Child tax credit payments married filing separately information

Home » » Child tax credit payments married filing separately informationYour Child tax credit payments married filing separately images are available. Child tax credit payments married filing separately are a topic that is being searched for and liked by netizens today. You can Find and Download the Child tax credit payments married filing separately files here. Find and Download all royalty-free images.

If you’re searching for child tax credit payments married filing separately pictures information connected with to the child tax credit payments married filing separately keyword, you have pay a visit to the ideal site. Our website always provides you with suggestions for seeing the maximum quality video and image content, please kindly hunt and find more enlightening video content and graphics that fit your interests.

Child Tax Credit Payments Married Filing Separately. When married filing separately the IRS does not allow you to take many of the credits available to those filing a joint return. You andor your spouse owe unpaid taxes or child support filing a joint tax return may result in the IRS offsetting your refund to pay the taxes. Examples of how the Economic Stimulus Act of 2008 may affect taxpayers who are married but file separately with or without children who qualify for the child tax credit payment. The Education Credits are one of the credits they disallow when filing separately.

What Tax Breaks Are Afforded To A Qualifying Widow From investopedia.com

What Tax Breaks Are Afforded To A Qualifying Widow From investopedia.com

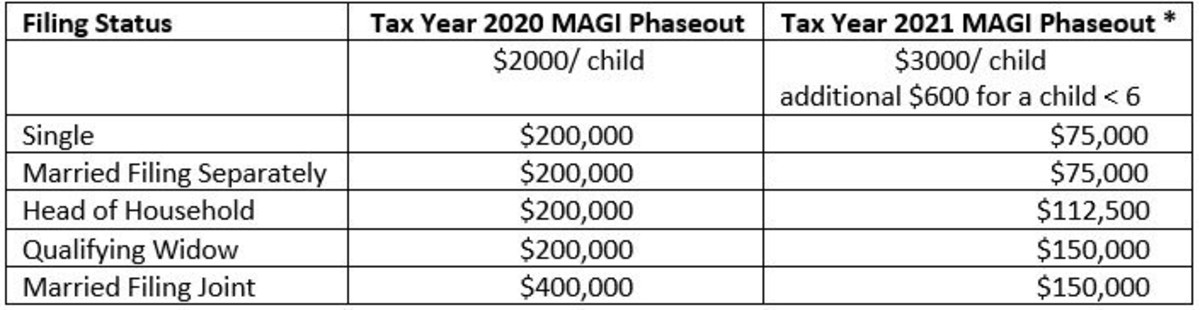

Those filing head of household can have an AGI up to 112500. The standard deduction for MFJ is set as 24400. For a married couple filing jointly the income cap is 150000. 200000 if married filing separately. Unmarried filers can get a credit of at least 2000 with income of 200000 or less. The enhanced tax credit will phase out for.

It works best if the couple earned over 150000 so received no EIP as MFJ.

For the purpose of this credit your modified adjusted gross income MAGI is your AGI plus excluded foreign earned income possession income and foreign housing. Credit for the elderly and disabled if they lived with their spouse Child and dependent care credit in most cases. Unmarried filers can get a credit of at least 2000 with income of 200000 or less. The standard deduction for MFJ is set as 24400. Examples of how the Economic Stimulus Act of 2008 may affect taxpayers who are married but file separately with or without children who qualify for the child tax credit payment. If that person also claims three kids like the OP then another 1100 per kid.

Source: forbes.com

Source: forbes.com

When married filing separately the IRS does not allow you to take many of the credits available to those filing a joint return. Up to 112500 head of household. It also increased the child tax credit to 2000 for each. Those filing head of household can have an AGI up to 112500. 2021 child tax credit income limits Like last year married filers can get a child tax credit of at least 2000 with income of 400000 or less.

Source: cnet.com

Source: cnet.com

If your Child Tax Credit is limited because of your tax liability you might be able to claim the additional Child. For a married couple filing jointly the income cap is 150000. If one of them earns less than 75000 and they file MFS then the lower income spouse will get RRC1 and RRC2 an extra 1800. You can take a reduced credit thats equal to half that of a. The CTC starts phasing out at an income of 400000 and is no longer available once your income hits 440000.

Source: investopedia.com

Source: investopedia.com

The standard deduction for MFJ is set as 24400. The standard deduction for MFJ is set as 24400. This enhanced portion of the CTC will be available for single or married filing separate parents with a 2020 tax return AGI adjusted gross income of up to 75000. Examples of how the Economic Stimulus Act of 2008 may affect taxpayers who are married but file separately with or without children who qualify for the child tax credit payment. Unmarried filers can get a credit of at least 2000 with income of 200000 or less.

Source: cbs46.com

Source: cbs46.com

Following are the tax credits that the IRS offers. Up to 400000 married filing jointly. For the purpose of this credit your modified adjusted gross income MAGI is your AGI plus excluded foreign earned income possession income and foreign housing. For a married couple filing jointly the income cap is 150000. Both have valid Social Security numbers SSNs Married couple no children.

Source: fox59.com

Source: fox59.com

Unmarried filers can get a credit of at least 2000 with income of 200000 or less. This enhanced portion of the CTC will be available for single or married filing separate parents with a 2020 tax return AGI adjusted gross income of up to 75000. 1 Married no children filing separately. When married filing separately the IRS does not allow you to take many of the credits available to those filing a joint return. If one of them earns less than 75000 and they file MFS then the lower income spouse will get RRC1 and RRC2 an extra 1800.

Source: abc7news.com

Source: abc7news.com

2021 child tax credit income limits Like last year married filers can get a child tax credit of at least 2000 with income of 400000 or less. If youre married filing separately the child tax credit is not available for the total amount youd receive if you filed jointly. The full credit is available to married couples with children filing jointly with adjusted gross income less than 150000 or 75000 for individuals. Unmarried filers can get a credit of at least 2000 with income of 200000 or less. Examples of how the Economic Stimulus Act of 2008 may affect taxpayers who are married but file separately with or without children who qualify for the child tax credit payment.

Source: investopedia.com

Source: investopedia.com

This enhanced portion of the CTC will be available for single or married filing separate parents with a 2020 tax return AGI adjusted gross income of up to 75000. For the purpose of this credit your modified adjusted gross income MAGI is your AGI plus excluded foreign earned income possession income and foreign housing. Up to 112500 head of household. You andor your spouse owe unpaid taxes or child support filing a joint tax return may result in the IRS offsetting your refund to pay the taxes. 1 Married no children filing separately.

Source: wgntv.com

Source: wgntv.com

For a married couple filing jointly the income cap is 150000. When married filing separately the IRS does not allow you to take many of the credits available to those filing a joint return. For the 2019 tax year this amount is 12200 per person so a married couple filing jointly would have a 24400 standard deduction. This is better than the 12200 deduction for single tas payers or a married person who choose to file separately. This enhanced portion of the CTC will be available for single or married filing separate parents with a 2020 tax return AGI adjusted gross income of up to 75000.

Source: aarp.org

Source: aarp.org

Those filing head of household can have an AGI up to 112500. Separately filing married taxpayers are prohibited from claiming several tax credits including. This is better than the 12200 deduction for single tas payers or a married person who choose to file separately. You may want to file a Married Filing Separately tax return if one or more of the following situations apply to you. Unmarried filers can get a credit of at least 2000 with income of 200000 or less.

Source: marca.com

Source: marca.com

If one of them earns less than 75000 and they file MFS then the lower income spouse will get RRC1 and RRC2 an extra 1800. Credit for the elderly and disabled if they lived with their spouse Child and dependent care credit in most cases. Joint filers are also eligible for several tax credits. The payment for each child or dependent between the age 6 and 17 is 3000. What are the income limits to get the full credit.

Source: fox8.com

Source: fox8.com

It works best if the couple earned over 150000 so received no EIP as MFJ. You can take a reduced credit thats equal to half that of a. 200000 if married filing separately. If your Child Tax Credit is limited because of your tax liability you might be able to claim the additional Child. Following are the tax credits that the IRS offers.

Source: thestreet.com

Source: thestreet.com

Up to 400000 married filing jointly. Following are the tax credits that the IRS offers. What are the income limits to get the full credit. Separately filing married taxpayers are prohibited from claiming several tax credits including. The CTC starts phasing out at an income of 400000 and is no longer available once your income hits 440000.

Source: creditkarma.com

Source: creditkarma.com

The standard deduction for MFJ is set as 24400. What are the income limits to get the full credit. Separately filing married taxpayers are prohibited from claiming several tax credits including. The full credit is available to married couples with children filing jointly with adjusted gross income less than 150000 or 75000 for individuals. Examples of how the Economic Stimulus Act of 2008 may affect taxpayers who are married but file separately with or without children who qualify for the child tax credit payment.

Source: nbc4i.com

Source: nbc4i.com

For this reason many people will look. Up to 150000 married filing jointly. Those filing head of household can have an AGI up to 112500. Joint filers are also eligible for several tax credits. If your Child Tax Credit is limited because of your tax liability you might be able to claim the additional Child.

Source: irs.gov

Source: irs.gov

What are the income limits to get the full credit. When married filing separately the IRS does not allow you to take many of the credits available to those filing a joint return. Separately filing married taxpayers are prohibited from claiming several tax credits including. 2021 child tax credit income limits Like last year married filers can get a child tax credit of at least 2000 with income of 400000 or less. If one of them earns less than 75000 and they file MFS then the lower income spouse will get RRC1 and RRC2 an extra 1800.

Source: cnet.com

Source: cnet.com

The standard deduction for MFJ is set as 24400. This enhanced portion of the CTC will be available for single or married filing separate parents with a 2020 tax return AGI adjusted gross income of up to 75000. Up to 112500 head of household. What are the income limits to get the full credit. For the purpose of this credit your modified adjusted gross income MAGI is your AGI plus excluded foreign earned income possession income and foreign housing.

Source: fox4kc.com

Source: fox4kc.com

Joint filers are also eligible for several tax credits. This enhanced portion of the CTC will be available for single or married filing separate parents with a 2020 tax return AGI adjusted gross income of up to 75000. Both have valid Social Security numbers SSNs Married couple no children. If your Child Tax Credit is limited because of your tax liability you might be able to claim the additional Child. 1 Married no children filing separately.

Source: wreg.com

Source: wreg.com

The enhanced tax credit will phase out for. For the 2019 tax year this amount is 12200 per person so a married couple filing jointly would have a 24400 standard deduction. The full credit will be available to individuals who have children and an adjusted gross income of less than 75000. For a married couple filing jointly the income cap is 150000. This is better than the 12200 deduction for single tas payers or a married person who choose to file separately.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title child tax credit payments married filing separately by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Child tax credit payments bill information

- Child tax credit july 2021 portal information

- Finance of america stock information

- Team usa in olympics information

- Mel gibson christ movie information

- Child tax credit portal down information

- Stephen a smith i dont care gif information

- Usa basketball in olympics information

- Social security yuba city information

- Stephen a smith megan olivi information