Child tax credit 2021 july 15th information

Home » » Child tax credit 2021 july 15th informationYour Child tax credit 2021 july 15th images are available. Child tax credit 2021 july 15th are a topic that is being searched for and liked by netizens today. You can Download the Child tax credit 2021 july 15th files here. Find and Download all free images.

If you’re searching for child tax credit 2021 july 15th images information linked to the child tax credit 2021 july 15th keyword, you have pay a visit to the right site. Our website always provides you with hints for seeking the maximum quality video and image content, please kindly hunt and locate more informative video content and graphics that match your interests.

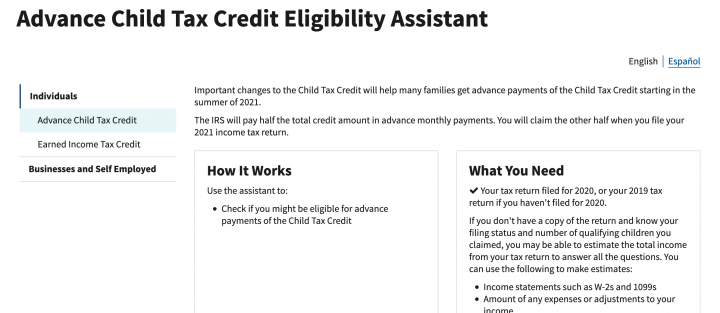

Child Tax Credit 2021 July 15th. Starting July 15 parents will be eligible to receive a new monthly payment for each child thanks to a new federal law. How to prepare with the eligibility assistant With payments for the Child Tax Credit beginning on 15 July the IRS. Called an advanced child tax credit the monthly payments are connected to. You will claim the other half when you file your 2021 income tax return.

8 rows Children born in 2021 make you eligible for the 2021 tax credit of 3600 per. Subsequent payments will be made on the 15th of each month in 2021 unless the 15th falls on. Most of the payments will be made automatically on the 15th. The legislation increased the maximum child tax credit in 2021 from 2000 to 3600 for children under 6 and 3000 for children 6 and up. Families with children under the age of 6 will get a tax credit of 3600 per child while the tax credit for children between the ages of 6 and 17 will be 3000 the White House said in a. In previous years parents would claim their children.

Child Tax Credit 2021 on July 15th.

The IRS will pay half the total credit amount in advance monthly payments beginning July 15. Child Tax Credit 2021 on July 15th. You will claim the other half when you file your 2021 income tax return. Families with children under the age of 6 will get a tax credit of 3600 per child while the tax credit for children between the ages of 6 and 17 will be 3000 the White House said in a. The newly expanded amount raises that to 3000 per child age 6 and older and to 3600 for children younger than age 6. How to prepare with the eligibility assistant With payments for the Child Tax Credit beginning on 15 July the IRS.

Source: texasnewstoday.com

Source: texasnewstoday.com

The child tax credit is also fully refundable which means taxpayers can receive the entire credit even if they dont have earned income or dont owe any income taxes. It also made the credit. New parents of 2021 babies can still get monthly child tax credit payments starting July 15. Most of the payments will be made automatically on the 15th. New monthly payments worth up to 300 from the enhanced child tax credit are set to begin on July 15 and will go to about 39 million households.

Source:

Source:

Families with children under the age of 6 will get a tax credit of 3600 per child while the tax credit for children between the ages of 6 and 17 will be 3000 the White House said in a. How to prepare with the eligibility assistant With payments for the Child Tax Credit beginning on 15 July the IRS. In previous years parents would claim their children. Starting July 15 parents will be eligible to receive a new monthly payment for each child thanks to a new federal law. The newly expanded amount raises that to 3000 per child age 6 and older and to 3600 for children younger than age 6.

Source: cnet.com

Source: cnet.com

New monthly payments worth up to 300 from the enhanced child tax credit are set to begin on July 15 and will go to about 39 million households. Families with children under the age of 6 will get a tax credit of 3600 per child while the tax credit for children between the ages of 6 and 17 will be 3000 the White House said in a. These changes apply to tax year 2021 only. The families of more than 65 million children will start receiving enhanced child tax credit monthly payments of up to 300 on July 15 the Biden administration announced Monday. Called an advanced child tax credit the monthly payments are connected to.

Source: cnet.com

Source: cnet.com

On July 15 there will be payments made to families on a monthly basis even those who have had a new-born child in the year 2021. In previous years parents would claim their children. Most of the payments will be made automatically on the 15th. Families with children under the age of 6 will get a tax credit of 3600 per child while the tax credit for children between the ages of 6 and 17 will be 3000 the White House said in a. The IRS has the first payment scheduled for July 15.

The IRS will pay half the total credit amount in advance monthly payments beginning July 15. Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer. It also made the credit. The families of more than 65 million children will start receiving enhanced child tax credit monthly payments of up to 300 on July 15 the Biden administration announced Monday. 8 rows Children born in 2021 make you eligible for the 2021 tax credit of 3600 per.

Source: time.com

Source: time.com

The Internal Revenue Service IRS launched a new tool ahead of the July 15 child tax credit payment that allows families to check and update. New monthly payments worth up to 300 from the enhanced child tax credit are set to begin on July 15 and will go to about 39 million households. The IRS will pay half the total credit amount in advance monthly payments beginning July 15. Families with children under the age of 6 will get a tax credit of 3600 per child while the tax credit for children between the ages of 6 and 17 will be 3000 the White House said in a. The newly expanded amount raises that to 3000 per child age 6 and older and to 3600 for children younger than age 6.

Source: time.com

Source: time.com

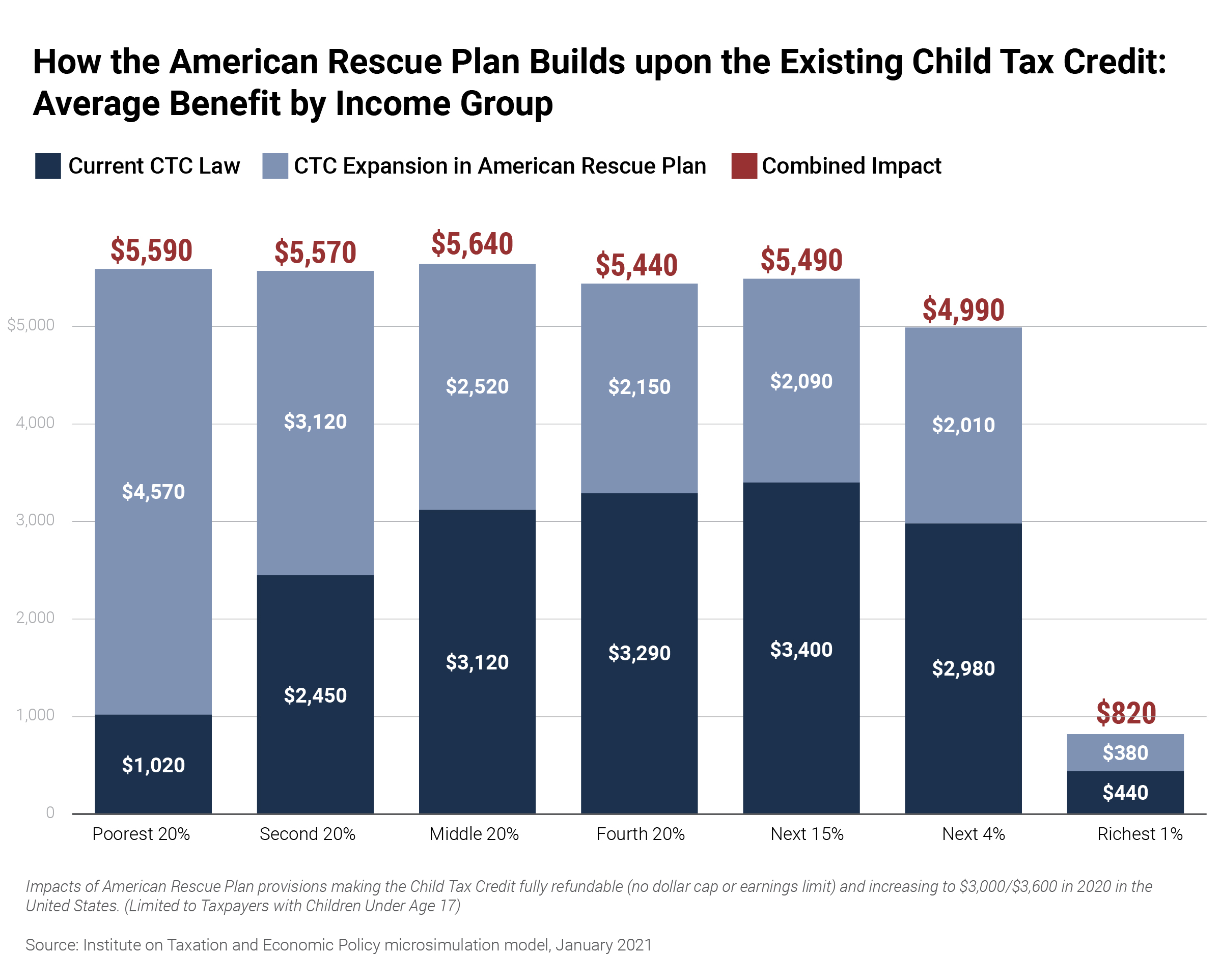

Under the ARPAwhich also provided for the checks to be sent out ahead of timethe payments were increased to 3000 per year for children aged six or. Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer. Families with children under the age of 6 will get a tax credit of 3600 per child while the tax credit for children between the ages of 6 and 17 will be 3000 the White House said in a. The IRS has the first payment scheduled for July 15. Called an advanced child tax credit the monthly payments are connected to.

Source: wfla.com

Source: wfla.com

How to prepare with the eligibility assistant With payments for the Child Tax Credit beginning on 15 July the IRS. Under the ARPAwhich also provided for the checks to be sent out ahead of timethe payments were increased to 3000 per year for children aged six or. On July 15 there will be payments made to families on a monthly basis even those who have had a new-born child in the year 2021. Subsequent payments will be made on the 15th of each month in 2021 unless the 15th falls on. In previous years parents would claim their children.

Under the ARPAwhich also provided for the checks to be sent out ahead of timethe payments were increased to 3000 per year for children aged six or. The legislation increased the maximum child tax credit in 2021 from 2000 to 3600 for children under 6 and 3000 for children 6 and up. How to prepare with the eligibility assistant With payments for the Child Tax Credit beginning on 15 July the IRS. In previous years parents would claim their children. The IRS will pay half the total credit amount in advance monthly payments beginning July 15.

Source: finance.yahoo.com

Source: finance.yahoo.com

Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer. Most of the payments will be made automatically on the 15th. How to prepare with the eligibility assistant With payments for the Child Tax Credit beginning on 15 July the IRS. In previous years parents would claim their children. These changes apply to tax year 2021 only.

How to prepare with the eligibility assistant With payments for the Child Tax Credit beginning on 15 July the IRS. The Internal Revenue Service IRS launched a new tool ahead of the July 15 child tax credit payment that allows families to check and update. Families with children under the age of 6 will get a tax credit of 3600 per child while the tax credit for children between the ages of 6 and 17 will be 3000 the White House said in a. Child Tax Credit 2021 on July 15th. Most of the payments will be made automatically on the 15th.

Source:

Source:

Families with children under the age of 6 will get a tax credit of 3600 per child while the tax credit for children between the ages of 6 and 17 will be 3000 the White House said in a. New monthly payments worth up to 300 from the enhanced child tax credit are set to begin on July 15 and will go to about 39 million households. New parents of 2021 babies can still get monthly child tax credit payments starting July 15. Families with children under the age of 6 will get a tax credit of 3600 per child while the tax credit for children between the ages of 6 and 17 will be 3000 the White House said in a. Under the ARPAwhich also provided for the checks to be sent out ahead of timethe payments were increased to 3000 per year for children aged six or.

Source: businessinsider.com

The child tax credit is also fully refundable which means taxpayers can receive the entire credit even if they dont have earned income or dont owe any income taxes. Child Tax Credit 2021 on July 15th. In previous years parents would claim their children. The child tax credit is also fully refundable which means taxpayers can receive the entire credit even if they dont have earned income or dont owe any income taxes. Called an advanced child tax credit the monthly payments are connected to.

Source: itep.org

Source: itep.org

The Internal Revenue Service IRS launched a new tool ahead of the July 15 child tax credit payment that allows families to check and update. The IRS has confirmed that from 15 July they will begin automatically distributing the new Child Tax Credit monthly payments worth up to 300 per child. Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer. Under the ARPAwhich also provided for the checks to be sent out ahead of timethe payments were increased to 3000 per year for children aged six or. These changes apply to tax year 2021 only.

Source: cnbc.com

Source: cnbc.com

Called an advanced child tax credit the monthly payments are connected to. The newly expanded amount raises that to 3000 per child age 6 and older and to 3600 for children younger than age 6. Starting July 15 parents will be eligible to receive a new monthly payment for each child thanks to a new federal law. You will claim the other half when you file your 2021 income tax return. The IRS will pay half the total credit amount in advance monthly payments beginning July 15.

Source:

Source:

The legislation increased the maximum child tax credit in 2021 from 2000 to 3600 for children under 6 and 3000 for children 6 and up. Called an advanced child tax credit the monthly payments are connected to. The legislation increased the maximum child tax credit in 2021 from 2000 to 3600 for children under 6 and 3000 for children 6 and up. These changes apply to tax year 2021 only. Families with children under the age of 6 will get a tax credit of 3600 per child while the tax credit for children between the ages of 6 and 17 will be 3000 the White House said in a.

Source: cnet.com

Source: cnet.com

It also made the credit. Most of the payments will be made automatically on the 15th. How to prepare with the eligibility assistant With payments for the Child Tax Credit beginning on 15 July the IRS. The IRS will pay half the total credit amount in advance monthly payments beginning July 15. Under the ARPAwhich also provided for the checks to be sent out ahead of timethe payments were increased to 3000 per year for children aged six or.

Source: kvoa.com

Source: kvoa.com

How to prepare with the eligibility assistant With payments for the Child Tax Credit beginning on 15 July the IRS. New monthly payments worth up to 300 from the enhanced child tax credit are set to begin on July 15 and will go to about 39 million households. The child tax credit is also fully refundable which means taxpayers can receive the entire credit even if they dont have earned income or dont owe any income taxes. The legislation increased the maximum child tax credit in 2021 from 2000 to 3600 for children under 6 and 3000 for children 6 and up. On July 15 there will be payments made to families on a monthly basis even those who have had a new-born child in the year 2021.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title child tax credit 2021 july 15th by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Child tax credit payments bill information

- Child tax credit july 2021 portal information

- Finance of america stock information

- Team usa in olympics information

- Mel gibson christ movie information

- Child tax credit portal down information

- Stephen a smith i dont care gif information

- Usa basketball in olympics information

- Social security yuba city information

- Stephen a smith megan olivi information