Child tax credit history information

Home » » Child tax credit history informationYour Child tax credit history images are ready in this website. Child tax credit history are a topic that is being searched for and liked by netizens now. You can Download the Child tax credit history files here. Find and Download all free images.

If you’re looking for child tax credit history images information related to the child tax credit history keyword, you have come to the ideal site. Our site frequently gives you suggestions for downloading the maximum quality video and picture content, please kindly surf and find more enlightening video content and images that match your interests.

Child Tax Credit History. The IRS will pay half the total credit amount in advance monthly payments beginning July 15. Over the past 20 years legislative changes have significantly changed the credit transforming it from a generally nonrefundable credit available only to the middle and upper-middle class to a partially refundable credit that more low. Monthly payments will be 250 for older children and 300 for younger ones Previously. In addition to the higher amounts mentioned above children aged 17 are now eligible.

What Non Tax Filing Parents Need To Do To Get Their Child Tax Credit Payments Cnet From cnet.com

What Non Tax Filing Parents Need To Do To Get Their Child Tax Credit Payments Cnet From cnet.com

For parents of eligible children up to age 5 the IRS will pay 3600 half as six monthly payments and half as a. 105-34 to help ease the financial burden that families incur when they have children. UK social security law preserved the right to claim child tax credits from the original date of a claim for asylum in the UK so long as a claim was made within one month of the date of refugee status. Is the Child Tax Credit subject to offsets. The child tax credit math is somewhat involved this time around. You will claim the other half when you file your 2021 income tax return.

Over the past 20 years.

However over the years the tax credit has gone largely unchanged while the cost of child care has risen dramatically. The Child Tax Credit. Historic Child Tax Credit starts in Julyup to 300 per child monthly June 25 2021 942 AM CDT By Marilyn Bechtel. UK social security law preserved the right to claim child tax credits from the original date of a claim for asylum in the UK so long as a claim was made within one month of the date of refugee status. Is the Child Tax Credit subject to offsets. For parents of eligible children up to age 5 the IRS will pay 3600 half as six monthly payments and half as a.

Source:

Source:

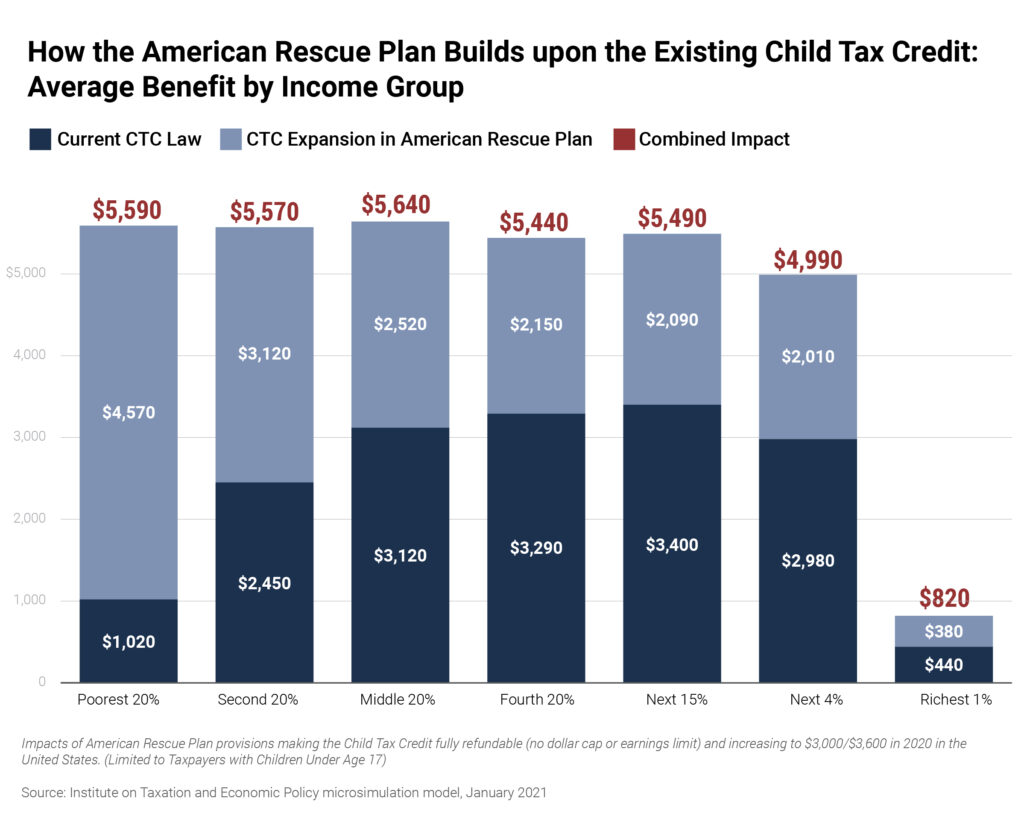

For parents of eligible children up to age 5 the IRS will pay 3600 half as six monthly payments and half as a. Previously the CTC provided 2000 for each qualifying child under the age of 17. For those with children the American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from 2000 to 3600 for children. The child tax credit was created in 1997 by the Taxpayer Relief Act of 1997 PL. You will claim the other half when you file your 2021 income tax return.

Source: taxfoundation.org

Source: taxfoundation.org

The Child Tax Credit. You will claim the other half when you file your 2021 income tax return. Historic Child Tax Credit starts in Julyup to 300 per child monthly June 25 2021 942 AM CDT By Marilyn Bechtel. The IRS will pay half the total credit amount in advance monthly payments beginning July 15. The Child Tax Credit.

Source: cnet.com

Source: cnet.com

Historic Child Tax Credit starts in Julyup to 300 per child monthly June 25 2021 942 AM CDT By Marilyn Bechtel. With the latest COVID-19 relief package Congress expanded the child tax credit increasing the maximum amount a taxpayer could claim from 2000 per child. Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer. For those with children the American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from 2000 to 3600 for children. Historic Child Tax Credit starts in Julyup to 300 per child monthly June 25 2021 942 AM CDT By Marilyn Bechtel.

Source: taxfoundation.org

Source: taxfoundation.org

Like other tax credits the child tax credit reduces tax liability dollar for dollar of the value of the credit. You will claim the other half when you file your 2021 income tax return. The child tax credit was created in 1997 by the Taxpayer Relief Act of 1997 PL. The IRS will pay half the total credit amount in advance monthly payments beginning July 15. The Child Tax Credit.

Source: taxpolicycenter.org

Source: taxpolicycenter.org

However over the years the tax credit has gone largely unchanged while the cost of child care has risen dramatically. These changes apply to tax year 2021 only. 105-34 as a 500-per-child nonrefundable credit to provide tax relief to middle-. You will claim the other half when you file your 2021 income tax return. Over the past 20 years legislative changes have significantly changed the credit transforming it from a generally nonrefundable credit available only to the middle and upper-middle class to a partially refundable credit that more low.

Source: taxpolicycenter.org

Source: taxpolicycenter.org

However over the years the tax credit has gone largely unchanged while the cost of child care has risen dramatically. Historic Child Tax Credit starts in Julyup to 300 per child monthly June 25 2021 942 AM CDT By Marilyn Bechtel. Legislative History Congressional Research Service 1 Introduction The child tax credit was created in 1997 by the Taxpayer Relief Act of 1997 PL. The IRS will pay half the total credit amount in advance monthly payments beginning July 15. You will claim the other half when you file your 2021 income tax return.

Source: fox59.com

Source: fox59.com

You will claim the other half when you file your 2021 income tax return. 105-34 as a 500-per-child nonrefundable credit to provide tax relief to middle-. The child tax credit was initially structured in the Taxpayer Relief Act of 1997 PL. 105-34 to help ease the financial burden that families incur when they have children. 105-34 to help ease the financial burden that families incur when they have children.

Source: cnet.com

Source: cnet.com

Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer. For parents of eligible children up to age 5 the IRS will pay 3600 half as six monthly payments and half as a. Legislative History Congressional Research Service 1 Introduction The child tax credit was created in 1997 by the Taxpayer Relief Act of 1997 PL. Is the Child Tax Credit subject to offsets. The child tax credit was initially structured in the Taxpayer Relief Act of 1997 PL.

Source: taxpolicycenter.org

Source: taxpolicycenter.org

105-34 as a 500-per-child nonrefundable credit to provide tax relief to middle-. Is the Child Tax Credit subject to offsets. In addition to the higher amounts mentioned above children aged 17 are now eligible. The child tax credit was created in 1997 by the Taxpayer Relief Act of 1997 PL. 105-34 to help ease the financial burden that families incur when they have children.

Source: forbes.com

Source: forbes.com

In March 2021 the American Rescue Plan passed and ushered in a historic one-year expansion of the Child Tax Credit CTC that has the power to significantly boost income security reduce child poverty advance racial equity and create a public investment for the good of all children. Legislative History Congressional Research Service 1 Introduction The child tax credit was created in 1997 by the Taxpayer Relief Act of 1997 PL. The IRS will pay half the total credit amount in advance monthly payments beginning July 15. However over the years the tax credit has gone largely unchanged while the cost of child care has risen dramatically. With the latest COVID-19 relief package Congress expanded the child tax credit increasing the maximum amount a taxpayer could claim from 2000 per child.

Source: cnet.com

Source: cnet.com

For parents of eligible children up to age 5 the IRS will pay 3600 half as six monthly payments and half as a. The Child Tax Credit. What was the previous Child Tax Credit worth. The child tax credit was created in 1997 by the Taxpayer Relief Act of 1997 PL. 105-34 to help ease the financial burden that families incur when they have children.

Source: taxpolicycenter.org

Source: taxpolicycenter.org

Like other tax credits the child tax credit reduces tax liability dollar for dollar of the value of the credit. Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer. For those with children the American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from 2000 to 3600 for children. HMRC argued that no such claim could ever be made as it was no longer possible to claim tax credits since the roll out of Universal Credit. These changes apply to tax year 2021 only.

Source: cnet.com

Source: cnet.com

105-34 to help ease the financial burden that families incur when they have children. What was the previous Child Tax Credit worth. The total credit is up to 3600 for each child under age 6 and up to 3000 for each child age 6 to 17. 105-34 to help ease the financial burden that families incur when they have children. Previously the CTC provided 2000 for each qualifying child under the age of 17.

Source: nmvoices.org

Source: nmvoices.org

The child tax credit math is somewhat involved this time around. Over the past 20 years legislative changes have significantly changed the credit transforming it from a generally nonrefundable credit available only to the middle and upper-middle class to a partially refundable credit that more low. These changes apply to tax year 2021 only. For parents of eligible children up to age 5 the IRS will pay 3600 half as six monthly payments and half as a. UK social security law preserved the right to claim child tax credits from the original date of a claim for asylum in the UK so long as a claim was made within one month of the date of refugee status.

Source: itep.org

Source: itep.org

105-34 to help ease the financial burden that families incur when they have children. Monthly payments will be 250 for older children and 300 for younger ones Previously. The child tax credit was created in 1997 by the Taxpayer Relief Act of 1997 PL. However over the years the tax credit has gone largely unchanged while the cost of child care has risen dramatically. 105-34 to help ease the financial burden that families incur when they have children.

Source: npr.org

Source: npr.org

Over the past 20 years. The child tax credit math is somewhat involved this time around. 105-34 as a 500-per-child nonrefundable credit to provide tax relief to middle-. Previously the CTC provided 2000 for each qualifying child under the age of 17. The child tax credit was initially structured in the Taxpayer Relief Act of 1997 PL.

Source: taxpolicycenter.org

Source: taxpolicycenter.org

105-34 to help ease the financial burden that families incur when they have children. The child tax credit math is somewhat involved this time around. 105-34 to help ease the financial burden that families incur when they have children. Historic Child Tax Credit starts in Julyup to 300 per child monthly June 25 2021 942 AM CDT By Marilyn Bechtel. On October 4th 1976 the Child and Dependent Care Tax Credit CDCTC was established to help working families with work-related child care expenses.

Source: cbpp.org

Source: cbpp.org

Is the Child Tax Credit subject to offsets. On October 4th 1976 the Child and Dependent Care Tax Credit CDCTC was established to help working families with work-related child care expenses. Over the past 20 years legislative changes have significantly changed the credit transforming it from a generally nonrefundable credit available only to the middle and upper-middle class to a partially refundable credit that more low. For parents of eligible children up to age 5 the IRS will pay 3600 half as six monthly payments and half as a. Previously the CTC provided 2000 for each qualifying child under the age of 17.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title child tax credit history by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Child tax credit payments bill information

- Child tax credit july 2021 portal information

- Finance of america stock information

- Team usa in olympics information

- Mel gibson christ movie information

- Child tax credit portal down information

- Stephen a smith i dont care gif information

- Usa basketball in olympics information

- Social security yuba city information

- Stephen a smith megan olivi information