Child tax credit 2021 non filers information

Home » » Child tax credit 2021 non filers informationYour Child tax credit 2021 non filers images are ready in this website. Child tax credit 2021 non filers are a topic that is being searched for and liked by netizens now. You can Get the Child tax credit 2021 non filers files here. Find and Download all royalty-free images.

If you’re looking for child tax credit 2021 non filers pictures information linked to the child tax credit 2021 non filers topic, you have pay a visit to the ideal blog. Our website always provides you with suggestions for viewing the highest quality video and image content, please kindly hunt and locate more informative video articles and images that match your interests.

Child Tax Credit 2021 Non Filers. 250 - 300 Monthly Payment. More from Invest in. Filed a 2019 or 2020 tax. To qualify for advance Child Tax Credit payments you and your spouse if you filed a joint return must have.

Non Tax Filers Can Sign Up For Boosted Child Tax Credit Soon Irs Says From fox6now.com

Non Tax Filers Can Sign Up For Boosted Child Tax Credit Soon Irs Says From fox6now.com

More from Invest in. 2021-24 the IRS clarified how individuals who are not otherwise required to file 2020 federal income tax returns can claim advance child tax credit CTC payments as well as stimulus payments ie third-round economic impact payments 2020 recovery rebate credit payments and additional 2020 recovery rebate credit payments. Child Tax Credit Explained. You will claim the other half when you file your 2021 income tax return. How to access the Child Tax Credit non-filers online portal The portal is designed for those who have not filed either a 2019 or 2020 tax return and who have not claimed a. Internal Revenue Service Launches Web Portal for Child Tax Credit Giving Non-filers Four Weeks to Declare Eligibility.

Up to 500 for children aged 18 as well as those aged 19 to 24 who are also full-time students The Child Tax Credit will also be fully refundable this year which means that a family with one.

2021 child tax credit age brackets Ages 5 and younger Up to 3600 each child with half of credit as 300 monthly payments. In 2021 the maximum enhanced child tax credit is 3600 for children younger than age 6 and 3000 for those between 6 and 17. June 15 2021. The new credit increases the. Eligible recipients of the child tax credit are single parents with. 2021 child tax credit age brackets Ages 5 and younger Up to 3600 each child with half of credit as 300 monthly payments.

Source: mlive.com

Source: mlive.com

Internal Revenue Service Launches Web Portal for Child Tax Credit Giving Non-filers Four Weeks to Declare Eligibility. Internal Revenue Service Launches Web Portal for Child Tax Credit. 2021 child tax credit age brackets Ages 5 and younger Up to 3600 each child with half of credit as 300 monthly payments. For a full schedule of payments see When will the IRS begin issuing the advance Child Tax Credit. The IRS will pay half the total credit amount in advance monthly payments.

Source: fool.com

Source: fool.com

You will claim the other half when you file your 2021 income tax return. If that family would rather receive the entire expanded credit on their 2021 tax return the IRS would then credit the family for 9000 on next years returns and they will not receive a monthly. Up to 500 for children aged 18 as well as those aged 19 to 24 who are also full-time students The Child Tax Credit will also be fully refundable this year which means that a family with one. Child Tax Credit Update. 250 - 300 Monthly Payment.

Source: pinterest.com

Source: pinterest.com

The new credit increases the. The child tax credit was enhanced by the American Rescue Plan signed into law by President Joe Biden in March. How much you get per child. The new credit increases the. It is not too late to sign up for Child Tax Credit payments.

Source:

In 2021 the maximum enhanced child tax credit is 3600 for children younger than age 6 and 3000 for those between 6 and 17. You will claim the other half when you file your 2021 income tax return. You will claim the other half when you file your 2021 income tax return. It is not too late to sign up for Child Tax Credit payments. To qualify for advance Child Tax Credit payments you and your spouse if you filed a joint return must have.

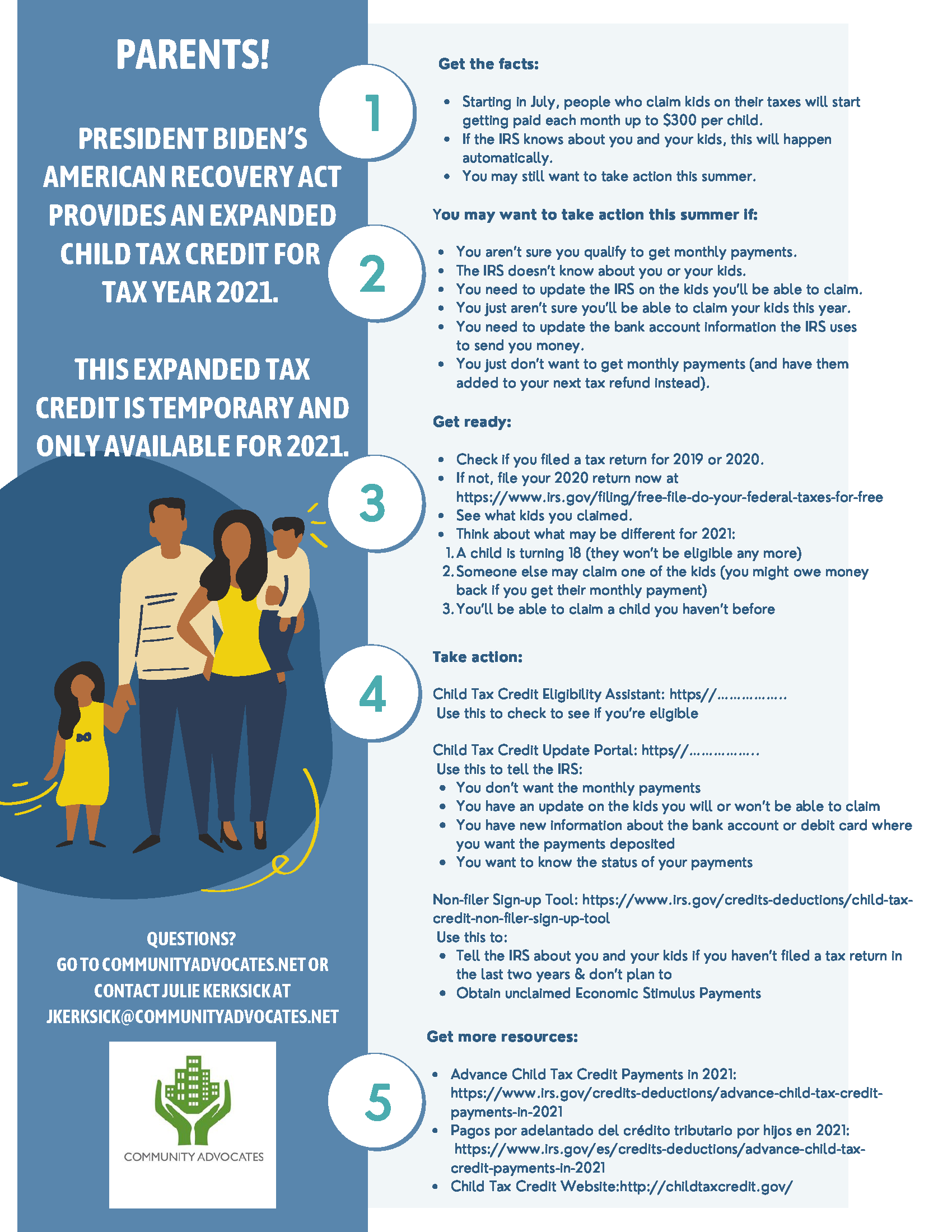

Source: communityadvocates.net

Source: communityadvocates.net

2021 child tax credit age brackets Ages 5 and younger Up to 3600 each child with half of credit as 300 monthly payments. How much you get per child. Internal Revenue Service Launches Web Portal for Child Tax Credit. You will claim the other half when you file your 2021 income tax return. Filed a 2019 or 2020 tax.

Source: pinterest.com

Source: pinterest.com

Most families are already signed up. 2021 child tax credit age brackets Ages 5 and younger Up to 3600 each child with half of credit as 300 monthly payments. How much you get per child. The new credit increases the. If that family would rather receive the entire expanded credit on their 2021 tax return the IRS would then credit the family for 9000 on next years returns and they will not receive a monthly.

Source: pinterest.com

Source: pinterest.com

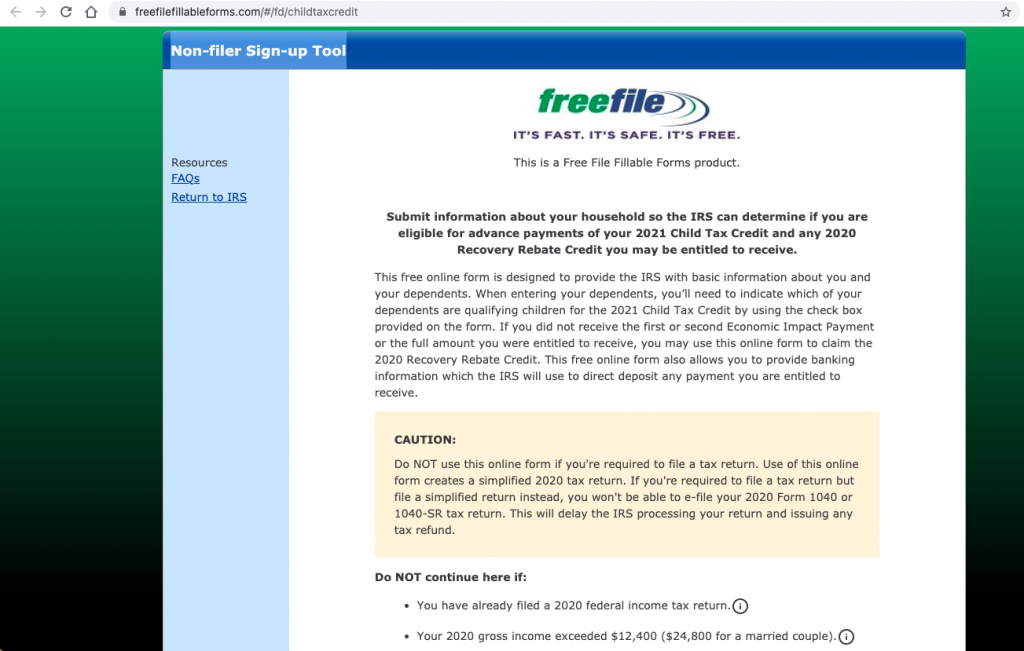

This week the IRS launched its Non-filer Sign-up Tool for households that are eligible for the newly expanded Child Tax Credit CTC but do not typically file taxes because their income is too low. You will claim the other half when you file your 2021 income tax return. 250 - 300 Monthly Payment. Well make the first advance payment on July 15 2021. In 2021 the maximum enhanced child tax credit is 3600 for children younger than age 6 and 3000 for those between 6 and 17.

Source: in.pinterest.com

Source: in.pinterest.com

This week the IRS launched its Non-filer Sign-up Tool for households that are eligible for the newly expanded Child Tax Credit CTC but do not typically file taxes because their income is too low. How much you get per child. These changes apply to tax year 2021 only. 2021-24 the IRS clarified how individuals who are not otherwise required to file 2020 federal income tax returns can claim advance child tax credit CTC payments as well as stimulus payments ie third-round economic impact payments 2020 recovery rebate credit payments and additional 2020 recovery rebate credit payments. Child Tax Credit Explained.

Source: peoplespolicyproject.org

Source: peoplespolicyproject.org

To qualify for advance Child Tax Credit payments you and your spouse if you filed a joint return must have. It is not too late to sign up for Child Tax Credit payments. The Internal Revenue Service announced the. If youve filed tax returns for 2019 or 2020 or if you signed up with the Non-Filer tool last year. 7 rows The child tax credit payments are advances on next years tax refund for.

Source: en.as.com

Source: en.as.com

Filed a 2019 or 2020 tax. Filed a 2019 or 2020 tax. This week the IRS launched its Non-filer Sign-up Tool for households that are eligible for the newly expanded Child Tax Credit CTC but do not typically file taxes because their income is too low. You will claim the other half when you file your 2021 income tax return. The Internal Revenue Service announced the.

Source: pinterest.com

Source: pinterest.com

How to access the Child Tax Credit non-filers online portal The portal is designed for those who have not filed either a 2019 or 2020 tax return and who have not claimed a. The Internal Revenue Service announced the. June 15 2021. The 1 month deadline for these families to learn about this benefit then stand up and be counted in time is worrying to say the least. Child Tax Credit Update.

Source: fox6now.com

Source: fox6now.com

How much you get per child. More from Invest in. 7 rows The child tax credit payments are advances on next years tax refund for. Internal Revenue Service Launches Web Portal for Child Tax Credit. 2021 child tax credit age brackets Ages 5 and younger Up to 3600 each child with half of credit as 300 monthly payments.

Source: taxpayeradvocate.irs.gov

Source: taxpayeradvocate.irs.gov

250 - 300 Monthly Payment. 7 rows The child tax credit payments are advances on next years tax refund for. In 2021 the maximum enhanced child tax credit is 3600 for children younger than age 6 and 3000 for those between 6 and 17. 2021-24 the IRS clarified how individuals who are not otherwise required to file 2020 federal income tax returns can claim advance child tax credit CTC payments as well as stimulus payments ie third-round economic impact payments 2020 recovery rebate credit payments and additional 2020 recovery rebate credit payments. Instead parents could simply claim the credit next year on a 2021 tax return but this will delay receiving the major tax break.

Source: pinterest.com

Source: pinterest.com

You will claim the other half when you file your 2021 income tax return. Up to 500 for children aged 18 as well as those aged 19 to 24 who are also full-time students The Child Tax Credit will also be fully refundable this year which means that a family with one. Internal Revenue Service Launches Web Portal for Child Tax Credit. Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021. 250 - 300 Monthly Payment.

Source: pinterest.com

Source: pinterest.com

Most families are already signed up. Eligible recipients of the child tax credit are single parents with. These changes apply to tax year 2021 only. June 15 2021. Filed a 2019 or 2020 tax.

Source: cnet.com

Source: cnet.com

Most families are already signed up. More from Invest in. Child Tax Credit Update. For a full schedule of payments see When will the IRS begin issuing the advance Child Tax Credit. Most families are already signed up.

Source: technohoop.com

Source: technohoop.com

The IRS will pay half the total credit amount in advance monthly payments. Paul E Williams June 18 2021. 2021-24 the IRS clarified how individuals who are not otherwise required to file 2020 federal income tax returns can claim advance child tax credit CTC payments as well as stimulus payments ie third-round economic impact payments 2020 recovery rebate credit payments and additional 2020 recovery rebate credit payments. Child Tax Credit Update. To qualify for advance Child Tax Credit payments you and your spouse if you filed a joint return must have.

Source:

Source:

June 15 2021. 2021 child tax credit age brackets Ages 5 and younger Up to 3600 each child with half of credit as 300 monthly payments. June 15 2021. Most families are already signed up. 2021 child tax credit age brackets Ages 5 and younger Up to 3600 each child with half of credit as 300 monthly payments.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title child tax credit 2021 non filers by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Child tax credit payments bill information

- Child tax credit july 2021 portal information

- Finance of america stock information

- Team usa in olympics information

- Mel gibson christ movie information

- Child tax credit portal down information

- Stephen a smith i dont care gif information

- Usa basketball in olympics information

- Social security yuba city information

- Stephen a smith megan olivi information