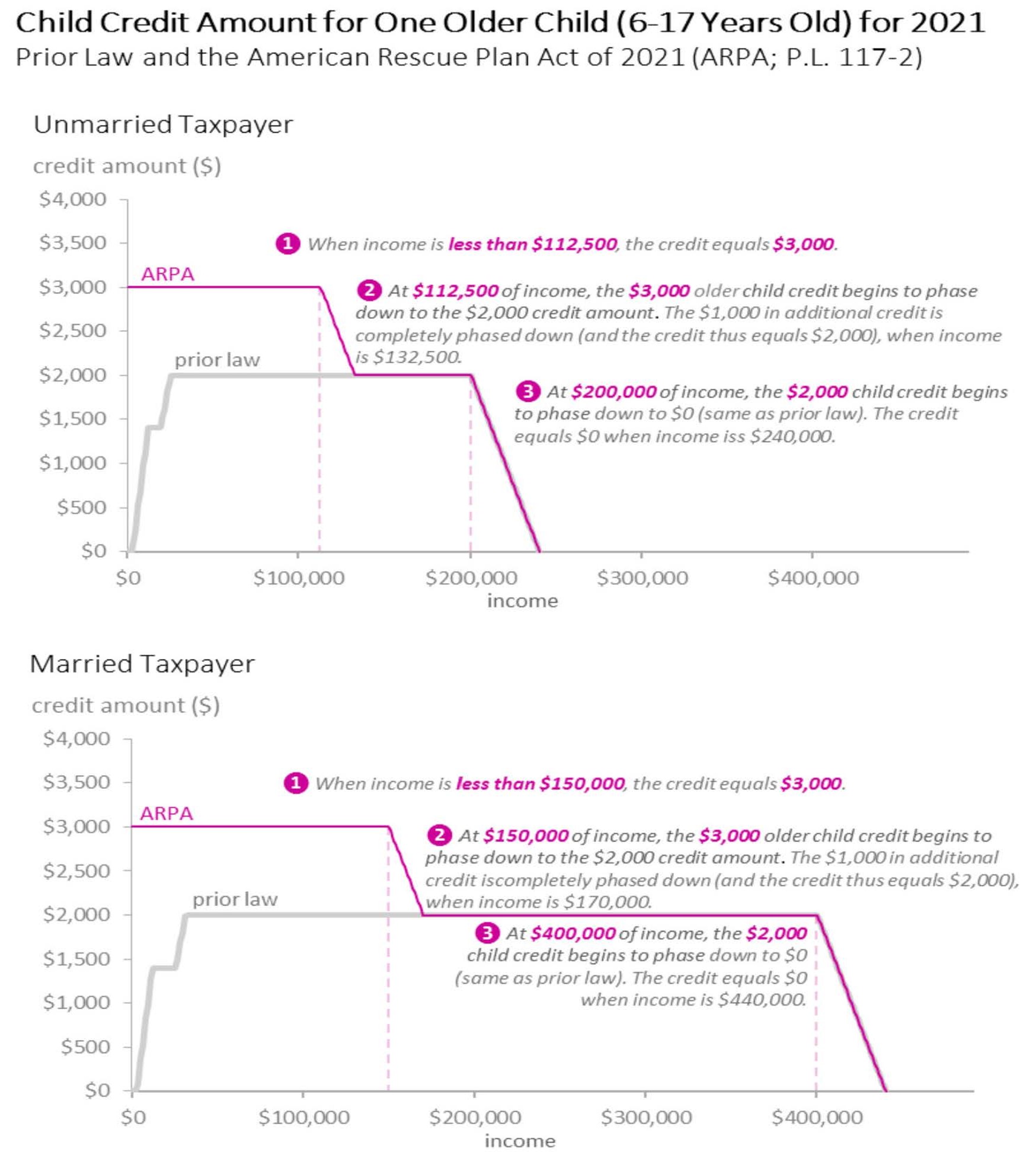

The payment for children. To do so visit the Child Tax Credit Update Portal and tap Manage Advance Payments. Two parents divorced in 2020 and share legal custody of a 17-year old child. You will claim the other half when you file your 2021 income tax return. However the enhanced tax credit the increase of 1000 or 1600 has stricter income criteria.

Source: in.pinterest.com

Source: in.pinterest.com

The IRS will pay half the total credit amount in advance monthly payments beginning July 15. You will claim the other half when you file your 2021 income tax return. You can create one on the page if. The spouse who claimed the dependent for 2020 will want to unenroll on the IRS tool via the tool see below. To qualify for advance Child Tax Credit payments you and your spouse if you filed a joint return must have.

Source: individuals.healthreformquotes.com

Source: individuals.healthreformquotes.com

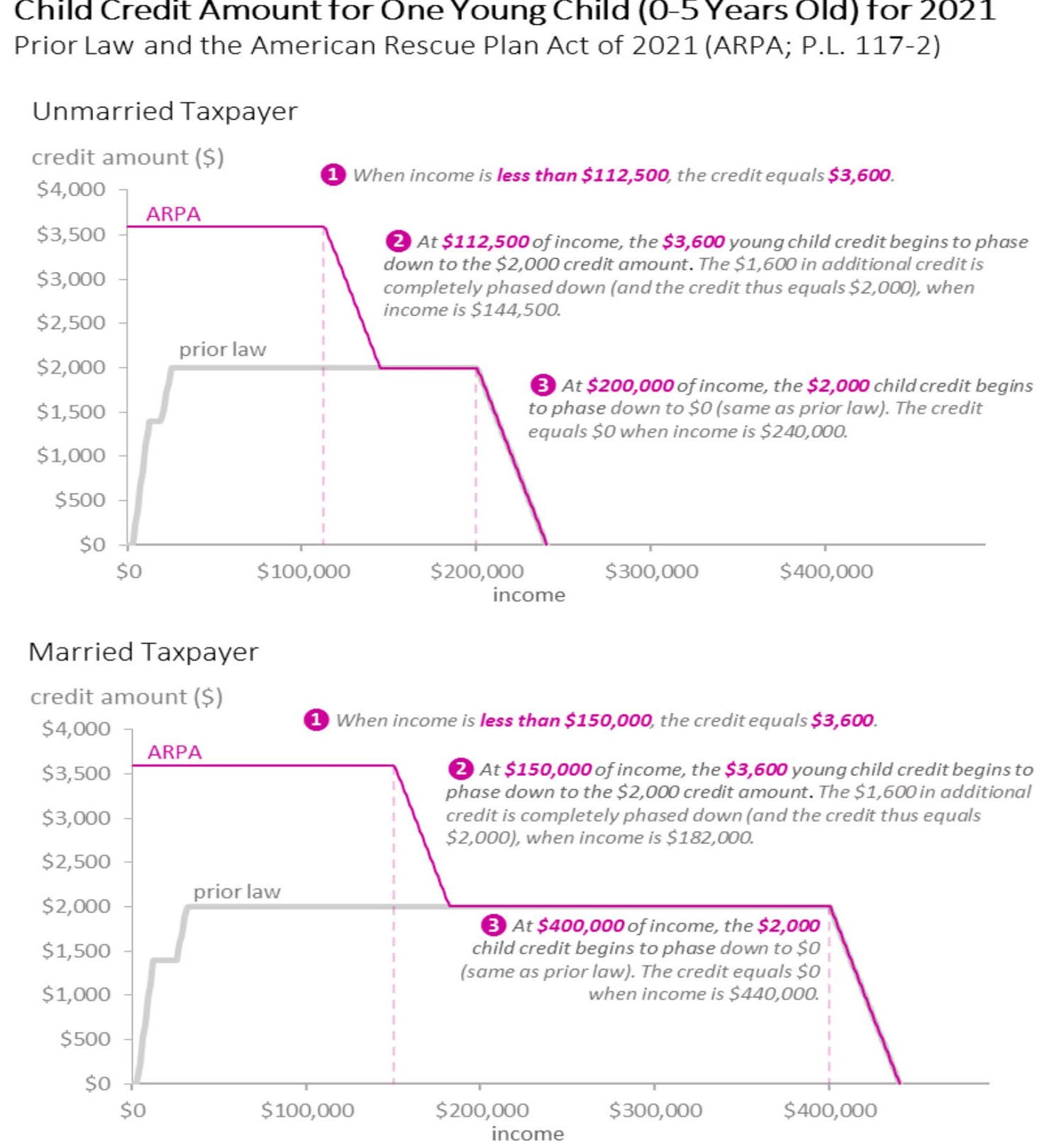

Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021. The child tax credit Non-filer Sign-up Tool is a way for those who arent required to file a tax return to give the tax agency basic information on their dependents. Kids who are under the age of 6 can count for up to 3600 each. You can create one on the page if. To do so visit the Child Tax Credit Update Portal and tap Manage Advance Payments.

Source: mcg-cpa.com

Source: mcg-cpa.com

Find out if you can claim a child or relative as a dependent with the Interactive Tax Assistant. Well issue the first advance payment on July 15 2021. This tool can be used by low. The mother claimed the child as a dependent on her tax return for 2020 and the father will claim the child as a. The child tax credit Non-filer Sign-up Tool is a way for those who arent required to file a tax return to give the tax agency basic information on their dependents.

Source: abc7news.com

Source: abc7news.com

These families will be able to use the portal. Half the total credit amount will be paid in advance monthly payments and you will claim the other half when you file your 2021 income tax return. IRS Child Tax Credit Portal and you will want to add your dependent and claim them on your 2021 tax return due in 2022. These families will be able to use the portal. The child tax credit Non-filer Sign-up Tool is a way for those who arent required to file a tax return to give the tax agency basic information on their dependents.

Source: in.pinterest.com

Source: in.pinterest.com

Kids who are under the age of 6 can count for up to 3600 each. Find out if you can claim a child or relative as a dependent with the Interactive Tax Assistant. The spouse who claimed the dependent for 2020 will want to unenroll on the IRS tool via the tool see below. This tool can be used by low. Claiming Dependents and Filing Status.

Source: everycrsreport.com

Source: everycrsreport.com

File Form 8332 ReleaseRevocation of Release of Claim to Exemption for Child by Custodial Parent. Half the total credit amount will be paid in advance monthly payments and you will claim the other half when you file your 2021 income tax return. To qualify for advance Child Tax Credit payments you and your spouse if you filed a joint return must have. The child tax credit Non-filer Sign-up Tool is a way for those who arent required to file a tax return to give the tax agency basic information on their dependents. You can create one on the page if.

Source: storenfinancial.com

Source: storenfinancial.com

These families will be able to use the portal. You can create one on the page if. This secure password-protected tool is available to any eligible family with internet access and a smart phone or computer. The American Rescue Plan passed in March upped the child tax credit amount to. 7 rows The total that eligible families with qualifying children will receive for the.

Source: cnet.com

Source: cnet.com

The Child Tax Credit Update Portal will allow taxpayers to report any change in status dependents income throughout the year. The expanded credit provides parents with a 3000 credit for every child age 6 to 17 and 3600 for every child under age 6 up from 2000 per dependent child up to. This tool can be used by low. Determine your filing status with the Interactive Tax Assistant. You can create one on the page if.

Source: cnet.com

Source: cnet.com

To do so visit the Child Tax Credit Update Portal and tap Manage Advance Payments. However the enhanced tax credit the increase of 1000 or 1600 has stricter income criteria. Two parents divorced in 2020 and share legal custody of a 17-year old child. All parents with adjusted gross income AGI below 200000 single or 400000 married filing jointly are eligible for the old 2000 per child tax credit. Youll then need to sign in with your IRS username or IDme account.

Source: aarp.org

Source: aarp.org

The 2021 credit means parents can now get up to a 3000 credit for every child age 6 to 17 and up to 3600 for every child under age 6 with half of the total credit split into recurring. More functionality will be added later this year that will allow you to. Kids who are under the age of 6 can count for up to 3600 each. To do so visit the Child Tax Credit Update Portal and tap Manage Advance Payments. You will claim the other half when you file your 2021 income tax return.

Source: savingtoinvest.com

Source: savingtoinvest.com

You will claim the other half when you file your 2021 income tax return. The American Rescue Plan passed in March upped the child tax credit amount to. The payments - 300 a month for children under the age of 6 and 250 a month for children ages 6-17 - were provided for in the stimulus bill that. Kids who are under the age of 6 can count for up to 3600 each. Ages five and younger is up to 3600 in total up to 300 in advance monthly Ages six to 17 is up to 3000 in total up to 250 in advance monthly Your amount changes based on your income.

Source: tax2win.in

Source: tax2win.in

Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021. These changes apply to tax year 2021 only. The payments - 300 a month for children under the age of 6 and 250 a month for children ages 6-17 - were provided for in the stimulus bill that. This secure password-protected tool is available to any eligible family with internet access and a smart phone or computer. Youll then need to sign in with your IRS username or IDme account.

Source: individuals.healthreformquotes.com

Source: individuals.healthreformquotes.com

More functionality will be added later this year that will allow you to. Kids who are under the age of 6 can count for up to 3600 each. The Child Tax Credit Update Portal allows families to verify their eligibility for the payments and if they choose to unenroll or opt out from receiving the monthly payments so they can receive a lump sum when they file their tax return next year. IRS Child Tax Credit Portal and you will want to add your dependent and claim them on your 2021 tax return due in 2022. Youll then need to sign in with your IRS username or IDme account.

Source: hawkinsashcpas.com

Source: hawkinsashcpas.com

The prior child tax credit offers families 2000 per kid age 16 and younger so adding an additional 1000 to 1600 per kid can. The expanded credit provides parents with a 3000 credit for every child age 6 to 17 and 3600 for every child under age 6 up from 2000 per dependent child up to. The IRS will pay half the total credit amount in advance monthly payments beginning July 15. To qualify for advance Child Tax Credit payments you and your spouse if you filed a joint return must have. These changes apply to tax year 2021 only.

Source: bankrate.com

Source: bankrate.com

7 rows The total that eligible families with qualifying children will receive for the. To do so visit the Child Tax Credit Update Portal and tap Manage Advance Payments. File Form 8332 ReleaseRevocation of Release of Claim to Exemption for Child by Custodial Parent. More functionality will be added later this year that will allow you to. After that the credit starts to phase out.

Source: hawkinsashcpas.com

Source: hawkinsashcpas.com

You can create one on the page if. Claiming Dependents and Filing Status. Youll then need to sign in with your IRS username or IDme account. IRS Child Tax Credit Portal and you will want to add your dependent and claim them on your 2021 tax return due in 2022. The IRS will provide on IRSgov a Child Tax Credit Update Portal CTC UP before the first payments begin which initially will allow you solely to elect not to receive advance Child Tax Credit payments during 2021.

Source: wsj.com

Source: wsj.com

The mother claimed the child as a dependent on her tax return for 2020 and the father will claim the child as a. The prior child tax credit offers families 2000 per kid age 16 and younger so adding an additional 1000 to 1600 per kid can. This secure password-protected tool is available to any eligible family with internet access and a smart phone or computer. After that the credit starts to phase out. To do so visit the Child Tax Credit Update Portal and tap Manage Advance Payments.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title child tax credit portal add dependent by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Child tax credit payments bill information

- Child tax credit july 2021 portal information

- Finance of america stock information

- Team usa in olympics information

- Mel gibson christ movie information

- Child tax credit portal down information

- Stephen a smith i dont care gif information

- Usa basketball in olympics information

- Social security yuba city information

- Stephen a smith megan olivi information