Child tax credit 2021 qualifications ssi information

Home » » Child tax credit 2021 qualifications ssi informationYour Child tax credit 2021 qualifications ssi images are available in this site. Child tax credit 2021 qualifications ssi are a topic that is being searched for and liked by netizens today. You can Find and Download the Child tax credit 2021 qualifications ssi files here. Get all free photos and vectors.

If you’re searching for child tax credit 2021 qualifications ssi images information linked to the child tax credit 2021 qualifications ssi topic, you have come to the right site. Our website frequently provides you with hints for seeking the highest quality video and image content, please kindly hunt and find more enlightening video articles and graphics that match your interests.

Child Tax Credit 2021 Qualifications Ssi. If some of your Social Security benefits are taxable you can claim the child tax credit but there is no social security tax credit to claim. But in 2021 the rules are different. Half of the credit may be advanced to families over the next six. The child tax credit reduces the tax you owe so you must have some taxable income to claim the credit.

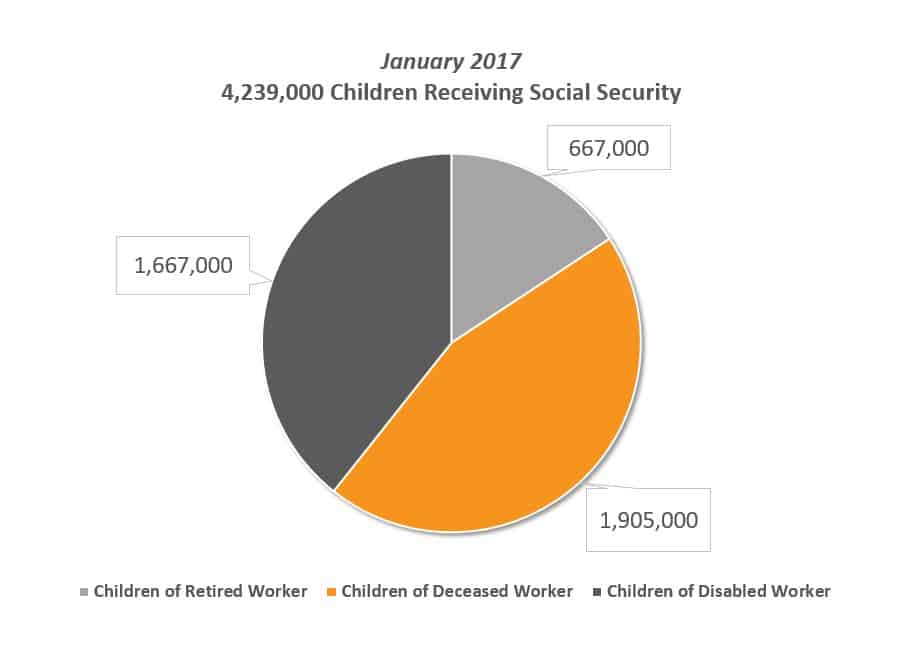

Social Security Benefits For Children The 4 Most Important Things You Should Know Social Security Intelligence From socialsecurityintelligence.com

Social Security Benefits For Children The 4 Most Important Things You Should Know Social Security Intelligence From socialsecurityintelligence.com

Depending on eligibility families with qualifying dependents could receive up to 300 per month for each child under age 6. File a joint return and you and your spouse have a combined income that is. For this year only the child tax credit has increased from 2000 per child to 3000 per child. More than 44000 up to 85 percent of your benefits may be taxable. Typically to qualify for the child tax credit you need at least 2500 of earned income which is basically money you earn by working. But in 2021 the rules are different.

Along with 1400 stimulus checks and enhanced unemployment benefits the package includes updates to the current child tax credit.

Typically to qualify for the child tax credit you need at least 2500 of earned income which is basically money you earn by working. The child tax credit reduces the tax you owe so you must have some taxable income to claim the credit. More than 34000 up to 85 percent of your benefits may be taxable. Child tax credit 2021. When is it released and how much will you get. File a joint return and you and your spouse have a combined income that is.

Source: socialsecurityintelligence.com

Source: socialsecurityintelligence.com

Parents of children under age 6 would be eligible for an even larger 3600 total credit. If some of your Social Security benefits are taxable you can claim the child tax credit but there is no social security tax credit to claim. In 2021 the child tax credit offers up to 3000 per qualifying dependent child 17 or younger on Dec. Those payments will be sent out as an advance on 2021. I f you receive SSI or SSDI benefits you may be wondering when your third stimulus check will arrive if it hasnt already.

Source: krqe.com

Source: krqe.com

If some of your Social Security benefits are taxable you can claim the child tax credit but there is no social security tax credit to claim. Well use information you provided earlier to determine if you qualify and automatically enroll you for advance payments. Half of the credit may be advanced to families over the next six. 15980 21920 married filing jointly with no qualifying children 51464 57414 married filing jointly with three or more qualifying children. You dont need earned income to qualify for the credit.

Source: pinterest.com

Source: pinterest.com

Half of the credit may be advanced to families over the next six. The credit increases to 3600 if the child is under 6 on Dec. In 2021 the child tax credit offers up to 3000 per qualifying dependent child 17 or younger on Dec. 15980 21920 married filing jointly with no qualifying children 51464 57414 married filing jointly with three or more qualifying children. Child tax credit 2021.

Source: socialsecurityintelligence.com

Source: socialsecurityintelligence.com

Well use information you provided earlier to determine if you qualify and automatically enroll you for advance payments. For the 2021 tax year you qualify for the EITC if your annual earned income is less than. Typically to qualify for the child tax credit you need at least 2500 of earned income which is basically money you earn by working. More than 44000 up to 85 percent of your benefits may be taxable. 2021 child tax credit income limits Heads of household earning 112500 or less get the full amount As a head of household your AGI will need to be 112500 or less to qualify for the full child.

Source: wtvq.com

Source: wtvq.com

According to the plan the legislation expands the Child Tax Credit from 2000 per child to 3000 per child for age 6 and above and 3600 per child for children under 6. In 2021 the maximum enhanced child tax credit is 3600 for children younger than age 6 and 3000 for those between 6 and 17. Typically to qualify for the child tax credit you need at least 2500 of earned income which is basically money you earn by working. Between 32000 and 44000 you may have to pay income tax on up to 50 percent of your benefits. More than 34000 up to 85 percent of your benefits may be taxable.

Source: socialsecurityintelligence.com

Source: socialsecurityintelligence.com

The big difference in 2021 is that half of the child tax credit will be paid out via monthly payments of up to 300 per child through the end of the year. More than 44000 up to 85 percent of your benefits may be taxable. In 2021 the child tax credit offers up to 3000 per qualifying dependent child 17 or younger on Dec. Child tax credit 2021. The credit increases to 3600 if the child is under 6 on Dec.

Source: thearcca.org

Source: thearcca.org

Half of the credit may be advanced to families over the next six. According to the plan the legislation expands the Child Tax Credit from 2000 per child to 3000 per child for age 6 and above and 3600 per child for children under 6. But in 2021 the rules are different. Parents of children under age 6 would be eligible for an even larger 3600 total credit. Between 32000 and 44000 you may have to pay income tax on up to 50 percent of your benefits.

Source: fool.com

Source: fool.com

You dont need earned income to qualify for the credit. And Made less than certain income limits. In 2021 the maximum enhanced child tax credit is 3600 for children younger than age 6 and 3000 for those between 6 and 17. 15980 21920 married filing jointly with no qualifying children 51464 57414 married filing jointly with three or more qualifying children. 2021 child tax credit income limits Heads of household earning 112500 or less get the full amount As a head of household your AGI will need to be 112500 or less to qualify for the full child.

Source: marca.com

Source: marca.com

File a joint return and you and your spouse have a combined income that is. Previously the tax credit was 2000 per child under age 17. I f you receive SSI or SSDI benefits you may be wondering when your third stimulus check will arrive if it hasnt already. In 2021 the child tax credit offers up to 3000 per qualifying dependent child 17 or younger on Dec. And Made less than certain income limits.

Source: pinterest.com

Source: pinterest.com

Parents of children under age 6 would be eligible for an even larger 3600 total credit. Those payments will be sent out as an advance on 2021. Parents of children under age 6 would be eligible for an even larger 3600 total credit. Typically to qualify for the child tax credit you need at least 2500 of earned income which is basically money you earn by working. You dont need earned income to qualify for the credit.

Source: in.pinterest.com

Source: in.pinterest.com

Along with 1400 stimulus checks and enhanced unemployment benefits the package includes updates to the current child tax credit. 2021 child tax credit income limits Heads of household earning 112500 or less get the full amount As a head of household your AGI will need to be 112500 or less to qualify for the full child. More than 44000 up to 85 percent of your benefits may be taxable. For this year only the child tax credit has increased from 2000 per child to 3000 per child. The big difference in 2021 is that half of the child tax credit will be paid out via monthly payments of up to 300 per child through the end of the year.

Source: investopedia.com

Source: investopedia.com

And Made less than certain income limits. For the 2021 tax year you qualify for the EITC if your annual earned income is less than. Under current legislation the CTC increased to 3000 per child under 18 and 3600 per child under 6 for the 2021 tax year. Child tax credit 2021. More than 44000 up to 85 percent of your benefits may be taxable.

Source: socialsecurityintelligence.com

Source: socialsecurityintelligence.com

When is it released and how much will you get. Between 32000 and 44000 you may have to pay income tax on up to 50 percent of your benefits. For the 2021 tax year you qualify for the EITC if your annual earned income is less than. When is it released and how much will you get. Previously the tax credit was 2000 per child under age 17.

Source: kb.drakesoftware.com

Source: kb.drakesoftware.com

You do not need to take any additional action to get advance payments. Child tax credit 2021. Those payments will be sent out as an advance on 2021. Between 32000 and 44000 you may have to pay income tax on up to 50 percent of your benefits. Parents of children under age 6 would be eligible for an even larger 3600 total credit.

Source: youtube.com

Source: youtube.com

Half of the credit may be advanced to families over the next six. In the tax year 2021 under the new provisions families are. File a joint return and you and your spouse have a combined income that is. When is it released and how much will you get. Parents of children under age 6 would be eligible for an even larger 3600 total credit.

Source: everycrsreport.com

Source: everycrsreport.com

For the 2021 tax year you qualify for the EITC if your annual earned income is less than. For the 2021 tax year you qualify for the EITC if your annual earned income is less than. Typically to qualify for the child tax credit you need at least 2500 of earned income which is basically money you earn by working. Between 32000 and 44000 you may have to pay income tax on up to 50 percent of your benefits. 2021 child tax credit income limits Heads of household earning 112500 or less get the full amount As a head of household your AGI will need to be 112500 or less to qualify for the full child.

Source: mathislaw.com

Source: mathislaw.com

File a joint return and you and your spouse have a combined income that is. If all your income was nontaxable Social Security you wont have a tax liability to. When is it released and how much will you get. And Made less than certain income limits. In the tax year 2021 under the new provisions families are.

Source: kitces.com

Source: kitces.com

File a joint return and you and your spouse have a combined income that is. Depending on eligibility families with qualifying dependents could receive up to 300 per month for each child under age 6. In the tax year 2021 under the new provisions families are. The IRS has an EITC Assistant tool on its website that you can use to see if you qualify for the credit. The credit increases to 3600 if the child is under 6 on Dec.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title child tax credit 2021 qualifications ssi by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Child tax credit payments bill information

- Child tax credit july 2021 portal information

- Finance of america stock information

- Team usa in olympics information

- Mel gibson christ movie information

- Child tax credit portal down information

- Stephen a smith i dont care gif information

- Usa basketball in olympics information

- Social security yuba city information

- Stephen a smith megan olivi information