Child tax credit how to opt out information

Home » » Child tax credit how to opt out informationYour Child tax credit how to opt out images are ready. Child tax credit how to opt out are a topic that is being searched for and liked by netizens today. You can Download the Child tax credit how to opt out files here. Get all royalty-free photos.

If you’re looking for child tax credit how to opt out images information connected with to the child tax credit how to opt out keyword, you have pay a visit to the right blog. Our website frequently provides you with suggestions for viewing the highest quality video and image content, please kindly surf and find more enlightening video content and images that match your interests.

Child Tax Credit How To Opt Out. It will also feature an option to opt out of receiving multiple payments this. Well issue the first advance payment on July 15 2021. Head to the new Child Tax Credit Update Portaland click the Manage Advance Paymentsbutton. To do so one must access the IRSs online portal enter your personal information and submit.

Irs Child Tax Credit Portal How Can I Use It To Opt Out And What Other Uses Does It Have As Com From en.as.com

Irs Child Tax Credit Portal How Can I Use It To Opt Out And What Other Uses Does It Have As Com From en.as.com

Head to the Child Tax Credit Update Portal and tap the blue button Unenroll from Advance Payments. Enter Payment Info Here tool. To qualify for advance Child Tax Credit payments you and your spouse if you filed a joint return must have. Given us your information in 2020 to receive the Economic Impact Payment using the Non-Filers. By July 1 the IRS will set up an online portal thats designed specifically for the new child tax credit payments. It will also feature an option to opt out of receiving multiple payments this.

Child Tax Credit 2021.

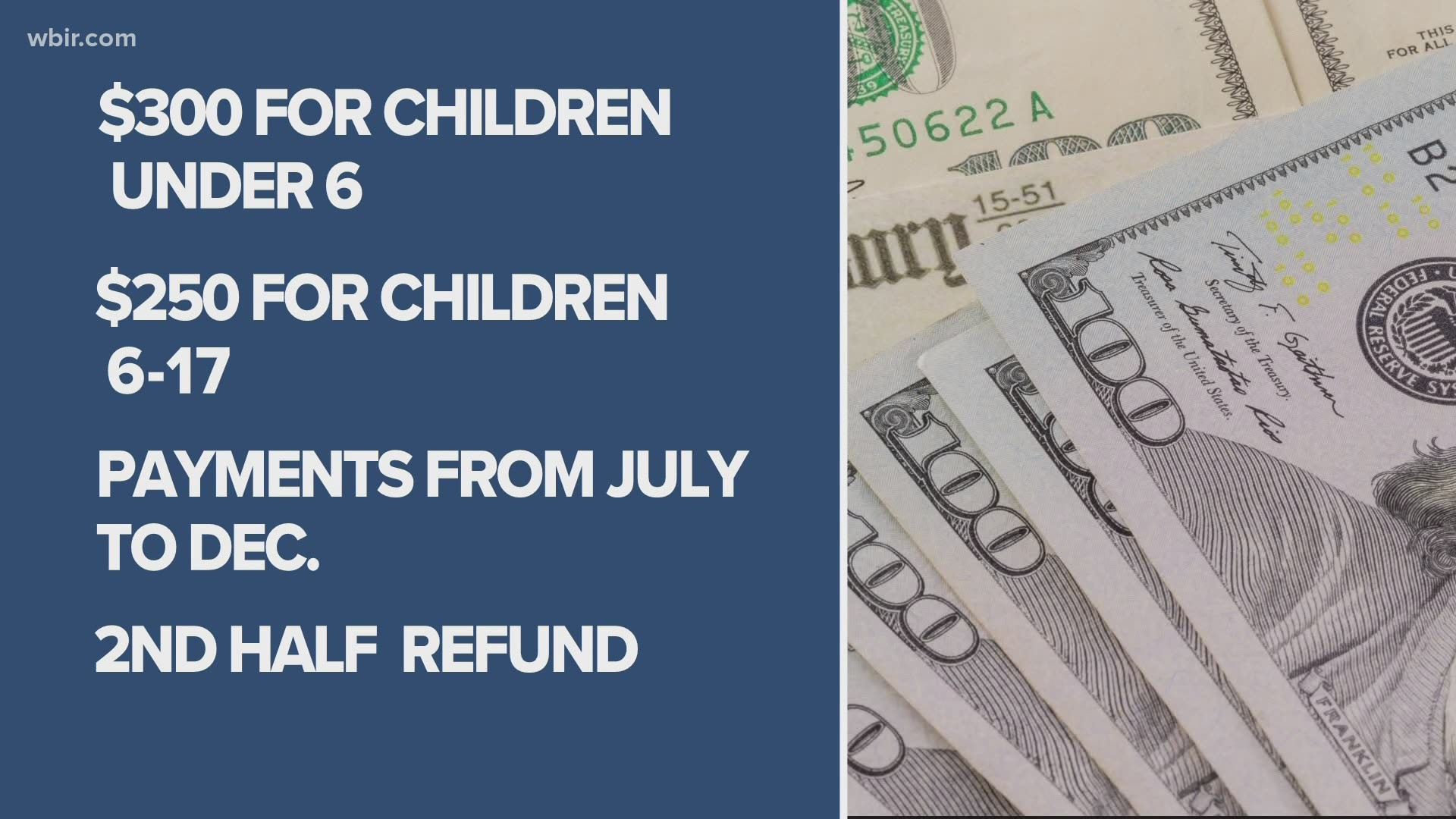

Head to the new Child Tax Credit Update Portaland click the Manage Advance Paymentsbutton. By July 1 the IRS will set up an online portal thats designed specifically for the new child tax credit payments. Opting Out of Monthly Payments The IRS has a new tool for eligible families who want to opt out of the 250 or 300 monthly child tax credit payment. On Tuesday the IRS unveiled a Child Tax Credit Update Portal where you can verify that your family qualifies for the credit and opt out of receiving any payments this year getting it all with. Enter Payment Info Here tool. That means that instead of receiving monthly payments of say 300 for your 4.

Source: ramseysolutions.com

Source: ramseysolutions.com

The process of opting out may take several. Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the return. To do so one must access the IRSs online portal enter your personal information and submit. The portal will be updated later this year to allow people to see their payment history and change their bank account information or. 30003600 child tax credit.

Source: forbes.com

Source: forbes.com

On the next page tap the button marked IDme Create an account. There isnt a penalty to opt-out of the child tax credit. However the credit is meant to be spent soon or next year. On Tuesday the IRS unveiled a Child Tax Credit Update Portal where you can verify that your family qualifies for the credit and opt out of receiving any payments this year getting it all with. Parents who filed taxes in 2019 andor 2020 and meet the income requirements will automatically start receiving advance Child Tax Credit.

Source: abc7news.com

Source: abc7news.com

Now enter your email address. To qualify for advance Child Tax Credit payments you and your spouse if you filed a joint return must have. If you dont make any changes on. The process of opting out may take several. Anyone wishing to opt-out can do so on the IRS website via a tool called the Child Tax Credit Update Portal.

Source: fox4kc.com

Source: fox4kc.com

To qualify for advance Child Tax Credit payments you and your spouse if you filed a joint return must have. That means that instead of receiving monthly payments of say 300 for your 4. The portal will be updated later this year to allow people to see their payment history and change their bank account information or. What You Need To Know. Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the return.

Source: cnet.com

Source: cnet.com

Half the total credit amount will be paid in advance monthly payments and you will claim the other half when you file your 2021 income tax return. The Child Tax Credit Update Portal now lets youopt out of receivingthe monthly child tax credit payments. Head to the new Child Tax Credit Update Portaland click the Manage Advance Paymentsbutton. Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021. Head to the new Child Tax Credit Update Portaland click the Manage Advance Paymentsbutton.

Source: pinterest.com

Source: pinterest.com

What You Need To Know. Well issue the first advance payment on July 15 2021. To qualify for advance Child Tax Credit payments you and your spouse if you filed a joint return must have. Anyone wishing to opt-out can do so on the IRS website via a tool called the Child Tax Credit Update Portal. If you think your income will stay below the threshold for the credit or if.

Source:

Source:

If you think your income will stay below the threshold for the credit or if. Child Tax Credit 2021. Opting Out Of Advance Payments. Well issue the first advance payment on July 15 2021. The Child Tax Credit Update Portal now lets youopt out of receivingthe monthly child tax credit payments.

Source: kgw.com

Source: kgw.com

Head to the new Child Tax Credit Update Portaland click the Manage Advance Paymentsbutton. How to opt out of child tax credit payments 1. How to opt out of child tax credit payments 1. By July 1 the IRS will set up an online portal thats designed specifically for the new child tax credit payments. Opting Out of Monthly Payments The IRS has a new tool for eligible families who want to opt out of the 250 or 300 monthly child tax credit payment.

Source: nymag.com

Source: nymag.com

Child Tax Credit 2021. Now enter your email address. Child Tax Credit 2021. Well issue the first advance payment on July 15 2021. Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the return.

Source: marca.com

Source: marca.com

Parents who filed taxes in 2019 andor 2020 and meet the income requirements will automatically start receiving advance Child Tax Credit. How to opt out of child tax credit payments 1. How to opt out of child tax credit payments 1. The tool allows people to un-enroll from the tax credit before the first payment is made on July 15. Fortunately the process of opting out is very simple.

Source: aarp.org

Source: aarp.org

There isnt a penalty to opt-out of the child tax credit. If you dont make any changes on. Enter Payment Info Here tool. Child Tax Credit 2021. The Advance Child Tax Credit Portal has finally arrived and Im going to walk you through every step.

Source: abc10.com

Source: abc10.com

On the next page tap the button marked IDme Create an account. The Advance Child Tax Credit Portal has finally arrived and Im going to walk you through every step. Opting Out Of Advance Payments. That means that instead of receiving monthly payments of say 300 for your 4. Opting Out of Monthly Payments The IRS has a new tool for eligible families who want to opt out of the 250 or 300 monthly child tax credit payment.

Source: money.com

Source: money.com

Half the total credit amount will be paid in advance monthly payments and you will claim the other half when you file your 2021 income tax return. Fortunately the process of opting out is very simple. Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the return. Given us your information in 2020 to receive the Economic Impact Payment using the Non-Filers. Anyone wishing to opt-out can do so on the IRS website via a tool called the Child Tax Credit Update Portal.

Source: klfy.com

Source: klfy.com

How to opt out of child tax credit payments 1. By July 1 the IRS will set up an online portal thats designed specifically for the new child tax credit payments. The process of opting out may take several. The Child Tax Credit Update Portal now lets youopt out of receivingthe monthly child tax credit payments. There isnt a penalty to opt-out of the child tax credit.

Source: en.as.com

Source: en.as.com

Opting Out of Monthly Payments The IRS has a new tool for eligible families who want to opt out of the 250 or 300 monthly child tax credit payment. If you dont make any changes on. Opting Out of Monthly Payments The IRS has a new tool for eligible families who want to opt out of the 250 or 300 monthly child tax credit payment. How to opt out of child tax credit payments 1. If you have questions about what the Advance Child Tax Credit is and if you qualify check out my prior blog post covering all the details.

Source: cnet.com

Source: cnet.com

On the next page tap the button marked IDme Create an account. Given us your information in 2020 to receive the Economic Impact Payment using the Non-Filers. Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021. To qualify for advance Child Tax Credit payments you and your spouse if you filed a joint return must have. The process of opting out may take several.

Source: cnet.com

Source: cnet.com

Opting Out of Monthly Payments The IRS has a new tool for eligible families who want to opt out of the 250 or 300 monthly child tax credit payment. The Advance Child Tax Credit Portal has finally arrived and Im going to walk you through every step. That means that instead of receiving monthly payments of say 300 for your 4. To do so one must access the IRSs online portal enter your personal information and submit. Head to the new Child Tax Credit Update Portaland click the Manage Advance Paymentsbutton.

Source: cnet.com

Source: cnet.com

However the credit is meant to be spent soon or next year. To qualify for advance Child Tax Credit payments you and your spouse if you filed a joint return must have. To do so one must access the IRSs online portal enter your personal information and submit. Given us your information in 2020 to receive the Economic Impact Payment using the Non-Filers. Enter Payment Info Here tool.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title child tax credit how to opt out by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Child tax credit payments bill information

- Child tax credit july 2021 portal information

- Finance of america stock information

- Team usa in olympics information

- Mel gibson christ movie information

- Child tax credit portal down information

- Stephen a smith i dont care gif information

- Usa basketball in olympics information

- Social security yuba city information

- Stephen a smith megan olivi information