Child tax credit 2021 california information

Home » » Child tax credit 2021 california informationYour Child tax credit 2021 california images are ready. Child tax credit 2021 california are a topic that is being searched for and liked by netizens now. You can Get the Child tax credit 2021 california files here. Download all free photos.

If you’re looking for child tax credit 2021 california images information connected with to the child tax credit 2021 california topic, you have come to the right blog. Our website always provides you with suggestions for downloading the highest quality video and image content, please kindly surf and locate more enlightening video articles and images that match your interests.

Child Tax Credit 2021 California. You will claim the other half when you file your 2021 income tax return. Currently the new tax credit. Children of undocumented parents can also qualify for child tax credits under two requirementsChildren must have a Social Security number issued before May 17 2021 and undocumented parents or guardians Individual taxpayer identification number Or ITIN. In 2021 the maximum enhanced child tax credit is 3600 for children younger than age 6 and 3000 for those between 6 and 17.

Tax Day Are Taxes Due Today 12 Tips For Last Minute Filers From usatoday.com

Tax Day Are Taxes Due Today 12 Tips For Last Minute Filers From usatoday.com

Children born in 2021 make you eligible for the 2021 tax credit of 3600 per child. Thats up to 7200 for twins This is on top of payments for any other qualified child dependents you claim. FAQs that may affect your child support payments are below. In previous years parents would claim their children. 2021 Child Tax Credit Advance Payments June 16 2021. You will claim the other half when you file your 2021 income tax return.

2021 Child Tax Credit Advance Payments June 16 2021.

The full credit amount is 3000 per child age six through 17 and 3600 per child under six. Eligible families will receive the credit as a monthly payment from the IRS. In previous years parents would claim their children. This tax credit amount has increased from 2000 for all children to 3600 for children under the age of 6 and 3000 for children between the ages of 6 and 17. The Young Child Tax Credit was introduced in tax year 2019. FAQs that may affect your child support payments are below.

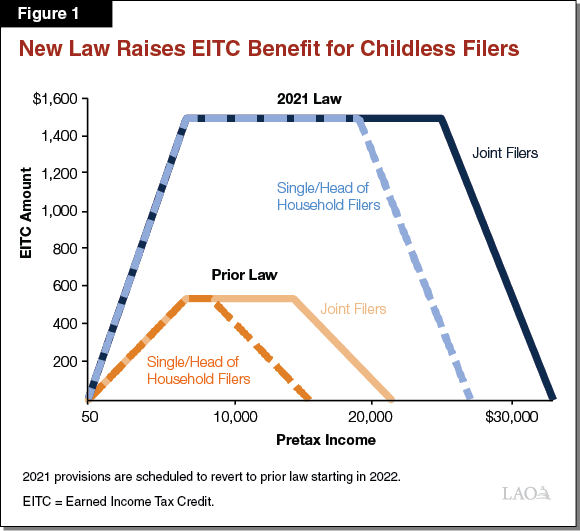

Source: lao.ca.gov

Source: lao.ca.gov

Starting July 15 they. The Personal Income Tax Law allows various credits against the taxes imposed by that law including a young child tax credit and a credit in modified conformity with federal law for dependent care services. Children who are adopted can also qualify if theyre US. Aside from having children who are 17 or younger as of December 31 2021. In previous years parents would claim their children.

Source: newyork.cbslocal.com

Source: newyork.cbslocal.com

You will claim the other half when you file your 2021 income tax return. Starting July 15 they. Half the total credit amount will be paid in advance monthly payments and you will claim the other half when you file your 2021 income tax return. - Child Tax Credit payments will begin on 15 July providing support for 39 million eligible families Full details - US unemployment rate leads to increased calls for fourth stimulus check. Child tax credit.

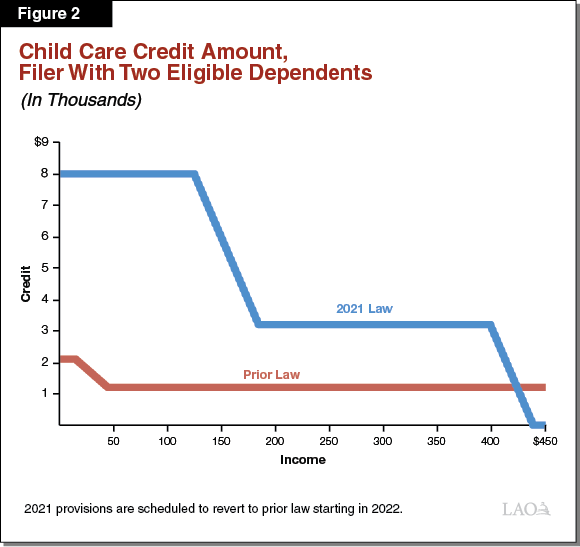

Source: lao.ca.gov

Source: lao.ca.gov

This tax credit amount has increased from 2000 for all children to 3600 for children under the age of 6 and 3000 for children between the ages of 6 and 17. 2021 Child Tax Credit Advance Payments June 16 2021. Monthly 300 payments are in the works for California families struggling to make ends meet. The income thresholds for the full credit amounts are. In previous years parents would claim their children.

Source:

Source:

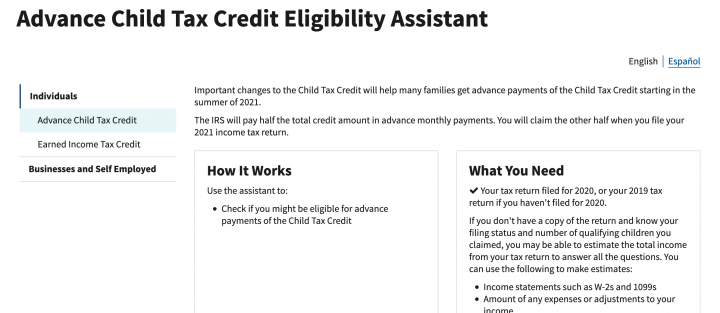

Filed a 2019 or 2020 tax return and claimed the Child Tax Credit. Thats up to 7200 for twins This is on top of payments for any other qualified child dependents you claim. Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021. If you have a baby in 2021 your newborn will count toward the child tax credit payment of 3600. - Child Tax Credit payments will begin on 15 July providing support for 39 million eligible families Full details - US unemployment rate leads to increased calls for fourth stimulus check.

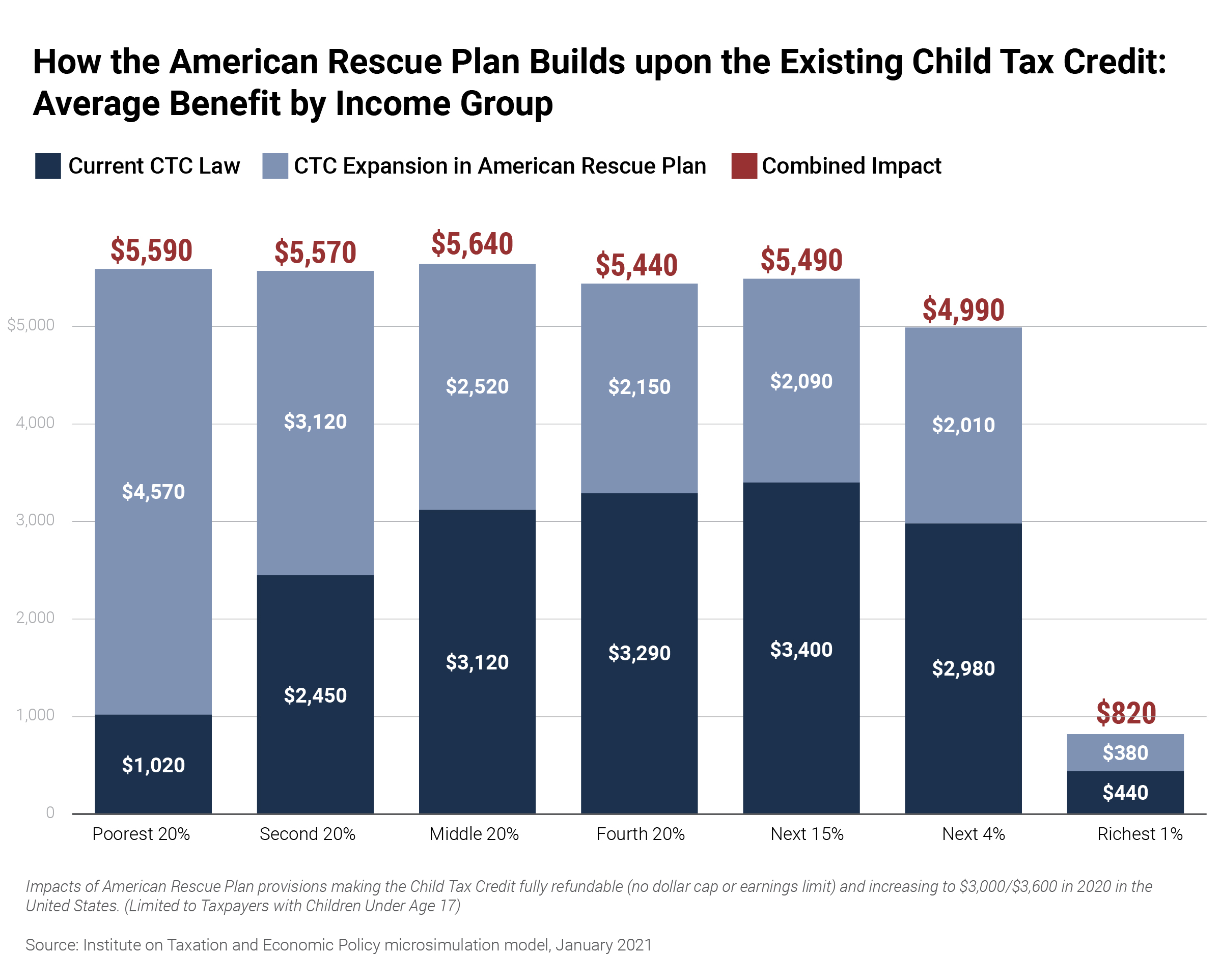

Source: itep.org

Source: itep.org

But in 2021 and the returns people will file next year qualifying parents will be able to get a credit of up to 3000 for children to 17 and 3600 for those 5 and under. On July 15 there will be payments made to families on a monthly basis even those who have had a new-born child in the year 2021. In previous years parents would claim their children. The Young Child Tax Credit was introduced in tax year 2019. Children of undocumented parents can also qualify for child tax credits under two requirementsChildren must have a Social Security number issued before May 17 2021 and undocumented parents or guardians Individual taxpayer identification number Or ITIN.

Source: aarp.org

Source: aarp.org

The new Child Tax Credit provides families with up to 300 per month for young children and up to 250 per month for kids ages six through 17 for the 2021 tax year. Monthly 300 payments are in the works for California families struggling to make ends meet. The Young Child Tax Credit was introduced in tax year 2019. But in 2021 and the returns people will file next year qualifying parents will be able to get a credit of up to 3000 for children to 17 and 3600 for those 5 and under. 2021 Child Tax Credit Advance Payments June 16 2021.

Source: cnet.com

Source: cnet.com

The American Rescue Plan Act of 2021 expands the Child Tax credit for tax year 2021 only. For a full schedule of payments see If Im eligible to. FAQs that may affect your child support payments are below. On July 15 there will be payments made to families on a monthly basis even those who have had a new-born child in the year 2021. Children of undocumented parents can also qualify for child tax credits under two requirementsChildren must have a Social Security number issued before May 17 2021 and undocumented parents or guardians Individual taxpayer identification number Or ITIN.

Source: ktla.com

Source: ktla.com

To qualify for advance Child Tax Credit payments you and your spouse if you filed a joint return must have. The IRS announced important changes to the Child Tax Credit that will help many families receive advance payments. Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021. For a full schedule of payments see If Im eligible to. - Child Tax Credit payments will begin on 15 July providing support for 39 million eligible families Full details - US unemployment rate leads to increased calls for fourth stimulus check.

Source: usatoday.com

Source: usatoday.com

Currently the new tax credit. These changes apply to tax year 2021 only. The full credit amount is 3000 per child age six through 17 and 3600 per child under six. Half the total credit amount will be paid in advance monthly payments and you will claim the other half when you file your 2021 income tax return. The new Child Tax Credit provides families with up to 300 per month for young children and up to 250 per month for kids ages six through 17 for the 2021 tax year.

Source: freshbooks.com

Source: freshbooks.com

Filed a 2019 or 2020 tax return and claimed the Child Tax Credit. If you qualify for CalEITC and have a child under the age of 6 as of the end of the tax year you may qualify for up to 1000 through this credit. On July 15 there will be payments made to families on a monthly basis even those who have had a new-born child in the year 2021. The full credit amount is 3000 per child age six through 17 and 3600 per child under six. The income thresholds for the full credit amounts are.

Source: marca.com

Source: marca.com

These changes apply to tax year 2021 only. Thats up to 7200 for twins This is on top of payments for any other qualified child dependents you claim. The IRS begins the roll-out of the Child Tax Credit on July 15 as part of the American Rescue Plan. But in 2021 and the returns people will file next year qualifying parents will be able to get a credit of up to 3000 for children to 17 and 3600 for those 5 and under. Children of undocumented parents can also qualify for child tax credits under two requirementsChildren must have a Social Security number issued before May 17 2021 and undocumented parents or guardians Individual taxpayer identification number Or ITIN.

Source: investopedia.com

Source: investopedia.com

This tax credit amount has increased from 2000 for all children to 3600 for children under the age of 6 and 3000 for children between the ages of 6 and 17. Eligible families will receive the credit as a monthly payment from the IRS. Previously the credit had excluded children who had turned 17 and was limited to 2000 per child. To qualify for advance Child Tax Credit payments you and your spouse if you filed a joint return must have. You will claim the other half when you file your 2021 income tax return.

Source:

Source:

The new Child Tax Credit provides families with up to 300 per month for young children and up to 250 per month for kids ages six through 17 for the 2021 tax year. Thats up to 7200 for twins This is on top of payments for any other qualified child dependents you claim. - Child Tax Credit payments will begin on 15 July providing support for 39 million eligible families Full details - US unemployment rate leads to increased calls for fourth stimulus check. 2021 Child Tax Credit Advance Payments June 16 2021. Aside from having children who are 17 or younger as of December 31 2021.

Source: 6abc.com

Source: 6abc.com

To qualify for advance Child Tax Credit payments you and your spouse if you filed a joint return must have. In previous years parents would claim their children. Currently the new tax credit. These changes apply to tax year 2021 only. The Personal Income Tax Law allows various credits against the taxes imposed by that law including a young child tax credit and a credit in modified conformity with federal law for dependent care services.

Source: cbs42.com

Source: cbs42.com

Filed a 2019 or 2020 tax return and claimed the Child Tax Credit. But in 2021 and the returns people will file next year qualifying parents will be able to get a credit of up to 3000 for children to 17 and 3600 for those 5 and under. Starting July 15 they. This bill would state the intent of the Legislature to enact legislation that would conform to President Bidens proposal. Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021.

Source: forbes.com

Source: forbes.com

The Young Child Tax Credit was introduced in tax year 2019. Monthly 300 payments are in the works for California families struggling to make ends meet. The Young Child Tax Credit was introduced in tax year 2019. On July 15 there will be payments made to families on a monthly basis even those who have had a new-born child in the year 2021. Children born in 2021 make you eligible for the 2021 tax credit of 3600 per child.

Source: electrek.co

Source: electrek.co

The income thresholds for the full credit amounts are. In previous years parents would claim their children. This tax credit amount has increased from 2000 for all children to 3600 for children under the age of 6 and 3000 for children between the ages of 6 and 17. The income thresholds for the full credit amounts are. Thats up to 7200 for twins This is on top of payments for any other qualified child dependents you claim.

Source: ktla.com

Source: ktla.com

If you qualify for CalEITC and have a child under the age of 6 as of the end of the tax year you may qualify for up to 1000 through this credit. In previous years parents would claim their children. Monthly 300 payments are in the works for California families struggling to make ends meet. But in 2021 and the returns people will file next year qualifying parents will be able to get a credit of up to 3000 for children to 17 and 3600 for those 5 and under. Thats up to 7200 for twins This is on top of payments for any other qualified child dependents you claim.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title child tax credit 2021 california by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Child tax credit payments bill information

- Child tax credit july 2021 portal information

- Finance of america stock information

- Team usa in olympics information

- Mel gibson christ movie information

- Child tax credit portal down information

- Stephen a smith i dont care gif information

- Usa basketball in olympics information

- Social security yuba city information

- Stephen a smith megan olivi information