Child tax credit 2021 bill information

Home » » Child tax credit 2021 bill informationYour Child tax credit 2021 bill images are available. Child tax credit 2021 bill are a topic that is being searched for and liked by netizens today. You can Get the Child tax credit 2021 bill files here. Get all free photos.

If you’re searching for child tax credit 2021 bill pictures information connected with to the child tax credit 2021 bill keyword, you have pay a visit to the ideal blog. Our site frequently gives you hints for downloading the maximum quality video and picture content, please kindly hunt and locate more informative video content and images that match your interests.

Child Tax Credit 2021 Bill. - Child Tax Credit payments will begin on 15 July providing support for 39 million eligible families Full details - US unemployment rate leads to increased calls for fourth stimulus check. The American Rescue Plan will temporarily give more money to families. However under the new law families can get an increased tax break of 3000 for every child aged six to 17 for the 2021 tax year only. The third stimulus bill The American Rescue Plan provides a refundable 2021 tax credit worth up to 3600 per child under 6 years.

Fourth Stimulus Check And Child Tax Credit Summary 3 July 2021 As Com From en.as.com

Fourth Stimulus Check And Child Tax Credit Summary 3 July 2021 As Com From en.as.com

The advance child tax credit payments will start in July on a monthly basis. Keep in mind that this is a different credit from the 2021 child tax credit. While you can get 3600 for every child under the age of six. June 20 2021 800 AM 1 min read Yagi-Studio Getty ImagesiStockphoto Starting on July 15 monthly payments will start rolling out to millions of. Texas Legislature takes up contentious voting bills in special session. You will claim the other half when you file your 2021 income tax return.

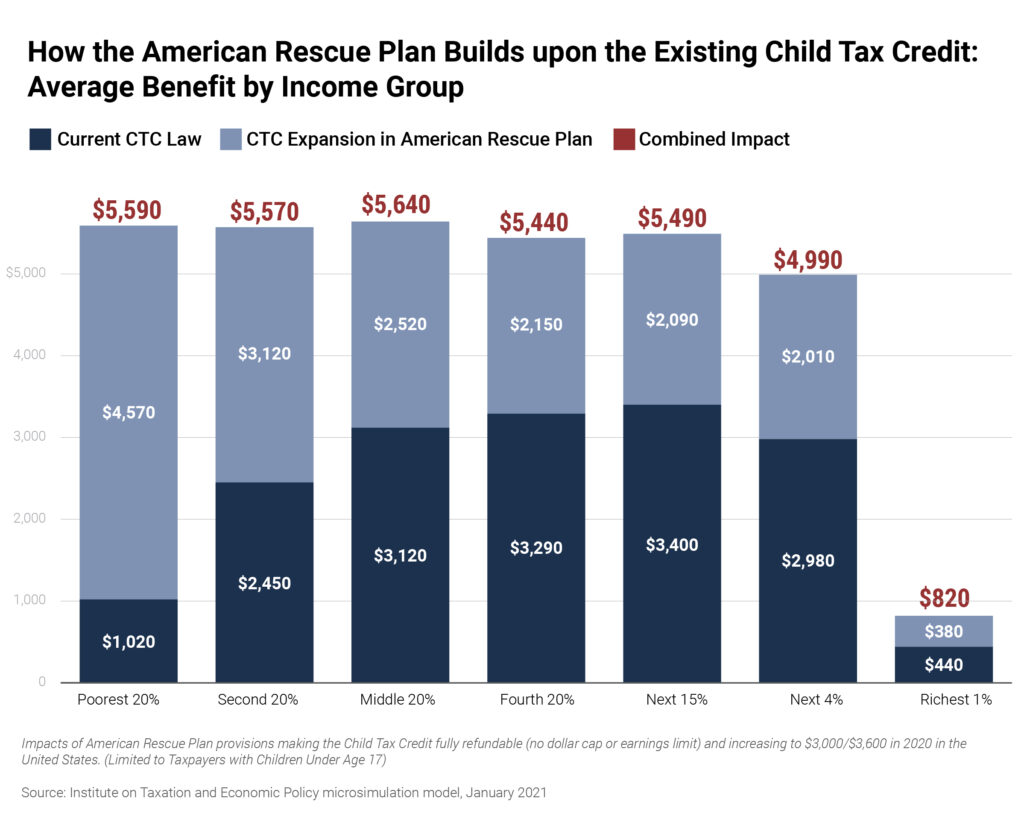

In the relief law passed in March 2021 Congress added an extra tax credit for many families with children.

June 20 2021 800 AM 1 min read Yagi-Studio Getty ImagesiStockphoto Starting on July 15 monthly payments will start rolling out to millions of. More from Invest in. Texas Legislature takes up contentious voting bills in special session. In that case you can get between 500 and. For 2021 only it is up to 1600 per child under 6 and 1000 per child. Most taxpayers have previously been able to reduce their federal income tax bill by up to 2000 per child.

Source: cnet.com

Source: cnet.com

The bill provides a 3000 tax credit for children aged 6 to 17. As part of the March 2021 stimulus bill the value of the credit as well as the age limit have been increased. However under the new law families can get an increased tax break of 3000 for every child aged six to 17 for the 2021 tax year only. - Child Tax Credit payments will begin on 15 July providing support for 39 million eligible families Full details - US unemployment rate leads to increased calls for fourth stimulus check. Slashing child poverty with expanded Child Tax Credit July 15 2021 could wind up being one of the most important days in the history of American anti-poverty policy.

Source: cnet.com

Source: cnet.com

2021 Child Tax Credit. In the relief law passed in March 2021 Congress added an extra tax credit for many families with children. Filed a 2019 or 2020 tax. Texas Legislature takes up contentious voting bills in special session. The American Rescue Plan will temporarily give more money to families.

Source: cnet.com

Source: cnet.com

The bill provides a 3000 tax credit for children aged 6 to 17. First the plan would allow 17-year-old children to qualify. The third stimulus bill The American Rescue Plan provides a refundable 2021 tax credit worth up to 3600 per child under 6 years. These changes apply to tax year 2021 only. AB-509 Child tax credit.

Source: cnbc.com

Source: cnbc.com

If a child turns turn 6 or 18 in 2021 the family would qualify for a lesser tax credit in the case of the child turning 6 or no credit if he or she turns 18 for example. You will claim the other half when you file your 2021 income tax return. 2021 Child Tax Credit. The CTC is now fully refundable which means you can receive the credit even if. Filed a 2019 or 2020 tax.

Source: salon.com

Source: salon.com

The advance child tax credit payments will start in July on a monthly basis. If a child turns turn 6 or 18 in 2021 the family would qualify for a lesser tax credit in the case of the child turning 6 or no credit if he or she turns 18 for example. Texas Legislature takes up contentious voting bills in special session. Slashing child poverty with expanded Child Tax Credit July 15 2021 could wind up being one of the most important days in the history of American anti-poverty policy. AB-509 Child tax credit.

Source: cnet.com

Source: cnet.com

Second it would increase the credit to 3000 per child. The American Rescue Plan would temporarily expand the child tax credit for 2021. Second it would increase the credit to 3000 per. You will claim the other half when you file your 2021 income tax return. For 2021 only it is up to 1600 per child under 6 and 1000 per child.

Source: itep.org

Source: itep.org

Most taxpayers have previously been able to reduce their federal income tax bill by up to 2000 per child. Most taxpayers have previously been able to reduce their federal income tax bill by up to 2000 per child. In that case you can get between 500 and. If a child turns turn 6 or 18 in 2021 the family would qualify for a lesser tax credit in the case of the child turning 6 or no credit if he or she turns 18 for example. These changes apply to tax year 2021 only.

Source: cnet.com

Source: cnet.com

In that case you can get between 500 and. - Child Tax Credit payments will begin on 15 July providing support for 39 million eligible families Full details - US unemployment rate leads to increased calls for fourth stimulus check. Second it would increase the credit to 3000 per child. First the plan would allow 17-year-old children to qualify. To qualify for advance Child Tax Credit payments you and your spouse if you filed a joint return must have.

Source: forbes.com

Source: forbes.com

More from Invest in. - Child Tax Credit payments will begin on 15 July providing support for 39 million eligible families Full details - US unemployment rate leads to increased calls for fourth stimulus check. While you can get 3600 for every child under the age of six. The American Rescue Plan would temporarily expand the child tax credit for 2021. These changes apply to tax year 2021 only.

Source: en.as.com

Source: en.as.com

The CTC is now fully refundable which means you can receive the credit even if. As part of the March 2021 stimulus bill the value of the credit as well as the age limit have been increased. However under the new law families can get an increased tax break of 3000 for every child aged six to 17 for the 2021 tax year only. How much is the 2021 child tax credit. Second it would increase the credit to 3000 per.

Source: electrek.co

Source: electrek.co

The third stimulus bill The American Rescue Plan provides a refundable 2021 tax credit worth up to 3600 per child under 6 years. However under the new law families can get an increased tax break of 3000 for every child aged six to 17 for the 2021 tax year only. Texas Legislature takes up contentious voting bills in special session. As part of the March 2021 stimulus bill the value of the credit as well as the age limit have been increased. Thats the main takeaway of the changes implemented to the Child Tax Credit CTC this year.

Source: cnet.com

Source: cnet.com

The advance child tax credit payments will start in July on a monthly basis. As part of the March 2021 stimulus bill the value of the credit as well as the age limit have been increased. However under the new law families can get an increased tax break of 3000 for every child aged six to 17 for the 2021 tax year only. First the plan would allow 17-year-old children to qualify. In 2021 the maximum enhanced child tax credit is 3600 for children younger than age 6 and 3000 for those between 6 and 17.

Source: cnet.com

Source: cnet.com

As part of the March 2021 stimulus bill the value of the credit as well as the age limit have been increased. You will claim the other half when you file your 2021 income tax return. In the relief law passed in March 2021 Congress added an extra tax credit for many families with children. Thats the main takeaway of the changes implemented to the Child Tax Credit CTC this year. These changes apply to tax year 2021 only.

Source: cnet.com

Source: cnet.com

For 2021 the child tax credit increases to 3600 per child under age 6 and 3000 per child aged 6 to 17 the 2020 credit edges out 17 year olds. Texas Legislature takes up contentious voting bills in special session. How did Bidens stimulus bill change the child tax credit for 2021. As part of the March 2021 stimulus bill the value of the credit as well as the age limit have been increased. AB-509 Child tax credit.

Source: cnet.com

Source: cnet.com

Second it would increase the credit to 3000 per child. Thats the main takeaway of the changes implemented to the Child Tax Credit CTC this year. These changes apply to tax year 2021 only. - Child Tax Credit payments will begin on 15 July providing support for 39 million eligible families Full details - US unemployment rate leads to increased calls for fourth stimulus check. AB-509 Child tax credit.

Source: cnet.com

Source: cnet.com

The bill provides a 3000 tax credit for children aged 6 to 17. Heres who will get up to 1800 per child in cash and who will need to opt out. To qualify for advance Child Tax Credit payments you and your spouse if you filed a joint return must have. Filed a 2019 or 2020 tax. However under the new law families can get an increased tax break of 3000 for every child aged six to 17 for the 2021 tax year only.

Source: cnet.com

Source: cnet.com

To qualify for advance Child Tax Credit payments you and your spouse if you filed a joint return must have. How did Bidens stimulus bill change the child tax credit for 2021. You will claim the other half when you file your 2021 income tax return. First the plan would allow 17-year-old children to qualify. 2021 Child Tax Credit.

Source: nymag.com

Source: nymag.com

The CTC is now fully refundable which means you can receive the credit even if. Filed a 2019 or 2020 tax. The CTC is now fully refundable which means you can receive the credit even if. As part of the March 2021 stimulus bill the value of the credit as well as the age limit have been increased. First the plan would allow 17-year-old children to qualify.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title child tax credit 2021 bill by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Child tax credit payments bill information

- Child tax credit july 2021 portal information

- Finance of america stock information

- Team usa in olympics information

- Mel gibson christ movie information

- Child tax credit portal down information

- Stephen a smith i dont care gif information

- Usa basketball in olympics information

- Social security yuba city information

- Stephen a smith megan olivi information